Annual Review 2017

August 31, 2017

Bank of Japan

The Annual Review 2017 provides an overview of the Bank of Japan's organization and business operations, a review of its implementation of business operations and organizational management in fiscal 2016 (April 1, 2016-March 31, 2017), and a description of the Bank's accounts for the fiscal year.

The report is also available in the HTML format from October 13. From the Annual Review 2017, the HTML version has been released in addition to the PDF version.

Contents

The full text of the report is available in the PDF version. The HTML version does not include the sections marked with asterisks (*).

- Foreword by the Governor [PDF 53KB]

- About the Bank of Japan [PDF 952KB]

- I. Core Purposes

- II. Capital

- III. The Bank's Officers

- IV. Organization

- The Bank's Business Operations [PDF 261KB]

- I. Monetary Policy

- II. Financial System Policy

- III. Enhancement of Payment and Settlement Systems and Market Infrastructure

- IV. International Operations

- V. Issuance, Circulation, and Maintenance of Banknotes

- VI. Services Relating to the Government

- VII. Communication with the Public

- The Bank's Review of Fiscal 2016 [PDF 290KB]

- I. Introduction

- II. Review of Economic and Financial Developments and Monetary Policy Meetings

- III. Performance Reviews of Measures Taken Under the Strategic Priorities

- The Bank's Organizational Management in Fiscal 2016 [PDF 277KB]

- I. Statement of Accounts and Budget for Expenses

- II. IT Investment

- III. Human Resources

- IV. Organizational Management Measures

- V. Internal Audits

- The Bank's Accounts: Financial Statements and Other Documents for Fiscal 2016*[PDF 1,983KB]

- I. Assets and Liabilities, Profits and Losses, and Capital Adequacy Ratio

- II. Financial Statements

- III. Schedule for the Financial Statements

- IV. Expenses

- Appendixes [PDF 1,200KB]

- Appendix 1: Overview of Audits of the Bank of Japan*

- Appendix 2: The Bank of Japan's Strategic Priorities for Fiscal 2014-2018

- Attachment 1 for Appendix 2: The Bank of Japan's Budget for Expenses for Fiscal 2017*

- Attachment 2 for Appendix 2: The Ceiling on the Number of Full-Time Employees of the Bank of Japan for Fiscal 2017*

- Information [PDF 1,784KB]

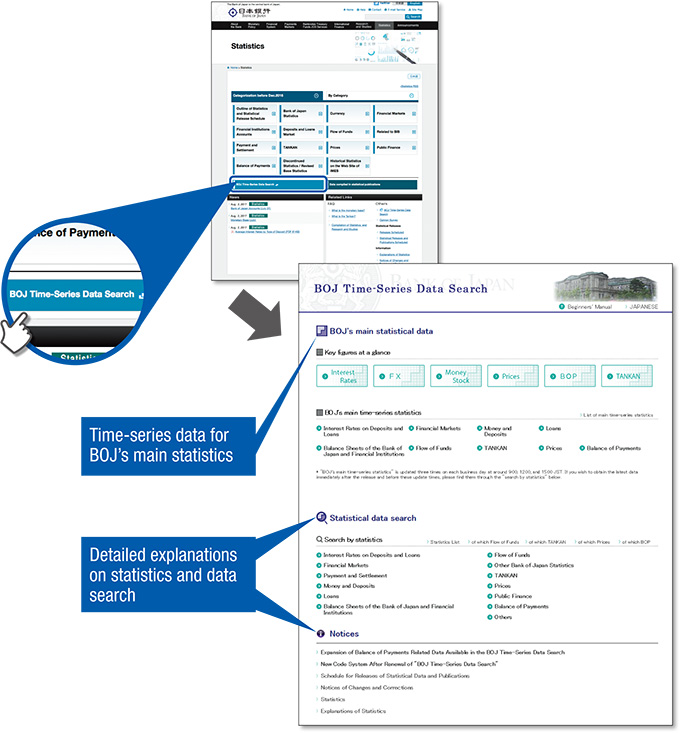

- I. Bank of Japan Website

- II. Visiting the Bank of Japan

- III. Publications and Reports

Foreword by the Governor

The Bank of Japan has two missions, to achieve price stability and ensure the stability of the financial system. On the price stability side, the Bank has been steadily pursuing its policy of Quantitative and Qualitative Monetary Easing with Yield Curve Control to achieve the price stability target of 2 percent in terms of the year-on-year rate of change in the consumer price index. The Bank works to fulfill the two missions by conducting, besides monetary policy, business operations in a wide range of areas such as financial system and bank examination, payment and settlement systems, market infrastructure, international finance, banknotes, treasury funds and Japanese government securities services, and public communications. The Bank pursues its various policies through the precise and deliberate execution of these central banking operations.

The Annual Review provides excerpts from the Japanese original Gyoumu Gaikyo Sho (Outline of Business Operations), which is prepared pursuant to Article 55 of the Bank of Japan Act. The Gyoumu Gaikyo Sho for fiscal 2016 and the Annual Review 2017 have been drawn up and released to explain to readers the implementation of the Bank's business operations during fiscal 2016. Throughout the fiscal year, the Bank, in accordance with "The Bank of Japan's Strategic Priorities for Fiscal 2014-2018," continued to address various issues and move forward with a number of action plans, while ensuring that its business operations and organizational management were conducted in a timely manner in view of changes in circumstances such as those accompanying the Kumamoto Earthquake. The Bank will proceed with its efforts as the country's central bank to achieve the sustainable growth and development of Japan's economy. I hope this year's Annual Review will help readers to gain an overview of the Bank's efforts.

Haruhiko Kuroda

Governor of the Bank of Japan

About the Bank of Japan

The Bank of Japan is the central bank of Japan. It is a juridical person established based on the Bank of Japan Act (hereafter the Act), and is not a government agency or a private corporation (Table 1).

| 1882 | June | The Bank of Japan Act of 1882 is promulgated; the Bank is to have capital of 10 million yen and is given a license to operate for 30 years from the start of business. |

|---|---|---|

| Oct. 10 | Business operation begins. | |

| 1887 | Mar. | An increase in the Bank's capital is announced from 10 million yen to 20 million yen. |

| 1895 | Aug. | An increase in the Bank's capital is announced from 20 million yen to 30 million yen. |

| 1896 | Apr. | The Head Office is moved to a new building at the present location. |

| 1910 | Feb. | The Bank is given a license to operate for 30 more years from October 10, 1912, and an increase in the Bank's capital is announced from 30 million yen to 60 million yen. |

| 1942 | Feb. | The Bank of Japan Act of 1942 is promulgated; the Bank is to have capital of 100 million yen. |

| May 1 | The Bank is reorganized under the Bank of Japan Act of 1942. | |

| 1949 | June | The Policy Board is established. |

| 1997 | June | The Bank of Japan Act of 1997 is promulgated; the Bank is to have capital of 100 million yen. |

| 1998 | Apr. 1 | The Bank of Japan Act of 1997 comes into effect. |

I. Core Purposes

The Act determines the Bank's core purposes as follows:

Article 1

- (1) The purpose of the Bank of Japan, or the central bank of Japan, is to issue banknotes and to carry out currency and monetary control.

- (2) In addition to what is prescribed in the preceding paragraph, the Bank of Japan's purpose is to ensure smooth settlement of funds among banks and other financial institutions, thereby contributing to the maintenance of stability of the financial system.

The Act also stipulates the principle governing the Bank's currency and monetary control as follows:

Article 2

Currency and monetary control by the Bank of Japan shall be aimed at achieving price stability, thereby contributing to the sound development of the national economy.

II. Capital

The Bank is capitalized at 100 million yen in accordance with Article 8, paragraph 1 of the Act. As of the end of March 2017, 55,008,000 yen is subscribed by the government, and the rest by the private sector (Table 2).1

The Act does not grant holders of subscription certificates the right to participate in the Bank's management, and, in the case of liquidation, only gives them the right to request distribution of residual assets up to the sum of the paid-up capital and, if any, the special reserve fund.2 Dividend payments as a proportion of paid-up capital are limited to 5 percent or below in each fiscal year.3

Notes:

- 1Article 8, paragraph 2 of the Act states as follows: "Of the amount of stated capital set forth in the preceding paragraph, the amount of contribution by the government shall be no less than fifty-five million yen."

- 2Stipulated by Article 60, paragraph 2, and Supplementary Provisions Article 22, paragraph 2.

- 3Stipulated by Article 53, paragraph 4.

| Subscribers | Amount of subscription (thous. yen)1 | Percentage of the total subscription (%) | |

|---|---|---|---|

| The government | 55,008 | 55.0 | |

| The private sector | 44,991 | 45.0 | |

| The private sector | Individuals | 40,039 | 40.0 |

| Financial institutions | 2,209 | 2.2 | |

| Public organizations | 191 | 0.2 | |

| Securities companies | 23 | 0.0 | |

| Other firms | 2,526 | 2.5 | |

| Total | 100,000 | 100.0 | |

Note:

- 1Rounded down to the nearest 1,000 yen. As of the end of March 2017.

III. The Bank's Officers

The Bank's officers are the Governor, Deputy Governors, Members of the Policy Board, Auditors, Executive Directors, and Counsellors.4 Of the above, the Governor, Deputy Governors, and Members of the Policy Board make up the Policy Board.5

The Governor, Deputy Governors, and Members of the Policy Board are appointed by the Cabinet, subject to the consent of the House of Representatives and the House of Councillors. Auditors are appointed by the Cabinet. Executive Directors and Counsellors are appointed by the Minister of Finance based on the Policy Board's recommendation.6

The terms of office are five years for the Governor, Deputy Governors, and Members of the Policy Board; four years for Auditors and Executive Directors; and two years for Counsellors.7 The Bank's officers, excluding Executive Directors, are not dismissed against their will during their terms of office, except in the cases prescribed in the Act, such as the formal commencement of bankruptcy proceedings against them.8

For duties and powers of the Bank's officers, see Table 3.9

Notes:

- 4Stipulated by Article 21. The officers of the Bank consist of a Governor, two Deputy Governors, six Members of the Policy Board, three or fewer Auditors, six or fewer Executive Directors, and a small number of Counsellors.

- 5Stipulated by Article 16, paragraph 2.

- 6Stipulated by Article 23.

- 7Stipulated by Article 24.

- 8Stipulated by Article 25.

- 9Duties and powers are stipulated by Article 16, paragraph 2, and Article 22.

| Duties and powers | ||

|---|---|---|

| Policy Board members | Decide the guideline for currency and monetary control and other important matters concerning the Bank's operations, and supervise the officers (excluding Auditors and Counsellors) in the fulfillment of their duties. | |

| Policy Board members | Governor | Represents the Bank and exercises general control over the Bank's business in accordance with decisions made by the Policy Board. At the same time, fulfills the duties of an independent Policy Board member. |

| Deputy Governors | In accordance with decisions made by the Governor, represent the Bank, administer the business of the Bank assisting the Governor, act for the Governor whenever the Governor is prevented from attending to his/her duties, and perform the Governor's duties during a vacancy in the office of the Governor. At the same time, fulfill the duties of independent Policy Board members. | |

| Members of the Policy Board |

Comprise the Policy Board, together with the Governor and Deputy Governors. | |

| Auditors | Audit the business of the Bank. May, when they find it necessary based on the audit results, submit their opinions to the Minister of Finance, the Prime Minister (the Commissioner of the Financial Services Agency when the Prime Minister delegates such authority under Article 61-2 of the Act), or the Policy Board. | |

| Executive Directors | In accordance with decisions made by the Governor, administer the business of the Bank assisting the Governor and Deputy Governors, act for the Governor when the Governor and Deputy Governors are prevented from attending to their duties, and perform the Governor's duties during a vacancy in the office of the Governor and Deputy Governors. | |

| Counsellors | Give advice to the Policy Board when consulted on any important matter concerning the Bank's business operations. May also express their opinions to the Policy Board when they find it necessary. | |

Policy Board Members1, 2

Standing from left to right: Hitoshi Suzuki, Makoto Sakurai, Yutaka Harada, Yukitoshi Funo, Takako Masai, and Goushi Kataoka

Seated from left to right: Kikuo Iwata, Haruhiko Kuroda, and Hiroshi Nakaso

Notes:

- 1Members are as of August 7, 2017.

- 2The texts of speeches by Policy Board members are available on the "Speeches by speaker" page on the Bank's website.

Haruhiko Kuroda

Governor (the 31st) and Chairman of the Policy Board

Date of Birth October 25, 1944

Education The University of Tokyo (1967, B.A. in Law)

University of Oxford (1971, M.Phil. in Economics)

| 1967 | Joined Japan's Ministry of Finance (MOF) |

|---|---|

| 1987 | Director, International Organizations Division, International Finance Bureau |

| 1988 | Secretary to the Minister of Finance |

| 1989 | Director, International Tax Affairs Division, Tax Bureau |

| 1990 | Director, Income Tax and Property Tax Policy Division, Tax Bureau |

| 1991 | Director, Co-ordination Division, Tax Bureau |

| 1993 | Regional Commissioner, Osaka Regional Taxation Bureau, National Tax Agency |

| 1994 | Deputy Director-General, International Finance Bureau, MOF |

| 1996 | President, Institute of Fiscal and Monetary Policy |

| 1997 | Director-General, International Finance Bureau |

| 1998 | Director-General, International Bureau |

| 1999 | Vice Minister of Finance for International Affairs |

| 2003 | Special Advisor to the Cabinet and Professor, Graduate School of Economics, Hitotsubashi University |

| 2005 | President, Asian Development Bank |

| 2013 | Present position |

Kikuo Iwata

Deputy Governor

Date of Birth October 3, 1942

Education The University of Tokyo (1966, B.A. in Economics; 1970, M.A. in Economics; and 1973, withdrew from doctoral program in Economics after completion of course requirements except for dissertation)

| 1973 | Lecturer, Sophia University |

|---|---|

| 1976 | Associate Professor, Sophia University |

| 1983 | Professor, Sophia University |

| 1998 | Professor, Gakushuin University |

| 2013 | Present position |

Hiroshi Nakaso

Deputy Governor

Date of Birth October 12, 1953

Education The University of Tokyo (1978, B.A. in Economics)

| 1978 | Joined the Bank of Japan |

|---|---|

| 1997 | Director, Head of Financial System Division, Financial and Payment System Department |

| 2000 | Deputy Director-General, Financial and Payment System Office Transferred to the Bank for International Settlements |

| 2001 | Deputy Director-General, Financial Markets Department and International Department, Bank of Japan |

| 2003 | Director-General, Financial Markets Department |

| 2008 | Executive Director |

| 2010 | Assistant Governor |

| 2013 | Present position |

Yutaka Harada

Date of Birth September 1, 1950

Education The University of Tokyo (1974, B.A. in Agricultural Economics)

University of Hawaii (1979, M.A. in Economics)

Gakushuin University (2012, Ph.D. in Economics)

| 1974 | Joined the Economic Planning Agency |

|---|---|

| 1995 | Director, Social Research Division, Social Policy Bureau |

| 1997 | Director, Overseas Research Division, Research Bureau |

| 1998 | Director, Price Policy Division, Price Bureau |

| 1999 | Vice President, Institute of Fiscal and Monetary Policy, Ministry of Finance |

| 2002 | Executive Research Fellow, Economic and Social Research Institute, Cabinet Office |

| 2004 | Chief Economist, Daiwa Institute of Research, Ltd. |

| 2012 | Professor, Waseda University |

| 2015 | Present position |

Yukitoshi Funo

Date of Birth February 1, 1947

Education Kobe University (1969, B.A. in Business Administration)

Columbia University (1976, MBA)

| 1970 | Joined Toyota Motor Corporation (TMC) |

|---|---|

| 2000 | Director, TMC |

| 2003 | President, Toyota Motor Sales, U.S.A., Inc. (TMS) |

| 2005 | Chairman and Chief Executive Officer, TMS |

| 2006 | Chairman and Chief Executive Officer, Toyota Motor North America, Inc. (TMA) |

| 2009 | Executive Vice President and Member of the Board, TMC |

| 2013 | Senior Advisor to the Board, TMC Chief Executive Officer, Institute for International Economic Studies |

| 2015 | Present position |

Makoto Sakurai

Date of Birth June 16, 1946

Education Chuo University (1969, B.A. in Economics)

The University of Tokyo (1972, M.A. in Economics; and 1976, withdrew from doctoral program in Economics after completion of course requirements except for dissertation)

| 1976 | Joined the Export-Import Bank of Japan |

|---|---|

| 1980 | Visiting Fellow, Economic Growth Center, Yale University |

| 1989 | Senior Economist, Research Institute for International Investment and Development, Export-Import Bank of Japan Director General and Chief Economist, Taisho Marine Research Institute Co., Ltd. |

| 1990 | Also served as Senior Research Fellow, Institute of Fiscal and Monetary Policy, Ministry of Finance |

| 1996 | President, Research Center for International Finance, Mitsui Marine Research Institute Co., Ltd. |

| 2007 | President, Sakurai & Associates International Finance Research Center |

| 2016 | Present position |

Takako Masai

Date of Birth March 8, 1965

Education Jissen Women's University (1988, B.A. in English Literature)

Hosei University (2007, MBA)

| 1988 | Joined Scotiabank, Tokyo |

|---|---|

| 1989 | Joined The Toronto-Dominion Bank, Tokyo |

| 1998 | Joined Credit Agricole Indosuez, Tokyo |

| 2004 | Joined Calyon Corporate and Investment Bank,3 Tokyo |

| 2007 | General Manager, Capital Markets Division, Shinsei Bank, Ltd. |

| 2011 | General Manager, Markets Division, Shinsei Bank, Ltd. General Manager, Markets Sub-Group, Shinsei Bank, Ltd. |

| 2013 | Executive Officer, Head of Markets Research Department, Markets Sub-Group, Shinsei Bank, Ltd. |

| 2015 | Executive Officer, General Manager of Markets Research Division, Shinsei Bank, Ltd. |

| 2016 | Executive Officer, General Manager of Financial Research Division, Shinsei Bank, Ltd. Present position |

Notes:

- 3Established in 2004 through merger of Credit Agricole Indosuez and Credit Lyonnais.

Hitoshi Suzuki

Date of Birth January 8, 1954

Education Keio University (1977, B.A. in Economics)

New York University (1984, MBA)

| 1977 | Joined The Mitsubishi Bank, Ltd. |

|---|---|

| 2005 | Executive Officer and General Manager, Treasury Planning Office and Treasury IT Planning Office, The Bank of Tokyo-Mitsubishi, Ltd. (BTM)4 |

| 2006 | Executive Officer and General Manager, Global Markets Planning Division, The Bank of Tokyo-Mitsubishi UFJ, Ltd. (BTMU)5 |

| 2007 | Executive Officer and General Manager, Strategic Credit Portfolio Management Division, BTMU |

| 2011 | Senior Managing Director, Chief Executive, Global Markets Unit, BTMU |

| 2012 | Deputy President, BTMU |

| 2014 | Corporate Auditor, BTMU |

| 2016 | Director, Audit and Supervisory Committee Member, BTMU |

| 2017 | Advisor, BTMU Present position |

Notes:

- 4Established in 1996 through merger of The Mitsubishi Bank, Ltd. and The Bank of Tokyo, Ltd.

- 5Established in 2006 through merger of The Bank of Tokyo-Mitsubishi, Ltd. and UFJ Bank Ltd.

Goushi Kataoka

Date of Birth November 30, 1972

Education Keio University (1996, B.A. in Business and Commerce; and 2001, M.A. in Business and Commerce)

| 1996 | Joined Sanwa Research Institute |

|---|---|

| 2005 | Senior Economist, Economic & Social Policy Department, UFJ Institute Ltd.6 |

| 2006 | Senior Economist, Economic & Social Policy Department, Mitsubishi UFJ Research and Consulting Co., Ltd.7 |

| 2016 | Senior Economist, Economic Policy Department, Mitsubishi UFJ Research and Consulting Co., Ltd. |

| 2017 | Present position |

Notes:

- 6Established in 2002 through merger of Sanwa Research Institute and Tokai Research & Consulting Inc.

- 7Established in 2006 through merger of UFJ Institute Ltd., The Diamond Business Consulting Co., Ltd., and Tokyo Research International Co., Ltd.

IV. Organization

Organization Chart of the Bank1

Notes:

- 1As of August 7, 2017.

- 2As stipulated by Article 16, paragraph 2 of the Act, the Policy Board shall consist of the Governor, two Deputy Governors, and six Members of the Policy Board.

- 3Local offices include the Computer Center represented by the Director-General of the Information System Services Department, and the Banknote Operations Center represented by the Director-General of the Currency Issue Department.

| Head office departments | Officials |

|---|---|

| Secretariat of the Policy Board | Yoji Onozawa (Director-General) Ken Matsushita (Director-General, Senior Secretary to the Governor) Takeshi Nakajima (Director-General for Parliamentary Affairs and Media Relations) Tetsuya Sakamoto (Director-General for Management Strategy, Budget, and Accounting) |

| Internal Auditors' Office | Morichika Hattori (Director-General) |

| Monetary Affairs Department | Takeshi Kato (Director-General) |

| Financial System and Bank Examination Department | Yasuhiro Yamada (Director-General) |

| Payment and Settlement Systems Department | Hiromi Yamaoka (Director-General) |

| Financial Markets Department | Seiichi Shimizu (Director-General) |

| Research and Statistics Department | Toshitaka Sekine (Director-General) |

| International Department | Yoshinori Nakata (Director-General) |

| Currency Issue Department | Yutaka Okada (Director-General) |

| Operations Department | Shinichiro Hayashi (Director-General) |

| Information System Services Department | Masayuki Mizuno (Director-General) |

| Public Relations Department | Seiichi Tsurumi (Director-General) |

| Personnel and Corporate Affairs Department | Mitsuru Nomura (Director-General) Hirohide Koguchi (Director-General for Personnel Management) |

| Administration Department | Taro Teruuchi (Director-General) |

| Institute for Monetary and Economic Studies | Shigenori Shiratsuka (Director-General) |

| Overseas representative offices | Telephone numbers | General managers/ chief representatives |

|

|---|---|---|---|

| New York | Bank of Japan Chief Representative Office for the Americas Bank of Japan Representative Office in New York 140 Broadway, 18th Floor, New York, NY 10005, U.S.A. |

+1-212-269-6566 | Kazushige Kamiyama (General Manager for the Americas and Chief Representative in New York) |

| Washington, D.C. |

Bank of Japan Representative Office in Washington, D.C. 2100 Pennsylvania Ave., N.W., Suite 505, Washington, D.C. 20037, U.S.A |

+1-202-466-2228 | Shinichiro Okawa (Chief Representative in Washington, D.C.) |

| London | Bank of Japan Chief Representative Office for Europe Bank of Japan Representative Office in London Basildon House, 7-11 Moorgate, London EC2R 6AF, U.K |

+44-20-7606-2454 | Tokiko Shimizu (General Manager for Europe and Chief Representative in London) |

| Paris | Bank of Japan Representative Office in Paris 17 Avenue George V, 75008 Paris, France |

+33-1-4720-7295 | Yuji Yokobori (Chief Representative in Paris) |

| Frankfurt | Bank of Japan Representative Office in Frankfurt Taunusanlage 21, 60325 Frankfurt am Main, Germany |

+49-69-9714310 | Jun Mifune (Chief Representative in Frankfurt) |

| Hong Kong | Bank of Japan Representative Office in Hong Kong Suite 1012, One Pacific Place, 88 Queensway, Central, Hong Kong |

+852-2525-8325 | Ryota Kojima (Chief Representative in Hong Kong) |

| Beijing | Bank of Japan Representative Office in Beijing 19th Floor, Unit 12C, China World Tower 2, No. 1 Jian Guo Men Wai Avenue, Beijing 100004, China |

+86-10-6505-9601 | Kenji Wada (Chief Representative in Beijing) |

Functions of Committees/Departments/Offices

Committees and Head Office Departments

- Management Committee

- Examines and manages Bank-wide issues regarding the Bank's operations. The members of this committee comprise the Deputy Governors and all Executive Directors.

- Compliance Committee

- Ensures that the officers and employees perform their duties fairly and in compliance with the relevant laws and regulations. The members of this committee comprise members appointed from among the Deputy Governors and Executive Directors by the Governor, the Director-General of the Internal Auditors' Office, and one or more legal experts from outside the Bank.

- Secretariat of the Policy Board

- (1) Arranges proceedings for Policy Board meetings, (2) liaises with the Diet and the media, (3) reviews the content and wording of important documents, and offers a legal perspective on them, (4) plans and formulates measures relating to the Bank's business operations and organizational management, (5) handles the Bank's budget, settlement, and accounting, (6) provides administrative services for the Bank's officers, and (7) supports Auditors in auditing.

- Internal Auditors' Office

- Audits the Bank's business operations.

- Monetary Affairs Department

- Plans and formulates monetary policy measures.

- Financial System and Bank Examination Department

- (1) Plans and formulates measures that contribute to the maintenance of an orderly financial system, (2) conducts on-site examinations and off-site monitoring of financial institutions that hold current accounts at the Bank, (3) judges financial institutions' eligibility to hold current accounts at the Bank and to have access to its lending facilities, and (4) determines the specifics of credit extension and discounting of bills by the Bank.

- Payment and Settlement Systems Department

- Plans and formulates measures in the following areas: (1) policy issues relating to payment and settlement systems; (2) financial institutions' access to payment and settlement services provided by the Bank; and (3) the Bank's business continuity planning.

- Financial Markets Department

- (1) Determines the specifics of daily market operations, (2) conducts foreign exchange interventions, (3) works toward improving the functioning of Japanese financial markets, including the foreign exchange market, and (4) monitors and analyzes developments in financial markets in Japan as well as overseas, including foreign exchange markets.

- Research and Statistics Department

- (1) Conducts research on the domestic economy and fiscal situation, and (2) compiles and releases statistics.

- International Department

- (1) Liaises and coordinates with overseas central banks and international organizations, (2) makes arrangements for investment in yen assets by overseas central banks, and conducts operations aimed at providing international financial support, (3) manages foreign currency assets held by the Bank, (4) conducts research on global economic and financial conditions, and (5) compiles Japan's balance of payments and other such statistics.

- Currency Issue Department

- (1) Conducts planning and operations relating to banknotes, and (2) conducts payment/receipt of coins, and examines and takes custody of them.

- Operations Department

- Conducts banking operations including the following: (1) discounting of bills; (2) credit extension; (3) purchasing/selling of bills, Japanese government securities, and other securities; (4) borrowing/lending of securities with cash collateral; (5) accepting of deposits; (6) domestic funds transfers; (7) handling of treasury funds; and (8) operations relating to stocks purchased by the Bank.

- Information System Services Department

- Manages the development and operation of the Bank's computer systems.

- Public Relations Department

- (1) Is responsible for public relations, (2) administers the Bank's library, and (3) works toward raising the public's awareness and understanding of financial and economic issues.

- Personnel and Corporate Affairs Department

- Handles business in corporate affairs, personnel policy issues relating to recruitment, assessment of job performance, career planning and training, wages and salaries, and the Bank's code of ethics.

- Administration Department

- Conducts administrative operations relating to the Bank's facilities, supplies, security, and transportation.

- Institute for Monetary and Economic Studies

- (1) Studies theoretical, institutional, technological, and historical aspects of monetary and economic issues, (2) collects, preserves, and exhibits historical materials and documents related to monetary and economic issues, and (3) exchanges views with academics.

Branches and Offices

- Branches

- The 32 branches mainly conduct operations relating to currency issue and banking operations, and research on the economic and financial situation in their respective areas.

- Local Offices in Japan

- The Computer Center in Fuchu City, Tokyo, operates the Bank's systems. The Banknote Operations Center in Toda City, Saitama Prefecture, receives, pays, and stores banknotes. The other 12 local offices handle some of the operations of the Head Office or branches.

- Overseas Representative Offices

- The seven overseas representative offices perform a liaison function, gather information, and conduct research.

The Bank's Business Operations

I. Monetary Policy

The Bank of Japan decides and implements monetary policy under the price stability target of 2 percent in terms of the year-on-year rate of change in the consumer price index (CPI), with the aim of achieving price stability and thereby contributing to the sound development of the national economy, as stipulated in Article 2 of the Bank of Japan Act (hereafter the Act). Monetary policy is decided by the Policy Board at Monetary Policy Meetings (MPMs), and market operations -- the Bank's day-to-day provision and absorption of funds in the market -- are carried out based on the guideline decided at each MPM. The Bank held eight MPMs in fiscal 2016.

The Bank releases each quarter the Outlook for Economic Activity and Prices (hereafter the Outlook Report) after the Policy Board has decided the text of "The Bank's View" section at MPMs held, in principle, in January, April, July, and October. In the Outlook Report, the Bank presents its outlook for developments in economic activity and prices, assesses upside and downside risks, and outlines its views on the future conduct of monetary policy. For MPMs other than the above, the Policy Board members' assessment of the economic and financial situation is expressed in the statement on monetary policy released after each MPM.

In order to make appropriate policy decisions, the Bank conducts research and analysis on economic and financial developments at home and abroad. Major findings are reflected in the Bank's releases including the Outlook Report and the Regional Economic Report. The Bank also conducts fundamental studies on economic and financial issues; it publishes the major findings in the Bank of Japan Working Paper Series, the Bank of Japan Research Laboratory Series, and in research papers released by the Institute for Monetary and Economic Studies (IMES), specifically in the Monetary and Economic Studies and the IMES Discussion Paper Series.1

The Bank, pursuant to Article 54, paragraph 1 of the Act, prepares the Semiannual Report on Currency and Monetary Control approximately every six months, covering matters related to the conduct of monetary policy (those listed in the items of Article 15, paragraph 1 of the Act) and business operations that the Bank has conducted based thereon, and submits it to the Diet through the Minister of Finance. In the most recent two issues of this report, the Bank explains in detail economic and financial developments as well as the Bank's conduct of monetary policy and market operations during fiscal 2016.2

Notes:

- 1Papers and statistics as well as lists of the Bank's publications in English are available on the Bank's website and on the IMES website; for a list of the Bank's major publications and reports, see III. Publications and Reports under Information.

- 2The summaries of these two issues in English are available on the Bank's website; for excerpts from these summaries, see II. Review of Economic and Financial Developments and Monetary Policy Meetings under The Bank's Review of Fiscal 2016. The full texts are available in Japanese on the Bank's website.

II. Financial System Policy

One of the core purposes of the Bank, as stipulated in Article 1, paragraph 2 of the Act, is to ensure smooth settlement of funds among banks and other financial institutions, thereby contributing to the maintenance of financial system stability. To this end, the Bank provides safe and convenient settlement assets in the form of deposits in current accounts that financial institutions hold at the Bank, and takes measures to enhance the safety and efficiency of payment and settlement systems. In order to ensure financial system stability, the Bank also takes various measures to make sure that a financial institution's inability to complete settlement of a transaction does not result in a chain of settlement failures at other institutions and thus disrupt the overall functioning of the financial system.

Specifically, the Bank may provide financial institutions suffering a shortage of liquidity with the following: (1) loans against collateral in the form of securities, pursuant to Article 33, and/or (2) other forms of liquidity, in its role as the lender of last resort, pursuant to Articles 37 and 38 of the Act.

In order to be ready to act effectively as the lender of last resort, the Bank strives to gain an accurate grasp of the business conditions at financial institutions and to encourage the maintenance of sound financial conditions, offering guidance and advice as necessary, through the conduct of on-site examinations (examinations that the Bank carries out by visiting the premises of financial institutions pursuant to Article 44 of the Act) as well as off-site monitoring (monitoring that is conducted through meetings with executives and staff of financial institutions, as well as through analysis of various documents submitted by these institutions) (Tables 1 and 2). In addition, through activities such as seminars and workshops organized by the Bank's Center for Advanced Financial Technology (CAFT), the Bank encourages financial institutions' efforts to improve their management of risks and business activities.

The Bank conducts research and analysis assessing risks in the financial system as a whole, i.e., taking a macroprudential perspective, by making use of insights obtained through its on-site examinations and off-site monitoring and paying due attention to the interconnectedness of the real economy, financial markets, and the behavior of financial institutions. The findings of this research and analysis are published in various forms -- for example, the Financial System Report -- and the Bank draws on them when taking part in initiatives with relevant parties to ensure the stability of the financial system. These findings are also made use of in developing financial system policies and implementing monetary policy. The Bank has also been participating in international initiatives to maintain the stability of the global financial system. These include discussions held by the Basel Committee on Banking Supervision, which comprises central banks and supervisory authorities from major countries.

The Bank, as and when necessary, conducts business requisite to maintaining financial system stability, including the provision of loans, pursuant to Article 38 of the Act (hereafter the term "special loans" covers all such business). The Bank decides on the extension of special loans based on the following four principles, taking into account the nature and purpose of the lender-of-last-resort function:

- Principle 1

- There must be a strong likelihood that systemic risk will materialize.

- Principle 2

- There must be no alternative to the provision of central bank money.

- Principle 3

- All relevant parties are required to take clear responsibility to avoid moral hazard.

- Principle 4

- The financial soundness of the Bank of Japan itself must not be impaired.

| Financial institutions that hold current accounts at the Bank | Financial institutions that have concluded agreements for bilateral electronic lending with the Bank | Financial institutions that have concluded loans-on-bills agreements with the Bank | Financial institutions that have concluded intraday-overdraft agreements with the Bank | ||

|---|---|---|---|---|---|

| Of which: Financial institutions that have concluded on-site examination contracts with the Bank | |||||

| City and regional banks | 126 (126) | 126 (126) | 126 (126) | 126 (126) | 126 (126) |

| Trust banks | 15 (15) | 15 (15) | 10 (10) | 10 (10) | 15 (15) |

| Foreign banks | 49 (50) | 49 (50) | 36 (37) | 40 (41) | 37 (38) |

| Shinkin banks | 255 (256) | 255 (256) | 112 (112) | 136 (137) | 171 (164) |

| Financial instruments business operators | 35 (35) | 35 (35) | 30 (30) | 35 (35) | 34 (34) |

| Bankers associations | 33 (33) | 0 (0) | 0 (0) | 0 (0) | 0 (0) |

| Other institutions | 19 (19) | 10 (10) | 9 (9) | 10 (10) | 11 (12) |

| Total | 532 (534) | 490 (492) | 323 (324) | 357 (359) | 394 (389) |

Note:

- 1Figures in parentheses indicate the number of institutions as of the end of fiscal 2015.

| Fiscal 2014 | Fiscal 2015 | Fiscal 2016 | |

|---|---|---|---|

| Domestically licensed banks1 | 33 | 30 | 33 |

| Shinkin banks | 40 | 36 | 37 |

| Other institutions2 | 12 | 12 | 15 |

| Total | 85 | 78 | 85 |

Notes:

- 1Established and licensed under Japanese legislation, excluding the Bank and government-related organizations.

- 2Including financial instruments business operators and Japanese branches of foreign banks.

III. Enhancement of Payment and Settlement Systems and Market Infrastructure

The Bank provides safe and convenient settlement assets in the form of banknotes and deposits in current accounts that financial institutions hold at the Bank. In addition, the Bank conducts settlement for Japanese government securities (JGSs) in its role as the book-entry transfer institution in the Japanese government bond (JGB) Book-Entry System. To ensure the safety and efficiency of these services, the Bank operates a computer network system for the settlement of funds and JGSs, the Bank of Japan Financial Network System (BOJ-NET).

The Bank conducts oversight of payment and settlement systems, monitoring their safety and efficiency and inducing improvements where necessary. Moreover, the Bank participates with other central banks in various international discussions and initiatives related to payment and settlement systems, including those of the Committee on Payments and Market Infrastructures (CPMI) at the Bank for International Settlements (BIS).

In addition, in order to strengthen and improve the efficiency of the functioning of markets as well as to support more robust risk management and innovation in financial services and market transactions, the Bank, with an eye on international developments, takes initiatives to reinforce the infrastructures of financial and capital markets -- exchanging views with market participants, supporting the formulation of additional rules on and revisions of market practices, and compiling and releasing statistics on market transactions. As part of its initiatives, the Bank has continued to enhance its business continuity arrangements in preparation for times of disaster or other emergency, and has provided active support to market participants in developing effective business continuity planning (BCP) in financial markets, payment and settlement systems, and the financial system.

In order to effectively implement measures to enhance payment and settlement systems and market infrastructure, the Bank conducts research and analysis on the safety and efficiency of payment and settlement systems as well as on the financial system and financial markets, in addition to fundamental research on related issues. Major findings are reflected in the Bank's releases including the Payment and Settlement Systems Report.

IV. International Operations

The Bank conducts operations in the field of international finance, such as foreign exchange transactions, including those executed as part of the Bank's management of its foreign currency assets, as well as business related to assisting other central banks and international organizations in their investment in yen. The Bank also handles government affairs that relate to international finance, such as the compilation and dissemination of Japan's balance of payments statistics and foreign exchange intervention.

In addition, the Bank takes part in international discussions on the state of the world economy as well as on measures to ensure the stability and improve the structure of financial markets. The Bank participates in various forums, such as meetings of the Group of Twenty (G-20), the Group of Seven (G-7), the International Monetary Fund (IMF), the BIS, and the Financial Stability Board (FSB), as well as other meetings of monetary authorities including central banks in Asia.

With regard to Asia, the Bank engages in various activities including the following: the promotion of monetary cooperation mainly through participation in the Executives' Meeting of East Asia-Pacific Central Banks (EMEAP) and the Association of Southeast Asian Nations Plus Three (ASEAN Plus Three); the strengthening of technical cooperation and staff training with a view to ensuring financial and economic stability; and the conduct of research on the region.

V. Issuance, Circulation, and Maintenance of Banknotes

The Bank, as the country's sole issuer of banknotes (Bank of Japan notes), ensures the stability of banknote supply and maintains public confidence in banknotes through the conduct of the following operations at its Head Office and branches in Japan. First, the Bank receives banknotes from and pays banknotes to financial institutions that hold current accounts at the Bank (BOJ account holders). Second, the Bank counts the banknotes it receives from BOJ account holders, examines them to verify their authenticity, and checks their fitness for recirculation. As for coins, they are delivered to the Bank by the government, which is the authorized issuer of coins, and then put into circulation.

As part of its measures to secure confidence in banknotes and coins, the Bank works to maintain the cleanliness of banknotes in circulation by preventing damaged or worn banknotes from being returned to circulation. In addition, the Bank remains active in advancing research and promoting public understanding regarding counterfeit deterrence and the smooth circulation of currency, in cooperation with relevant institutions at home and abroad, including other central banks.

VI. Services Relating to the Government

The Bank provides various services relating to the government, such as treasury funds and JGS services. Specifically, these are (1) receipt, disbursement, and accounting of treasury funds (the Bank classifies receipts and disbursements of treasury funds by the specific government account as well as by the individual government agency), (2) management of the deposits of the Japanese government, (3) custody of securities acquired by or submitted to the government, (4) issuance of, and principal and interest payment on, JGSs, and (5) operations relating to its role as the book-entry transfer institution in the JGB Book-Entry System. For the convenience of the public, the Bank designates certain branches and offices of financial institutions throughout the country as its agents and entrusts them with some of the services relating to treasury funds and JGSs.

Besides the above operations, the Bank engages in various transactions with the government, such as purchasing and selling of JGSs.

VII. Communication with the Public

With a view to satisfying the requirements of public accountability, the Bank releases in a timely manner a document that contains a summary of the opinions presented at each MPM (Summary of Opinions), the minutes of MPMs, and public statements on most of the Policy Board decisions. The Bank actively provides information through a variety of channels including the following: reporting to and attendance at the Diet; press conferences held and speeches delivered by the Bank's officers; and the Bank's website. Transcripts of MPMs held more than 10 years previously are also released.

To promote better understanding of the policies and business operations of the Bank, not only in the eyes of financial professionals but also of the public as a whole, the Bank endeavors to make its publications and releases better suited to the diverse needs and interests of their users. It also works to promote financial literacy among the public.

The Bank compiles and releases various statistics to be widely shared with the public and implements measures as part of refining its statistics to improve their user-friendliness.

Meanwhile, the Bank discloses information in accordance with the Act on Access to Information Held by Independent Administrative Agencies.

The Bank's Review of Fiscal 2016

I. Introduction

In March 2014, the Bank of Japan formulated and released "The Bank of Japan's Strategic Priorities for Fiscal 2014-2018."1 In this document, the Bank adopts a new five-year framework, the content of which will be kept basically unchanged for the whole period, with a view to (1) clarifying the Bank's objectives to be achieved over the medium term and (2) properly evaluating its progress in achieving these. The Bank conducts and makes public performance reviews of measures taken under the Strategic Priorities every fiscal year.

This section provides a brief review of economic and financial developments and decisions made at Monetary Policy Meetings (MPMs) in fiscal 2016, followed by performance reviews of measures taken under the Strategic Priorities. Each performance review is divided into two parts: a description of progress in implementing specific measures during fiscal 2016 for each of the strategic objectives for its business operations laid out in the Strategic Priorities, and the Bank's evaluation of that progress. The Bank's performance with regard to the strategic objectives for its organizational management is described in The Bank's Organizational Management in Fiscal 2016.

The Strategic Priorities states that the Bank shall (1) conduct an interim review of the content of the Strategic Priorities during the five-year period in order to address any changes in its environment and revise the content flexibly in response to any significant such changes, and (2) conduct, separately, a thorough review of the entire content of the Strategic Priorities. In fiscal 2016, the Bank conducted the interim review and decided to maintain the current content.

Note:

- 1For the text of "The Bank of Japan's Strategic Priorities for Fiscal 2014-2018," see Appendix 2.

II. Review of Economic and Financial Developments and Monetary Policy Meetings2

A. First Half of Fiscal 2016 (April-September 2016)

1. Economic developments

a. Looking back at the first half of fiscal 2016, Japan's economy continued its moderate recovery trend, with a virtuous cycle from income to spending being maintained, although exports and production were sluggish, due mainly to the effects of the slowdown in emerging economies.

Exports were more or less flat, due mainly to the effects of the slowdown in emerging economies. Turning to domestic demand, the decline in public investment leveled off. Business fixed investment followed a moderate increasing trend as corporate profits were at high levels. Against the background of steady improvement in the employment and income situation, private consumption was resilient, although relatively weak developments were seen in some indicators. Housing investment continued to pick up. Reflecting these developments in demand both at home and abroad, industrial production continued to be more or less flat.

b. On the price front, the year-on-year rate of change in the consumer price index (CPI, all items less fresh food) became slightly negative. Inflation expectations remained in a weakening phase since summer 2015 as an adaptive component played a large role in their formation, with the observed inflation rate being about 0 percent or slightly negative.

2. Financial developments

a. Money market rates declined further on the whole.

Turning to developments in the bond market, long-term interest rates moved further into negative territory through end-July. Thereafter, the rates turned to an increase, mainly on the back of rises in U.S. and European long-term interest rates. Through the end of the first half of fiscal 2016, the rates were slightly below 0 percent under Quantitative and Qualitative Monetary Easing (QQE) with Yield Curve Control, which was introduced at the September MPM.

The Nikkei 225 Stock Average temporarily fell to a level below 15,000 yen, with a drop in stock prices globally prompted by the United Kingdom's June referendum in which the majority voted to leave the European Union (EU). Thereafter, it rose to around 16,500 yen amid the situation of rises in U.S. and European stock prices.

In the foreign exchange market, through July, the yen appreciated against the U.S. dollar, mainly due to expectations that the pace of the policy interest rate hikes in the United States would be more moderate and to market participants' concern over the impact of the United Kingdom's vote to leave the EU. Thereafter, the U.S. dollar/yen rate was more or less flat, albeit with some fluctuations, and was in the range of 100-101 yen at end-September. The yen also appreciated against the euro and was in the range of 112-113 yen at end-September.

b. As for corporate finance, in terms of credit supply, financial institutions' lending attitudes as perceived by firms were highly accommodative.

Firms' credit demand increased moderately, mainly for funds related to mergers and acquisitions and funds for business fixed investment. With regard to firms' funding, the year-on-year rate of increase in the amount outstanding of lending by domestic commercial banks was around 2 percent. The year-on-year rate of change in the amount outstanding of corporate bonds turned positive and rose. In addition, the year-on-year rate of change in that of CP turned positive on average.

c. The monetary base (currency in circulation plus current account balances at the Bank) increased significantly as asset purchases by the Bank progressed, and the year-on-year rate of growth was in the range of 20-30 percent. The year-on-year rate of growth in the money stock (M2) was in the range of 3.0-4.0 percent.

3. MPMs3

a. Four MPMs were held in the first half of fiscal 2016.

At all the MPMs held in the first half of fiscal 2016, the Policy Board judged that Japan's economy continued its moderate recovery trend, although exports and production were sluggish, due mainly to the effects of the slowdown in emerging economies.

b. In the conduct of monetary policy, at the July MPM, the Policy Board decided upon the following measures to enhance monetary easing.

- (1) An increase in purchases of exchange-traded funds (ETFs)

The Bank will purchase ETFs so that their amount outstanding will increase at an annual pace of about 6 trillion yen (almost double the previous pace of about 3.3 trillion yen).

- (2) Measures to ensure smooth fund raising in foreign currencies by Japanese firms and financial institutions

(a) Increasing the size of the Bank's U.S. dollar lending program to support growth

The Bank will increase the size of its U.S. dollar lending program to support growth (the Special Rules for the U.S. Dollar Lending Arrangement to Enhance the Fund-Provisioning Measure to Support Strengthening the Foundations for Economic Growth Conducted through the Loan Support Program) to 24 billion USD (about 2.5 trillion yen; double the previous size of 12 billion USD). Under this lending program, the Bank provides its U.S. dollar funds for a period of up to four years to support Japanese firms' overseas activities through financial institutions.

(b) Establishing a new facility for lending securities to be pledged as collateral for the U.S. Dollar Funds-Supplying Operations

The Bank will establish a new facility in which it lends Japanese government securities (JGSs) to financial institutions against their current account balances with the Bank so that these JGSs can be pledged as collateral for the U.S. Dollar Funds-Supplying Operations.

Moreover, at the September MPM, the Policy Board conducted a comprehensive assessment of the developments in economic activity and prices under QQE and QQE with a Negative Interest Rate as well as their policy effects. Based on this, with a view to achieving the price stability target of 2 percent at the earliest possible time, the Bank decided to introduce QQE with Yield Curve Control by strengthening the two previous policy frameworks mentioned earlier.

- (1) Yield curve control

- (a) Guideline for market operations

The guideline for market operations specifies a short-term policy interest rate and a target level of a long-term interest rate. The Bank decided to set the following guideline for market operations for the intermeeting period. The Bank will cut the interest rates further if judged necessary.

- The short-term policy interest rate:

- The Bank will apply a negative interest rate of minus 0.1 percent to the Policy-Rate Balances in current accounts held by financial institutions at the Bank.

- The long-term interest rate:

- The Bank will purchase Japanese government bonds (JGBs) so that 10-year JGB yields will remain more or less at the current level (around zero percent). With regard to the amount of JGBs to be purchased, the Bank will conduct purchases at more or less the current pace -- an annual pace of increase in the amount outstanding of its JGB holdings of about 80 trillion yen -- aiming to achieve the target level of the long-term interest rate specified by the guideline. JGBs with a wide range of maturities will continue to be eligible for purchase, while the guideline for the average remaining maturity of the Bank's JGB purchases will be abolished.

- (b) New tools for market operations to facilitate yield curve control

The Bank decided to introduce the following new tools for market operations so as to control the yield curve smoothly.

- (i) Outright purchases of JGBs with yields designated by the Bank (fixed-rate purchase operations)

- (ii) Fixed-rate funds-supplying operations for a period of up to 10 years (extending the longest maturity of the operations from the previous period of one year)

- (a) Guideline for market operations

- (2) Guidelines for asset purchases

With regard to asset purchases other than JGB purchases, the Bank decided to set the following guidelines.

- (a) The Bank will purchase ETFs and Japan real estate investment trusts (J-REITs) so that their amounts outstanding will increase at annual paces of about 6 trillion yen and about 90 billion yen, respectively.

- (b) As for CP and corporate bonds, the Bank will maintain their amounts outstanding at about 2.2 trillion yen and about 3.2 trillion yen, respectively.

- (3) Inflation-overshooting commitment

The Bank will continue with QQE with Yield Curve Control, aiming to achieve the price stability target of 2 percent, as long as it is necessary for maintaining that target in a stable manner. It will continue expanding the monetary base until the year-on-year rate of increase in the observed CPI (all items less fresh food) exceeds the price stability target of 2 percent and stays above the target in a stable manner, while the pace of increase in the monetary base may fluctuate in the short run under market operations that aim at controlling the yield curve.

The Bank will make policy adjustments as appropriate, taking account of developments in economic activity and prices as well as financial conditions, with a view to maintaining the momentum toward achieving the price stability target of 2 percent.

B. Second Half of Fiscal 2016 (October 2016-March 2017)

1. Economic developments

a. Looking back at the second half of fiscal 2016, Japan's economy continued its moderate recovery trend, with a virtuous cycle from income to spending being maintained.

Exports followed an increasing trend after having picked up, with the effects of the slowdown in emerging economies waning. Turning to domestic demand, public investment and housing investment were more or less flat. Business fixed investment was on a moderate increasing trend as corporate profits improved. Private consumption was resilient against the background of steady improvement in the employment and income situation. Reflecting these developments in demand both at home and abroad, industrial production picked up and then followed an increasing trend.

b. On the price front, the year-on-year rate of change in the CPI (all items less fresh food) became about 0 percent, after increasing gradually from being slightly negative. Inflation expectations remained in a weakening phase as an adaptive component played a large role in their formation, with the observed inflation rate being about 0 percent or slightly negative.

2. Financial developments

a. Money market rates were at low levels on the whole.

Turning to developments in the bond market, the long-term interest rate was stable at the target level of around zero percent under QQE with Yield Curve Control.

The Nikkei 225 Stock Average was more or less flat until early November, and then rose significantly through end-2016 with a global rise in stock prices mainly stemming from expectations for the new U.S. administration's economic policy. Thereafter, it remained more or less flat and was in the range of 18,500-19,000 yen at end-March.

In the foreign exchange market, through end-2016, the yen depreciated against the U.S. dollar, in a situation where the dollar appreciated against many currencies, mainly reflecting a rise in U.S. interest rates. Thereafter, due in part to a halt to the rise in U.S. interest rates and heightened uncertainties regarding political situations in Europe, the yen appreciated against the U.S. dollar and was in the range of 111-112 yen at end-March. The yen depreciated against the euro and was in the range of 119-120 yen at end-March.

b. As for corporate finance, in terms of credit supply, financial institutions' lending attitudes as perceived by firms were highly accommodative.

Firms' credit demand increased, mainly for funds related to mergers and acquisitions and funds for business fixed investment. With regard to firms' funding, the year-on-year rate of increase in the amount outstanding of lending by domestic commercial banks accelerated moderately and was 3 percent in March. The year-on-year rates of change in the amounts outstanding of CP and corporate bonds were positive.

c. The monetary base continued to increase at a high year-on-year growth rate in the range of 20-25 percent. The year-on-year rate of growth in the M2 was around 4 percent.

3. MPMs4

a. Four MPMs were held in the second half of fiscal 2016.

At the MPM held in October 2016, the Policy Board judged that Japan's economy continued its moderate recovery trend, although exports and production were sluggish, due mainly to the effects of the slowdown in emerging economies. At the MPMs held in December 2016 through March 2017, it judged that the economy continued its moderate recovery trend.

b. In the conduct of monetary policy, at all the MPMs held in the second half of fiscal 2016, the Policy Board decided to continue with the following guidelines for market operations and asset purchases under QQE with Yield Curve Control determined at the MPM held in September 2016.

- (1) Yield curve control

The Bank decided to set the following guideline for market operations for the intermeeting period.

- The short-term policy interest rate:

- The Bank will apply a negative interest rate of minus 0.1 percent to the Policy-Rate Balances in current accounts held by financial institutions at the Bank.

- The long-term interest rate:

- The Bank will purchase JGBs so that 10-year JGB yields will remain at around zero percent. With regard to the amount of JGBs to be purchased, the Bank will conduct purchases at more or less the current pace -- an annual pace of increase in the amount outstanding of its JGB holdings of about 80 trillion yen -- aiming to achieve the target level of the long-term interest rate specified by the guideline.

- (2) Guidelines for asset purchases

With regard to asset purchases other than JGB purchases, the Bank decided to set the following guidelines.

- (a) The Bank will purchase ETFs and J-REITs so that their amounts outstanding will increase at annual paces of about 6 trillion yen and about 90 billion yen, respectively.

- (b) As for CP and corporate bonds, the Bank will maintain their amounts outstanding at about 2.2 trillion yen and about 3.2 trillion yen, respectively.

With regard to the future conduct of monetary policy, the Policy Board confirmed the following at all the MPMs held in the second half of fiscal 2016: "the Bank will continue with QQE with Yield Curve Control, aiming to achieve the price stability target of 2 percent, as long as it is necessary for maintaining that target in a stable manner. It will continue expanding the monetary base until the year-on-year rate of increase in the observed CPI (all items less fresh food) exceeds 2 percent and stays above the target in a stable manner. The Bank will make policy adjustments as appropriate, taking account of developments in economic activity and prices as well as financial conditions, with a view to maintaining the momentum toward achieving the price stability target."

Notes:

- 2The review provided here comprises excerpts from the summaries of the latest two issues of the Semiannual Report on Currency and Monetary Control submitted to the Diet in December 2016 and June 2017. The full texts of both issues in Japanese and summaries in English are available on the Bank's website.

- 3Information related to MPMs is available on the "Monetary Policy Meetings" page on the Bank's website.

- 4Information related to MPMs is available on the "Monetary Policy Meetings" page on the Bank's website.

QQE with Yield Curve Control

At the September 2016 MPM, the Bank conducted a comprehensive assessment of the developments in economic activity and prices as well as the policy effects since the introduction of QQE (released as the Comprehensive Assessment1, 2). Based on its findings, the Bank decided to introduce QQE with Yield Curve Control,3, 4 which is a new framework for strengthening monetary easing.

The new policy framework consists of two components: the first is "yield curve control" in which the Bank controls short-term and long-term interest rates through market operations; the second is an "inflation-overshooting commitment" in which the Bank commits itself to expanding the monetary base until the year-on-year rate of increase in the observed CPI exceeds the price stability target of 2 percent and stays above the target in a stable manner.

1. Yield curve control

As shown in the Comprehensive Assessment, QQE, which was introduced in April 2013, has brought about improvements in economic activity and prices mainly through the decline in real interest rates, and Japan's economy is no longer in deflation, which is commonly defined as a sustained decline in prices. With this in mind, yield curve control, in which the Bank seeks a decline in real interest rates by controlling short-term and long-term interest rates, has been placed at the core of the new policy framework.

The experience so far with the negative interest rate policy, which was introduced in January 2016, shows that a combination of the negative interest rate on current account balances at the Bank and purchases of JGBs is effective for yield curve control. In addition, the Bank has decided to introduce new tools of market operations, such as fixed-rate purchase operations, to facilitate smooth implementation of yield curve control.

2. Inflation-overshooting commitment

The Bank has introduced an inflation-overshooting commitment, under which it continues expanding the monetary base until the year-on-year rate of increase in the observed CPI (all items less fresh food) exceeds the price stability target of 2 percent and stays above the target in a stable manner. Through this commitment, the Bank aims to enhance the credibility of achieving 2 percent among the public.

The Bank will make policy adjustments as appropriate, taking account of developments in economic activity and prices as well as financial conditions, with a view to maintaining the momentum toward achieving the price stability target of 2 percent.

Notes:

- 1See Comprehensive Assessment: Developments in Economic Activity and Prices as well as Policy Effects since the Introduction of Quantitative and Qualitative Monetary Easing (QQE) [PDF 812KB] on the Bank's website .

- 2For details of the analysis conducted in the Comprehensive Assessment, see Supplementary Paper Series for the "Comprehensive Assessment" on the Bank's website: (1) "Developments in Inflation Expectations over the Three Years since the Introduction of Quantitative and Qualitative Monetary Easing (QQE) [PDF 414KB]" released on October 14, 2016; (2) "Developments in the Natural Rate of Interest in Japan [PDF 369KB]" released on October 18, 2016; and (3) "Policy Effects since the Introduction of Quantitative and Qualitative Monetary Easing (QQE) -- Assessment Based on the Bank of Japan's Large-scale Macroeconomic Model (Q-JEM) -- [PDF 327KB]" released on November 7, 2016.

- 3The decisions made under QQE with Yield Curve Control are available on the "Monetary Policy Releases" page on the Bank's website.

- 4For details, refer to "New Framework for Strengthening Monetary Easing: 'Quantitative and Qualitative Monetary Easing with Yield Curve Control' [PDF 44KB]" released on September 21, 2016.

III. Performance Reviews of Measures Taken Under the Strategic Priorities

A. Plan and Formulate Monetary Policy Measures That Facilitate Policy Conduct

1. Progress in implementing specific measures

- (1) With a view to contributing to monetary policy conduct, the Bank conducted research and analysis from multiple perspectives regarding economic and financial conditions both at home and abroad, including the broader effects of the United Kingdom's vote to leave the EU and of the U.S. presidential election, as well as their implications for Japan's economy. In May 2016, the Bank started compiling the consumption activity index (CAI) so as to better capture developments in private consumption.

- (2) The Bank added various new approaches to its multi-perspective analysis on the effects and impacts of monetary policy, focusing on developments in inflation expectations and their formation mechanisms, as well as the downward effects on interest rates of JGB purchases and the introduction of the negative interest rate policy. Based on the results of its analysis, the Bank planned and formulated the following monetary policy measures flexibly.

- (a) Conducting the comprehensive assessment of the developments in economic activity and prices, as well as of the policy effects since the introduction of QQE, and introducing QQE with Yield Curve Control based on its findings.

- (b) Enhancing monetary easing through an increase in ETF purchases and measures to ensure smooth funding in foreign currencies by Japanese firms and financial institutions.

- (c) Introducing the Funds-Supplying Operation to Support Financial Institutions in Disaster Areas of the 2016 Kumamoto Earthquake and other measures.

- (d) Making changes to the maximum size of each ETF purchase.

- (e) Extending the duration of operations such as the Fund-Provisioning Measure to Stimulate Bank Lending.

- (3) In February 2017, the Bank simplified the principal terms and conditions for monetary policy measures with a view to contributing to the further enhancement of discussions on monetary policy.

- (4) The Bank enhanced dialogue with market participants through the following initiatives.

- (a) The Bank actively exchanged opinions on such occasions as the "Meeting on Market Operations" and the "Bond Market Group," each of which was held twice in fiscal 2016.

- (b) In February 2017, the Bank decided to announce a detailed schedule of JGB purchases for the following month in the outline of outright purchases of JGSs released at the end of each month.

- (5) Progress was made in fundamental research on the following: monetary policy; the macroeconomy; financial markets; legal and accounting systems, and information security, in finance-related fields; and monetary history. The Bank communicated its research findings to the public through the release of research papers and presentations at academic conferences both at home and abroad.

2. Evaluation of progress

With a view to contributing to monetary policy conduct, the Bank conducted research and analysis from multiple perspectives regarding economic and financial conditions both at home and abroad; it also carried out multi-perspective analysis on the effects and impacts of monetary policy. In light of its analysis, the Bank planned and formulated monetary policy measures flexibly, for example introducing QQE with Yield Curve Control based on the findings of the comprehensive assessment. In addition, the Bank enhanced dialogue with market participants through, for example, the "Meeting on Market Operations" and the "Bond Market Group," and made steady adjustments to its operational arrangements so as to ensure that monetary policy continued to be conducted appropriately.

Based on the above, the Bank considers that, in fiscal 2016, it achieved its intended objective in terms of providing a firm underpinning for monetary policy conduct. In fiscal 2017, the Bank will continue to work to have the necessary arrangements in place to conduct research and analysis that appropriately reflects changes in economic and financial conditions, to plan policy measures flexibly, and to conduct market operations properly.

B. Ensure Stability and Improve the Functioning of the Financial System

1. Progress in implementing specific measures

- (1) In line with the "On-Site Examination Policy for Fiscal 2016" decided by the Policy Board, the Bank stepped up its efforts to conduct on-site examinations of financial institutions more efficiently and effectively in light of the extent of their influence on the financial system and their risk profiles; it carried out examinations of 85 financial institutions. It conducted thorough assessments, for example, of financial institutions' business operations and the state of their property as well as their profitability and resilience against risks, including the actual business conditions of their financial group as a whole and the risk management of their overseas branches.

- (2) With regard to off-site monitoring, the Bank held in-depth interviews with financial institutions and secured a sound understanding of their business activities in areas where they had adopted a proactive risk-taking stance. It also continued to deepen its understanding of financial institutions' business conditions, such as business operations, risk management, and profitability, mainly through examining from multiple perspectives the effects of the introduction of the negative interest rate policy on financial business practices and financial institutions' management. In particular, the Bank sharpened its focus on business conditions at systemically important financial institutions by taking into account the systemic implications of, for example, the active expansion of their global business and the accompanying risks. It also encouraged such institutions' efforts to improve their risk management, for example, through exchanging views with them.

- (3) In the Financial System Report, the Bank, while refining its macro stress testing exercises, examined financial intermediation by Japanese financial institutions and current conditions in the financial system; it also deepened its quantitative analysis regarding potential vulnerabilities of the financial system in a low or negative interest rate environment. In addition, the Bank continued to share awareness of challenges and risks, particularly with financial institutions, through the following initiatives in fiscal 2016: releasing three issues of the Financial System Report Annex Series providing more detailed analysis of and insight into selected topics; actively communicating with financial institutions and analysts through 35 seminars; and pursuing dialogue with the boards of directors of financial institutions through on-site examinations and off-site monitoring.

- (4) The Bank further strengthened cooperation on the macroprudential front with the Financial Services Agency (FSA) by, for example, holding regular joint meetings -- twice in fiscal 2016 -- and sharing awareness of challenges and risks at all levels, as well as developing the framework for the operation of the countercyclical capital buffer.

- (5) The Bank executed business operations for the Loan Support Program in an appropriate manner -- for example making arrangements for measures to ensure smooth funding in foreign currencies by Japanese firms and financial institutions.

- (6) The Bank hosted large-scale seminars on topics such as financial institutions' support for firms making renewed efforts for business revitalization and discontinuance. It also held a series of workshops on utilizing IT to advance financial technology and management, and released in October 2016 a summary report of the discussions.

2. Evaluation of progress

The Bank enhanced its assessment particularly of business operations and risk management at financial institutions and facilitated necessary improvements through the following: in the Financial System Report, it presented its assessment of challenges and risks faced in maintaining and improving the stability and functioning of the financial system, and conducted on-site examinations and improved off-site monitoring based on this assessment. In particular, the Bank sharpened its focus on business conditions at systemically important financial institutions, taking into account the extent of any systemic implications, and facilitated necessary improvements. In addition, the Bank deepened dialogue with regional financial institutions on the key management issues and challenges facing them, such as strengthening their core profitability in a low interest rate environment.

The Bank carried out, efficiently and in an appropriate manner, both the selection of financial institutions to conduct transactions with the Bank and business operations relating to the provision of loans. It also further strengthened cooperation on the macroprudential front with the relevant authority.

During fiscal 2016, there were no circumstances that required the Bank to provide loans pursuant to Articles 37 and 38 of the Bank of Japan Act (hereafter the Act).

Based on the above, the Bank considers that it steadily tackled challenges in maintaining and improving the stability and functioning of the financial system in the face of financial institutions' macro risks and structural changes in the financial system, thereby producing the intended effects. In fiscal 2017, the Bank will work strenuously to identify challenges and risks faced in maintaining and improving the stability and functioning of the financial system, and to deepen its understanding of the situation on the ground, for example, for business operations and risk management at financial institutions. The Bank will also work further to share with relevant parties a common understanding of the current situation and of challenges facing financial institutions and the financial system.

C. Enhance Payment and Settlement Services and Reinforce Market Infrastructure

1. Progress in implementing specific measures

- (1) Looking to enhance Japan's payment and settlement services using the Bank of Japan Financial Network System (BOJ-NET), the Bank implemented the following initiatives in consultation with financial institutions and relevant parties.

- (a) Following deliberations at the Forum Towards Making Effective Use of the BOJ-NET, the Bank provided support in identifying issues and deciding appropriate courses of action, mainly with regard to the phased extension of the operating hours of the BOJ-NET. These issues included the expansion of trade volume in the ongoing first phase in which operating hours have been extended until 9:00 p.m., and the further extension of those hours in the second phase.

- (b) In February 2017, the Bank conducted a survey on cross-border yen payment services provided by banks in order to research and analyze potential demand by firms for such services as well as issues involved in offering them during the evening and night hours in Japan.

- (c) The Bank continued with its deliberations on Global Access, which allows BOJ-NET participant financial institutions access to the BOJ-NET from terminals in their overseas offices. The outcome of these deliberations was compiled and released in May 2017.

- (2) The Bank continued with its deliberations and coordination with other central banks and relevant parties regarding issues that remain on the way to realizing payment and settlement for cross-border transactions in yen or JGBs.