Annual Review 2020

October 30, 2020

Bank of Japan

The Annual Review 2020 provides an overview of the Bank of Japan's organization and business operations, a review of its implementation of business operations and organizational management in fiscal 2019 (April 1, 2019-March 31, 2020), and a description of the Bank's accounts for the fiscal year.

The report is also available in the HTML format from November 27.

Contents

The full text of the report is available in the PDF version. The HTML version does not include the sections marked with asterisks (*).

- Foreword by the Governor [PDF 66KB]

- About the Bank of Japan [PDF 4,758KB]

- I. Core Purposes

- II. Capital

- III. The Bank's Officers

- IV. Organization

- The Bank's Business Operations [PDF 1,394KB]

- I. Monetary Policy

- II. Financial System Policy

- III. Enhancement of Payment and Settlement Systems and Market Infrastructures

- IV. International Operations

- V. Issuance, Circulation, and Maintenance of Banknotes

- VI. Services Relating to the Government

- VII. Communication with the Public

- The Bank's Review of Fiscal 2019 [PDF 1,399KB]

- I. Introduction

- II. Review of Economic and Financial Developments and Monetary Policy Meetings

- III. The Bank's Response to the Novel Coronavirus (COVID-19)

- IV. Performance Reviews of Measures Taken under the Medium-Term Strategic Plan

- The Bank's Organizational Management in Fiscal 2019 [PDF 389KB]

- I. Statement of Accounts and Budget for Expenses

- II. IT Investment

- III. Human Resources

- IV. Organizational Management Measures

- V. Internal Audits

- The Bank's Accounts: Financial Statements and Other Documents for Fiscal 2019* [PDF 2,069KB]

- I. Assets and Liabilities, Profits and Losses, and Capital Adequacy Ratio

- II. Financial Statements

- III. Schedule for the Financial Statements

- IV. Expenses

- Appendixes [PDF 1,730KB]

- Appendix 1: Overview of Audits of the Bank of Japan*

- Appendix 2: Medium-Term Strategic Plan (Fiscal 2019-2023)

- Attachment 1 for Appendix 2: The Bank of Japan's Budget for Expenses for Fiscal 2020*

- Attachment 2 for Appendix 2: The Ceiling on the Number of Full-Time Employees of the Bank of Japan for Fiscal 2020*

- Information [PDF 1,350KB]

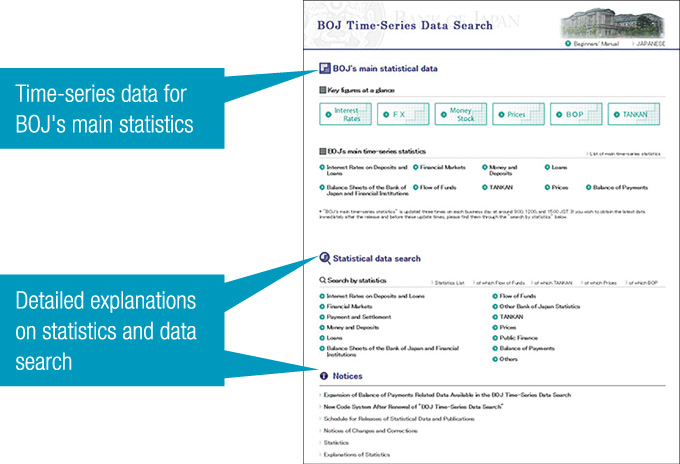

- I. Bank of Japan Website

- II. Visiting the Bank of Japan

- III. Publications and Reports

Foreword by the Governor

The Bank of Japan has two missions, to achieve price stability and ensure the stability of the financial system. On the price stability side, the Bank has been steadily pursuing its policy of Quantitative and Qualitative Monetary Easing with Yield Curve Control to achieve the price stability target of 2 percent in terms of the year-on-year rate of change in the consumer price index. The Bank works to fulfill the two missions by conducting, besides monetary policy, business operations in a wide range of areas such as financial system and bank examination, payment and settlement systems, market infrastructures, international finance, banknotes, treasury funds and Japanese government securities services, and public communications. The Bank pursues its various policies through the precise and deliberate execution of these central banking operations.

The Annual Review provides excerpts from the Japanese original Gyoumu Gaikyo Sho (Outline of Business Operations), which is prepared pursuant to Article 55 of the Bank of Japan Act. The Gyoumu Gaikyo Sho for fiscal 2019 and the Annual Review 2020 have been drawn up and released to explain to readers the implementation of the Bank's business operations during fiscal 2019. Throughout the fiscal year, the Bank, in accordance with the Medium-Term Strategic Plan (Fiscal 2019-2023), addressed various issues and moved forward with a number of measures, while ensuring that its business operations and organizational management were conducted in a timely manner in view of changes in circumstances, as can be seen, for example, from its measures in response to the spread of the novel coronavirus (COVID-19). The Bank will continue with its efforts as the country's central bank to achieve the sustainable growth and development of Japan's economy. I hope this year's Annual Review will help readers to gain an overview of the Bank's activities toward these ends.

KURODA Haruhiko

Governor of the Bank of Japan

About the Bank of Japan

The Bank of Japan is the central bank of Japan. It is a juridical person established based on the Bank of Japan Act (hereafter the Act), and is not a government agency or a private corporation (Table 1).

| 1882 | June | The Bank of Japan Act of 1882 is promulgated; the Bank is to have capital of 10 million yen and is given a license to operate for 30 years from the start of business. |

|---|---|---|

| Oct. 10 | Business operation begins. | |

| 1887 | Mar. | An increase in the Bank's capital is announced from 10 million yen to 20 million yen. |

| 1895 | Aug. | An increase in the Bank's capital is announced from 20 million yen to 30 million yen. |

| 1896 | Apr. | The Head Office is moved to a new building at the present location. |

| 1910 | Feb. | The Bank is given a license to operate for 30 more years from October 10, 1912, and an increase in the Bank's capital is announced from 30 million yen to 60 million yen. |

| 1942 | Feb. | The Bank of Japan Act of 1942 is promulgated; the Bank is to have capital of 100 million yen. |

| May 1 | The Bank is reorganized under the Bank of Japan Act of 1942. | |

| 1949 | June | The Policy Board is established. |

| 1997 | June | The Bank of Japan Act of 1997 is promulgated; the Bank is to have capital of 100 million yen. |

| 1998 | Apr. 1 | The Bank of Japan Act of 1997 comes into effect. |

I. Core Purposes

The Act determines the Bank's core purposes as follows:

Article 1

(1) The purpose of the Bank of Japan, or the central bank of Japan, is to issue banknotes and to carry out currency and monetary control.

(2) In addition to what is prescribed in the preceding paragraph, the Bank of Japan's purpose is to ensure smooth settlement of funds among banks and other financial institutions, thereby contributing to the maintenance of stability of the financial system.

The Act also stipulates the principle governing the Bank's currency and monetary control as follows:

Article 2

Currency and monetary control by the Bank of Japan shall be aimed at achieving price stability, thereby contributing to the sound development of the national economy.

II. Capital

The Bank is capitalized at 100 million yen in accordance with Article 8, paragraph 1 of the Act. As of the end of March 2020, 55,008,000 yen is subscribed by the government, and the rest by the private sector (Table 2).1

The Act does not grant holders of subscription certificates the right to participate in the Bank's management, and, in the case of liquidation, only gives them the right to request distribution of residual assets up to the sum of the paid-up capital and, if any, the special reserve fund.2 Dividend payments as a proportion of paid-up capital are limited to 5 percent or below in each fiscal year.3

Notes:

- 1.Article 8, paragraph 2 of the Act states as follows: "Of the amount of stated capital set forth in the preceding paragraph, the amount of contribution by the government shall be no less than fifty-five million yen."

- 2.Stipulated by Article 60, paragraph 2, and Supplementary Provisions Article 22, paragraph 2.

- 3.Stipulated by Article 53, paragraph 4.

| Subscribers | Amount of subscription (thous. yen)1 | Percentage of the total subscription (%) | |

|---|---|---|---|

| The government | 55,008 | 55.0 | |

| The private sector | 44,991 | 45.0 | |

| Individuals | 40,353 | 40.4 | |

| Financial institutions | 2,019 | 2.0 | |

| Public organizations | 191 | 0.2 | |

| Securities companies | 32 | 0.0 | |

| Other firms | 2,393 | 2.4 | |

| Total | 100,000 | 100.0 | |

Note:

- 1.Rounded down to the nearest 1,000 yen. As of the end of March 2020.

III. The Bank's Officers

The Bank's officers are the Governor, Deputy Governors, Members of the Policy Board, Auditors, Executive Directors, and Counsellors.4 Of the above, the Governor, Deputy Governors, and Members of the Policy Board make up the Policy Board.5

The Governor, Deputy Governors, and Members of the Policy Board are appointed by the Cabinet, subject to the consent of the House of Representatives and the House of Councillors. Auditors are appointed by the Cabinet. Executive Directors and Counsellors are appointed by the Minister of Finance based on the Policy Board's recommendation.6

The terms of office are five years for the Governor, Deputy Governors, and Members of the Policy Board; four years for Auditors and Executive Directors; and two years for Counsellors.7 The Bank's officers, excluding Executive Directors, are not dismissed against their will during their terms of office, except in the cases prescribed in the Act, such as the formal commencement of bankruptcy proceedings against them.8

For duties and powers of the Bank's officers, see Table 3.9

Notes:

- 4.Stipulated by Article 21. The officers of the Bank consist of a Governor, two Deputy Governors, six Members of the Policy Board, three or fewer Auditors, six or fewer Executive Directors, and a small number of Counsellors.

- 5.Stipulated by Article 16, paragraph 2.

- 6.Stipulated by Article 23.

- 7.Stipulated by Article 24.

- 8.Stipulated by Article 25.

- 9.Duties and powers are stipulated by Article 16, paragraph 2, and Article 22.

| Duties and powers | ||

|---|---|---|

| Policy Board members | Decide the guideline for currency and monetary control and other important matters concerning the Bank's operations, and supervise the officers (excluding Auditors and Counsellors) in the fulfillment of their duties. | |

| Governor | Represents the Bank and exercises general control over the Bank's business in accordance with decisions made by the Policy Board. At the same time, fulfills the duties of an independent Policy Board member. | |

| Deputy Governors | In accordance with decisions made by the Governor, represent the Bank, administer the business of the Bank assisting the Governor, act for the Governor whenever the Governor is prevented from attending to his/her duties, and perform the Governor's duties during a vacancy in the office of the Governor. At the same time, fulfill the duties of independent Policy Board members. | |

| Members of the Policy Board | Comprise the Policy Board, together with the Governor and Deputy Governors. | |

| Auditors | Audit the business of the Bank. May, when they find it necessary based on the audit results, submit their opinions to the Minister of Finance, the Prime Minister (the Commissioner of the Financial Services Agency when the Prime Minister delegates such authority under Article 61-2 of the Act), or the Policy Board. | |

| Executive Directors | In accordance with decisions made by the Governor, administer the business of the Bank assisting the Governor and Deputy Governors, act for the Governor when the Governor and Deputy Governors are prevented from attending to their duties, and perform the Governor's duties during vacancies in the offices of the Governor and Deputy Governors. | |

| Counsellors | Give advice to the Policy Board when consulted on any important matter concerning the Bank's business operations. May also express their opinions to the Policy Board when they find it necessary. | |

Policy Board Members1,2

Standing from left to right: ADACHI Seiji, SUZUKI Hitoshi, SAKURAI Makoto, MASAI Takako, KATAOKA Goushi, and NAKAMURA Toyoaki

Seated from left to right: AMAMIYA Masayoshi, KURODA Haruhiko, and WAKATABE Masazumi

Notes:

- 1.Members are as of October 5, 2020.

- 2.The texts of speeches by Policy Board members are available on the Bank's website (https://www.boj.or.jp/en/announcements/press/koen_speaker/index.htm).

KURODA HaruhikoGovernor (the 31st) and Chairman of the Policy Board Date of Birth October 25, 1944 |

|

| 1967 | Joined Japan's Ministry of Finance (MOF) |

| 1987 | Director, International Organizations Division, International Finance Bureau |

| 1988 | Secretary to the Minister of Finance |

| 1989 | Director, International Tax Affairs Division, Tax Bureau |

| 1990 | Director, Income Tax and Property Tax Policy Division, Tax Bureau |

| 1991 | Director, Co-ordination Division, Tax Bureau |

| 1993 | Regional Commissioner, Osaka Regional Taxation Bureau, National Tax Agency |

| 1994 | Deputy Director-General, International Finance Bureau, MOF |

| 1996 | President, Institute of Fiscal and Monetary Policy |

| 1997 | Director-General, International Finance Bureau |

| 1998 | Director-General, International Bureau |

| 1999 | Vice Minister of Finance for International Affairs |

| 2003 | Special Advisor to the Cabinet and Professor, Graduate School of Economics, Hitotsubashi University |

| 2005 | President, Asian Development Bank |

| 2013 | Present position |

AMAMIYA MasayoshiDeputy Governor Date of Birth September 30, 1955 |

|

| 1979 | Joined the Bank of Japan |

| 1998 | Director, Head of Planning Division II, Policy Planning Office |

| Director, Head of Money and Capital Markets Division, Financial Markets Department | |

| 1999 | Director, Head of Planning Division I, Policy Planning Office |

| 2001 | Associate Director-General, Policy Planning Office |

| 2002 | Associate Director-General, Bank Examination and Surveillance Department |

| 2004 | Deputy Director-General, Secretariat of the Policy Board |

| 2006 | Director-General, Monetary Affairs Department |

| 2010 | Executive Director |

| 2012 | Executive Director and General Manager, Osaka Branch |

| 2013 | Executive Director |

| 2018 | Present position |

WAKATABE MasazumiDeputy Governor Date of Birth February 26, 1965 |

|

| 1991 | Research Associate, Waseda University |

| 1998 | Assistant Professor, Waseda University |

| 2000 | Associate Professor, Waseda University |

| 2005 | Professor, Waseda University |

| 2017 | Visiting Scholar, Center on Japanese Economy and Business, Columbia Business School |

| 2018 | Present position |

SAKURAI MakotoDate of Birth June 16, 1946 |

|

| 1976 | Joined the Export-Import Bank of Japan |

| 1980 | Visiting Fellow, Economic Growth Center, Yale University |

| 1989 | Senior Economist, Research Institute for International Investment and Development, Export-Import Bank of Japan |

| Director General and Chief Economist, Taisho Marine Research Institute Co., Ltd. | |

| 1990 | Also served as Senior Research Fellow, Institute of Fiscal and Monetary Policy, Ministry of Finance |

| 1996 | President, Research Center for International Finance, Mitsui Marine Research Institute Co., Ltd. |

| 2007 | President, Sakurai & Associates International Finance Research Center |

| 2016 | Present position |

MASAI TakakoDate of Birth March 8, 1965 |

|

| 1988 | Joined Scotiabank, Tokyo |

| 1989 | Joined The Toronto-Dominion Bank, Tokyo |

| 1998 | Joined Credit Agricole Indosuez, Tokyo |

| 2004 | Joined Calyon Corporate and Investment Bank,3 Tokyo |

| 2007 | General Manager, Capital Markets Division, Shinsei Bank, Ltd. |

| 2011 | General Manager, Markets Division, Shinsei Bank, Ltd. |

| General Manager, Markets Sub-Group, Shinsei Bank, Ltd. | |

| 2013 | Executive Officer, Head of Markets Research Department, Markets Sub-Group, Shinsei Bank, Ltd. |

| 2015 | Executive Officer, General Manager of Markets Research Division, Shinsei Bank, Ltd. |

| 2016 | Executive Officer, General Manager of Financial Research Division, Shinsei Bank, Ltd. |

| Present position | |

Notes:

- 3.Established in 2004 through merger of Credit Agricole Indosuez and Credit Lyonnais.

SUZUKI HitoshiDate of Birth January 8, 1954 |

|

| 1977 | Joined The Mitsubishi Bank, Ltd. |

| 2005 | Executive Officer and General Manager, Treasury Planning Office and Treasury IT Planning Office, The Bank of Tokyo-Mitsubishi, Ltd. (BTM)4 |

| 2006 | Executive Officer and General Manager, Global Markets Planning Division, The Bank of Tokyo-Mitsubishi UFJ, Ltd. (BTMU)5 |

| 2007 | Executive Officer and General Manager, Strategic Credit Portfolio Management Division, BTMU |

| 2011 | Senior Managing Director, Chief Executive, Global Markets Unit, BTMU |

| 2012 | Deputy President, BTMU |

| 2014 | Corporate Auditor, BTMU |

| 2016 | Director, Audit and Supervisory Committee Member, BTMU |

| 2017 | Advisor, BTMU |

| Present position | |

Notes:

- 4.Established in 1996 through merger of The Mitsubishi Bank, Ltd. and The Bank of Tokyo, Ltd.

- 5.Established in 2006 through merger of The Bank of Tokyo-Mitsubishi, Ltd. and UFJ Bank Ltd., and subsequently renamed MUFG Bank, Ltd. in April 2018.

KATAOKA GoushiDate of Birth November 30, 1972 |

|

| 1996 | Joined Sanwa Research Institute |

| 2005 | Senior Economist, Economic & Social Policy Department, UFJ Institute Ltd.6 |

| 2006 | Senior Economist, Economic & Social Policy Department, Mitsubishi UFJ Research and Consulting Co., Ltd.7 |

| 2016 | Senior Economist, Economic Policy Department, Mitsubishi UFJ Research and Consulting Co., Ltd. |

| 2017 | Present position |

Notes:

- 6.Established in 2002 through merger of Sanwa Research Institute and Tokai Research & Consulting Inc.

- 7.Established in 2006 through merger of UFJ Institute Ltd., The Diamond Business Consulting Co., Ltd., and Tokyo Research International Co., Ltd.

ADACHI SeijiDate of Birth July 4, 1965 |

|

| 1989 | Joined Daiwa Securities Co. Ltd. |

| 1995 | Joined Daiwa Institute of Research Ltd. |

| 2001 | Joined Fuji Investment Management Co., Ltd. |

| Joined Credit Suisse First Boston Securities (Japan) Ltd., Tokyo Branch | |

| 2004 | Joined Deutsche Securities Ltd., Tokyo Branch |

| 2013 | Joined Marusan Securities Co., Ltd. |

| General Manager, Economic Research Department, Marusan Securities Co., Ltd. | |

| 2020 | Present position |

NAKAMURA ToyoakiDate of Birth August 3, 1952 |

|

| 1975 | Joined Hitachi, Ltd. |

| 2006 | General Manager of Finance Department I, Hitachi, Ltd. |

| 2007 | Representative Executive Officer, Senior Vice President (SVP) and Executive Officer, General Manager of Finance Department I and Director, Hitachi, Ltd. |

| 2009 | Representative Executive Officer, SVP and Executive Officer, in charge of Finance, Pension, Group Management and Business Development, Hitachi, Ltd. |

| 2012 | Representative Executive Officer, Executive Vice President (EVP) and Executive Officer, General Manager of Finance & Accounting Group, Hitachi, Ltd. |

| 2014 | Representative Executive Officer, EVP and Executive Officer, CFO, Hitachi, Ltd. |

| 2016 | Director, Hitachi, Ltd. |

| 2020 | Present position |

IV. Organization

Organization Chart of the Bank1

Notes:

- 1.As of October 5, 2020.

- 2.As stipulated by Article 16, paragraph 2 of the Act, the Policy Board shall consist of the Governor, two Deputy Governors, and six Members of the Policy Board.

- 3.Local offices include the Computer Center represented by the Director-General of the Information System Services Department, and the Banknote Operations Center represented by the Director-General of the Currency Issue Department.

| Head office departments | Officials |

|---|---|

| Secretariat of the Policy Board | NAKAJIMA Takeshi (Director-General) HIROSHIMA Tetsuya (Director-General, Senior Secretary to the Governor) NAKAONE Yasuhiro (Director-General for Management Strategy, Budget and Accounting) |

| Internal Auditors' Office | MIYASHITA Toshiro (Director-General) |

| Monetary Affairs Department | SHIMIZU Seiichi (Director-General) |

| Financial System and Bank Examination Department | KOGUCHI Hirohide (Director-General) |

| Payment and Settlement Systems Department | KAMIYAMA Kazushige (Director-General) |

| Financial Markets Department | OTANI Akira (Director-General) |

| Research and Statistics Department | KAMEDA Seisaku (Director-General) |

| International Department | FUKUMOTO Tomoyuki (Director-General) |

| Currency Issue Department | KANNO Hiroyuki (Director-General) |

| Operations Department | CHIDA Hidetsugu (Director-General) |

| Information System Services Department | TERUUCHI Taro (Director-General) |

| Public Relations Department | HAYASHI Shinichiro (Director-General) |

| Personnel and Corporate Affairs Department | SAKAMOTO Tetsuya (Director-General) HARIMOTO Keiko (Director-General for Personnel Management) |

| Administration Department | TANIGUCHI Fumikazu (Director-General) |

| Institute for Monetary and Economic Studies | MATSUSHITA Ken (Director-General) |

| Overseas representative offices | Telephone numbers | General managers/ chief representatives |

|

|---|---|---|---|

| New York | Bank of Japan Chief Representative Office for the Americas Bank of Japan Representative Office in New York 140 Broadway, 18th Floor, New York, NY 10005, U.S.A. |

+1-212-269-6566 | NAKAMURA Koji (General Manager for the Americas and Chief Representative in New York) |

| Washington, D.C. |

Bank of Japan Representative Office in Washington, D.C. 1801 Pennsylvania Ave., N.W., Suite 800, Washington, D.C. 20006, U.S.A. |

+1-202-466-2228 | MIYA Masafumi (Chief Representative in Washington, D.C.) |

| London | Bank of Japan Chief Representative Office for Europe Bank of Japan Representative Office in London Basildon House, 7-11 Moorgate, London EC2R 6AF, U.K. |

+44-20-7606-2454 | HANAJIRI Tetsuro (General Manager for Europe and Chief Representative in London) |

| Paris | Bank of Japan Representative Office in Paris 17 Avenue George V, 75008 Paris, France |

+33-1-4720-7295 | YAMASHITA Yuji (Chief Representative in Paris) |

| Frankfurt | Bank of Japan Representative Office in Frankfurt Taunusanlage 21, 60325 Frankfurt am Main, Germany |

+49-69-9714310 | ADACHI Yuichi (Chief Representative in Frankfurt) |

| Hong Kong | Bank of Japan Representative Office in Hong Kong Suite 1012, One Pacific Place, 88 Queensway, Central, Hong Kong |

+852-2525-8325 | TOYOKURA Chikara (Chief Representative in Hong Kong) |

| Beijing | Bank of Japan Representative Office in Beijing 19th Floor, Unit 12C, China World Tower 2, No. 1 Jian Guo Men Wai Avenue, Beijing 100004, China |

+86-10-6505-9601 | SAKASHITA Hideto (Chief Representative in Beijing) |

Functions of Committees/Departments/Offices

Committees and Head Office Departments

Management Committee

Examines and manages Bank-wide issues regarding the Bank's operations. The committee comprises the Deputy Governors and all Executive Directors.

Compliance Committee

Ensures that the officers and employees perform their duties fairly and in compliance with the relevant laws and regulations. The committee comprises members appointed from among the Deputy Governors and Executive Directors by the Governor, the Director-General of the Internal Auditors' Office, and one or more legal experts from outside the Bank.

Secretariat of the Policy Board

(1) Arranges proceedings for Policy Board meetings, (2) liaises with the Diet and the media, (3) reviews the content and wording of important documents, and offers a legal perspective on them, (4) plans and formulates measures relating to the Bank's business operations and organizational management, (5) handles the Bank's budget, settlement, and accounting, (6) provides administrative services for the Bank's officers, and (7) supports Auditors in auditing.

Internal Auditors' Office

Audits the Bank's business operations.

Monetary Affairs Department

Plans and formulates monetary policy measures.

Financial System and Bank Examination Department

(1) Plans and formulates measures that contribute to the maintenance of an orderly financial system, (2) conducts on-site examinations and off-site monitoring of financial institutions that hold current accounts at the Bank, (3) judges financial institutions' eligibility to hold current accounts at the Bank and to have access to its lending facilities, and (4) determines the specifics of credit extension and discounting of bills by the Bank.

Payment and Settlement Systems Department

Plans and formulates measures in the following areas: (1) policy issues relating to payment and settlement systems; (2) financial institutions' access to payment and settlement services provided by the Bank; and (3) the Bank's business continuity planning.

Financial Markets Department

(1) Determines the specifics of daily market operations, (2) conducts foreign exchange interventions, (3) works toward improving the functioning of Japanese financial markets, including the foreign exchange market, and (4) monitors and analyzes developments in financial markets in Japan as well as overseas, including foreign exchange markets.

Research and Statistics Department

(1) Conducts research on the domestic economy and fiscal situation, and (2) compiles and releases statistics.

International Department

(1) Liaises and coordinates with overseas central banks and international organizations, (2) makes arrangements for investment in yen assets by overseas central banks, and conducts operations aimed at providing international financial support, (3) manages foreign currency assets held by the Bank, (4) conducts research on global economic and financial conditions, and (5) compiles Japan's balance of payments and other such statistics.

Currency Issue Department

(1) Conducts planning and operations relating to banknotes, and (2) conducts payment/receipt of coins, and examines and takes custody of them.

Operations Department

Conducts banking operations including the following: (1) discounting of bills; (2) credit extension; (3) purchasing/selling of bills, Japanese government securities, and other securities; (4) borrowing/lending of securities with cash collateral; (5) accepting of deposits; (6) domestic funds transfers; (7) handling of treasury funds; and (8) operations relating to stocks purchased by the Bank.

Information System Services Department

Manages the development and operation of the Bank's computer systems.

Public Relations Department

(1) Conducts public relations activities, (2) administers the Bank's library, and (3) works toward raising public awareness and understanding of financial and economic issues.

Personnel and Corporate Affairs Department

Handles business in corporate affairs, personnel policy issues relating to recruitment, assessment of job performance, career planning and training, wages and salaries, and the Bank's code of ethics.

Administration Department

Conducts administrative operations relating to the Bank's facilities, supplies, security, and transportation.

Institute for Monetary and Economic Studies

(1) Studies theoretical, institutional, technological, and historical aspects of monetary and economic issues, (2) collects, preserves, and exhibits historical materials and documents related to monetary and economic issues, and (3) exchanges views with academics.

Branches and Offices

Branches

The 32 branches mainly conduct operations relating to currency issue and banking operations, and research on the economic and financial situation in their respective areas.

Local Offices in Japan

The Computer Center in Fuchu City, Tokyo, operates the Bank's systems. The Banknote Operations Center in Toda City, Saitama Prefecture, receives, pays, and stores banknotes. The other 12 local offices handle some of the operations of the Head Office or branches.

Overseas Representative Offices

The seven overseas representative offices perform a liaison function, gather information, and conduct research.

The Bank's Business Operations

I. Monetary Policy

The Bank of Japan decides and implements monetary policy under the price stability target of 2 percent in terms of the year-on-year rate of change in the consumer price index (CPI), with the aim of achieving price stability and thereby contributing to the sound development of the national economy, as stipulated in Article 2 of the Bank of Japan Act (hereafter the Act). Monetary policy is decided by the Policy Board at Monetary Policy Meetings (MPMs), and market operations -- the Bank's day-to-day provision and absorption of funds in the market -- are carried out based on the guideline decided at each MPM. The Bank held eight MPMs in fiscal 2019.

The Bank releases each quarter the Outlook for Economic Activity and Prices (hereafter the Outlook Report) after the Policy Board has decided the text of "The Bank's View" section at MPMs held, in principle, in January, April, July, and October. In the Outlook Report, the Bank presents its outlook for developments in economic activity and prices, assesses upside and downside risks, and outlines its views on the future conduct of monetary policy. For MPMs other than the above, the Policy Board members' assessment of the economic and financial situation is expressed in the statement on monetary policy released after each MPM.

In order to make appropriate policy decisions, the Bank conducts research and analysis on economic and financial developments at home and abroad. Major findings are reflected in the Bank's releases including the Outlook Report and the Regional Economic Report. The Bank also conducts fundamental studies on economic and financial issues; it publishes the major findings in the Bank of Japan Working Paper Series, the Bank of Japan Research Laboratory Series, and in research papers released by the Institute for Monetary and Economic Studies (IMES), specifically in the Monetary and Economic Studies and the IMES Discussion Paper Series.1

The Bank, pursuant to Article 54, paragraph 1 of the Act, prepares the Semiannual Report on Currency and Monetary Control approximately every six months, covering matters related to the conduct of monetary policy (those listed in the items of Article 15, paragraph 1 of the Act) and business operations that the Bank has conducted based thereon, and submits it to the Diet through the Minister of Finance. In the most recent two issues of this report, the Bank explains in detail economic and financial developments as well as the Bank's conduct of monetary policy and market operations during fiscal 2019.2

Notes:

- 1.Papers and statistics as well as lists of the Bank's publications in English are available on the Bank's website (https://www.boj.or.jp/en/index.htm) and on the IMES website (https://www.imes.boj.or.jp/en/index.html); click here for the list of the Bank's major publications and reports.

- 2.The summaries of these two issues in English are available on the Bank's website; click here for excerpts from these summaries. The full texts are available in Japanese on the website (https://www.boj.or.jp).

II. Financial System Policy

One of the core purposes of the Bank, as stipulated in Article 1, paragraph 2 of the Act, is to ensure smooth settlement of funds among banks and other financial institutions, thereby contributing to the maintenance of financial system stability. To this end, the Bank provides safe and convenient settlement assets in the form of deposits in current accounts that financial institutions hold at the Bank, and takes measures to enhance the safety and efficiency of payment and settlement systems. In order to ensure financial system stability, the Bank also takes various measures to make sure that a financial institution's inability to complete settlement of a transaction does not result in a chain of settlement failures at other institutions and thus disrupt the overall functioning of the financial system.

Specifically, the Bank may provide financial institutions suffering a shortage of liquidity with the following: (1) loans against collateral in the form of securities, pursuant to Article 33, and/or (2) other forms of liquidity, in its role as the lender of last resort, pursuant to Articles 37 and 38 of the Act.

In order to be ready to act effectively as the lender of last resort, the Bank strives to gain an accurate grasp of business conditions at financial institutions and to encourage the maintenance of sound financial conditions, offering guidance and advice as necessary, through the conduct of on-site examinations (examinations that the Bank carries out by visiting the premises of financial institutions pursuant to Article 44 of the Act) as well as off-site monitoring (monitoring that is conducted through meetings with executives and staff of financial institutions, as well as through analysis of various documents submitted by these institutions) (Tables 1 and 2). In addition, through activities such as seminars and workshops organized by the Bank's Center for Advanced Financial Technology (CAFT), the Bank encourages financial institutions' efforts to raise the sophistication of their business and risk management as well as business operations.

The Bank conducts research and analysis assessing risks in the financial system as a whole, i.e., taking a macroprudential perspective, by making use of insights obtained through its on-site examinations and off-site monitoring and paying due attention to the interconnectedness of the real economy, financial markets, and the behavior of financial institutions. The findings of this research and analysis are published in various forms -- for example, the Financial System Report -- and the Bank draws on them when taking part in initiatives with relevant parties to ensure the stability of the financial system. These findings are also made use of in developing and implementing policy. The Bank has also been participating in international initiatives to maintain the stability of the global financial system. These include discussions held by the Basel Committee on Banking Supervision, which comprises central banks and supervisory authorities from major economies.

The Bank, as and when necessary, conducts business requisite to maintaining financial system stability, including the provision of loans, pursuant to Article 38 of the Act (hereafter the term "special loans" covers all such business). The Bank decides on the extension of special loans based on the following four principles, taking into account the nature and purpose of the lender-of-last-resort function:

Principle 1

There must be a strong likelihood that systemic risk will materialize.

Principle 2

There must be no alternative to the provision of central bank money.

Principle 3

All relevant parties are required to take clear responsibility to avoid moral hazard.

Principle 4

The financial soundness of the Bank of Japan itself must not be impaired.

| Financial institutions that hold current accounts at the Bank | Financial institutions that have concluded agreements for bilateral electronic lending with the Bank | Financial institutions that have concluded loans-on-bills agreements with the Bank | Financial institutions that have concluded intraday-overdraft agreements with the Bank | ||

| Of which: Financial institutions that have concluded on-site examination contracts with the Bank | |||||

| City and regional banks | 123 (125) | 123 (125) | 122 (124) | 122 (124) | 123 (125) |

| Trust banks | 13 (13) | 13 (13) | 10 (10) | 10 (10) | 13 (13) |

| Foreign banks | 50 (50) | 50 (50) | 37 (37) | 41 (41) | 38 (38) |

| Shinkin banks | 248 (251) | 248 (251) | 112 (112) | 135 (136) | 169 (171) |

| Financial instruments business operators | 35 (34) | 35 (34) | 30 (29) | 35 (34) | 34 (33) |

| Bankers associations | 33 (33) | 0 (0) | 0 (0) | 0 (0) | 0 (0) |

| Other institutions | 18 (18) | 9 (9) | 9 (9) | 9 (9) | 11 (11) |

| Total | 520 (524) | 478 (482) | 320 (321) | 352 (354) | 388 (391) |

Note:

- 1.Figures in parentheses indicate the number of institutions as of the end of fiscal 2018.

| Fiscal 2017 | Fiscal 2018 | Fiscal 2019 | ||

| Domestically licensed banks1 | 29 | 29 | 34 | |

| Shinkin banks | 54 | 54 | 43 | |

| Other institutions2 | 17 | 8 | 8 | |

| Total | 100 | 91 | 85 | |

Notes:

- 1.Established and licensed under Japanese legislation, excluding the Bank and government-related organizations.

- 2.Including financial instruments business operators and Japanese branches of foreign banks.

III. Enhancement of Payment and Settlement Systems and Market Infrastructures

The Bank provides safe and convenient settlement assets in the form of banknotes and deposits in current accounts that financial institutions hold at the Bank. In addition, the Bank conducts settlement for Japanese government securities (JGSs) in its role as the book-entry transfer institution in the Japanese government bond (JGB) Book-Entry System. To ensure the safety and efficiency of these services, the Bank operates a computer network system for the settlement of funds and JGSs, the Bank of Japan Financial Network System (BOJ-NET).

The Bank conducts oversight of payment and settlement systems, monitoring their safety and efficiency and inducing improvements where necessary. Moreover, the Bank participates with other central banks in various international discussions and initiatives related to payment and settlement systems, including those of the Committee on Payments and Market Infrastructures (CPMI) at the Bank for International Settlements (BIS).

In addition, in order to strengthen and improve the efficiency of the functioning of markets as well as to support more robust risk management and innovation in financial services and market transactions, the Bank, with an eye on international developments, takes initiatives to reinforce the infrastructures of financial and capital markets. Specifically, it exchanges views with market participants, supports the formulation of additional rules on and revisions of market practices, and compiles and releases statistics on market transactions. As part of its initiatives, the Bank has continued to enhance its business continuity arrangements in preparation for times of disaster or other emergency, and has provided active support to market participants in developing effective business continuity planning (BCP) in financial markets, payment and settlement systems, and the financial system.

In order to effectively implement measures to enhance payment and settlement systems and market infrastructures, the Bank conducts research and analysis on the safety and efficiency of payment and settlement systems as well as on the financial system and financial markets, in addition to fundamental research on related issues. Major findings are reflected in the Bank's releases including the Payment and Settlement Systems Report.

IV. International Operations

The Bank conducts operations in the field of international finance, such as foreign exchange transactions, including those executed as part of the Bank's management of its foreign currency assets, as well as business related to assisting other central banks and international organizations in their investment in yen. The Bank also handles government affairs that relate to international finance, such as the compilation and dissemination of Japan's balance of payments statistics and foreign exchange intervention.

In addition, the Bank takes part in international discussions on the state of the world economy as well as on measures to ensure the stability and improve the structure of financial markets. The Bank participates in various forums, such as meetings of the Group of Twenty (G20), the Group of Seven (G7), the International Monetary Fund (IMF), the BIS, and the Financial Stability Board (FSB), as well as other meetings of monetary authorities including central banks in Asia.

With regard to Asia, the Bank engages in various activities including the following: the promotion of monetary cooperation, mainly through participation in the Executives' Meeting of East Asia-Pacific Central Banks (EMEAP) and the Association of Southeast Asian Nations Plus Three (ASEAN Plus Three); the strengthening of technical cooperation and staff training in support of efforts to ensure economic and financial stability in Asia; and the conduct of research on the region.

V. Issuance, Circulation, and Maintenance of Banknotes

The Bank, as the country's sole issuer of banknotes (Bank of Japan notes), ensures the stability of banknote supply and maintains public confidence in banknotes through the conduct of the following operations at its Head Office and branches in Japan. First, the Bank receives banknotes from and pays banknotes to financial institutions that hold current accounts at the Bank (BOJ account holders). Second, the Bank counts the banknotes it receives from BOJ account holders, examines them to verify their authenticity, and checks their fitness for recirculation. As for coins, they are delivered to the Bank by the government, which is the authorized issuer of coins, and then put into circulation.

As part of its measures to secure confidence in banknotes and coins, the Bank works to maintain the cleanliness of banknotes in circulation by preventing damaged or worn banknotes from being returned to circulation. In addition, the Bank remains active in advancing research and promoting public understanding regarding counterfeit deterrence and the smooth circulation of currency, in cooperation with relevant institutions at home and abroad, including other central banks.

VI. Services Relating to the Government

The Bank provides various services relating to the government, such as treasury funds and JGS services. Specifically, these are (1) receipt, disbursement, and accounting of treasury funds (the Bank classifies receipts and disbursements of treasury funds by the specific government account as well as by the individual government agency), (2) management of the deposits of the Japanese government, (3) custody of securities acquired by or submitted to the government, (4) issuance of, and principal and interest payment on, JGSs, and (5) operations relating to its role as the book-entry transfer institution in the JGB Book-Entry System. For the convenience of the public, the Bank designates certain branches and offices of financial institutions throughout the country as its agents and entrusts them with some of the services relating to treasury funds and JGSs.

Besides the above operations, the Bank engages in various transactions with the government, such as purchasing and selling of JGSs.

VII. Communication with the Public

With a view to satisfying the requirements of public accountability, the Bank releases in a timely manner a document that contains a summary of the opinions presented at each MPM (Summary of Opinions), the minutes of MPMs, and public statements on most of the Policy Board decisions. The Bank actively provides information through a variety of channels including the following: reporting to and attendance at the Diet; press conferences held and speeches delivered by the Bank's officers; and the Bank's website. Transcripts of MPMs held more than 10 years previously are also released.

To promote better understanding of the policies and business operations of the Bank, not only in the eyes of financial professionals but also of the general public, the Bank endeavors to tailor its publications and releases to the diverse needs and interests of their users. It also works to promote financial literacy among the public.

The Bank compiles and releases various statistics to be widely shared with the public and takes steps to refine its statistics to improve their user-friendliness.

Meanwhile, the Bank discloses information in accordance with the Act on Access to Information Held by Independent Administrative Agencies.

The Bank's Review of Fiscal 2019

I. Introduction

In March 2019, the Bank of Japan formulated and released the Medium-Term Strategic Plan (Fiscal 2019-2023) (Plan).1 The Plan's content will remain, in principle, fixed during the five-year period, with a view to clarifying the Bank's objectives over the medium term and to ensuring proper assessment of its performance. The Bank conducts and makes public performance reviews of measures taken under the Plan every fiscal year.

In fiscal 2019, the Bank's business operations were strongly affected by the novel coronavirus (COVID-19) toward the fiscal year-end. This section provides (1) a brief review of economic and financial developments as well as decisions made at Monetary Policy Meetings (MPMs) in fiscal 2019, (2) an overview of the Bank's response to COVID-19, and (3) performance reviews of measures taken under the Plan. Each performance review is divided into two parts: a description of progress in implementing specific measures during fiscal 2019 for each of the strategic objectives for its business operations laid out in the Plan, and the Bank's evaluation of that progress. The Bank's performance with regard to the strategic objectives for its organizational management is described in "The Bank's Organizational Management in Fiscal 2019."

The Bank will conduct an interim review of the Plan in or around fiscal 2021, in order to enable the Bank to address any changes in the environment. It will flexibly revise the Plan as appropriate in response to any significant changes. A comprehensive review of its performance over the entire period of the Plan will be conducted separately.

Notes:

- 1.For the text of the "Medium-Term Strategic Plan (Fiscal 2019-2023)," see Appendix 2.

II. Review of Economic and Financial Developments and Monetary Policy Meetings2

A. First Half of Fiscal 2019 (April-September 2019)

1. Economic developments

a. Looking back at the first half of fiscal 2019, Japan's economy had been on a moderate expanding trend, with a virtuous cycle from income to spending operating, although exports, production, and business sentiment had been affected by the slowdown in overseas economies.

Exports continued to show some weakness, reflecting the effects of the slowdown in overseas economies. On the other hand, with corporate profits staying at high levels on the whole, business fixed investment continued on an increasing trend. Private consumption had been increasing moderately, albeit with fluctuations, against the background of steady improvement in the employment and income situation. Meanwhile, housing investment and public investment had been more or less flat. Reflecting these developments in demand both at home and abroad, industrial production also had been more or less flat.

b. On the price front, the year-on-year rate of change in the consumer price index (CPI, all items less fresh food) had narrowed gradually within positive territory from the range of 0.5-1.0 percent, being at around 0.0-0.5 percent in the second half of April-September 2019. Inflation expectations had been more or less unchanged.

2. Financial developments

a. Money market rates had been at low levels on the whole.

Turning to developments in the bond market, the long-term interest rate had been at the target level of around zero percent under Quantitative and Qualitative Monetary Easing (QQE) with Yield Curve Control.

The Nikkei 225 Stock Average had fallen temporarily, mainly reflecting heightening uncertainties over U.S.-China trade negotiations, but started to rise from early September, mainly on the back of expectations for progress in U.S.-China trade negotiations and a resultant rebound in U.S. and European stock prices, and was in the range of 21,500-22,000 yen at end-September.

In the foreign exchange market, the yen had appreciated against the U.S. dollar temporarily, mainly reflecting heightening uncertainties over U.S.-China trade negotiations, but depreciated somewhat from early September and was in the range of 107-108 yen at the end of that month. The yen also had appreciated against the euro temporarily, but depreciated somewhat from early September.

b. As for corporate finance, in terms of credit supply, financial institutions' lending attitudes as perceived by firms remained highly accommodative.

Firms' credit demand had increased, mainly for funds for business fixed investment, as well as those related to mergers and acquisitions of firms. With regard to firms' funding, the year-on-year rate of increase in the amount outstanding of lending by domestic commercial banks had been in the range of 2-3 percent. The year-on-year rates of increase in the amounts outstanding of CP and corporate bonds had been at relatively high levels.

c. The monetary base (currency in circulation plus current account balances at the Bank) continued to increase at a year-on-year growth rate of around 3-4 percent. The year-on-year rate of increase in the money stock (M2) had been at around 2.0-2.5 percent.

3. MPMs3

a. Four MPMs were held in the first half of fiscal 2019.

The Policy Board judged at the MPMs held in April and June that Japan's economy had been on a moderate expanding trend, with a virtuous cycle from income to spending operating, although exports and production had been affected by the slowdown in overseas economies. At the July and September MPMs, it judged that the economy had been on a moderate expanding trend, with a virtuous cycle from income to spending operating, although exports, production, and business sentiment had been affected by the slowdown in overseas economies.

b. In the conduct of monetary policy, at all the MPMs held in the first half of fiscal 2019, the Policy Board decided to continue with the following guidelines for market operations and asset purchases under QQE with Yield Curve Control.

(1) Yield curve control

The Bank decided to set the following guideline for market operations for the intermeeting period.

The short-term policy interest rate:

The Bank will apply a negative interest rate of minus 0.1 percent to the Policy-Rate Balances in current accounts held by financial institutions at the Bank.

The long-term interest rate:

The Bank will purchase Japanese government bonds (JGBs) so that 10-year JGB yields will remain at around zero percent. While doing so, the yields may move upward and downward to some extent mainly depending on developments in economic activity and prices. With regard to the amount of JGBs to be purchased, the Bank will conduct purchases in a flexible manner so that their amount outstanding will increase at an annual pace of about 80 trillion yen.

(2) Guidelines for asset purchases

With regard to asset purchases other than JGB purchases, the Bank decided to set the following guidelines.

(a) The Bank will purchase exchange-traded funds (ETFs) and Japan real estate investment trusts (J-REITs) so that their amounts outstanding will increase at annual paces of about 6 trillion yen and about 90 billion yen, respectively. With a view to lowering risk premia of asset prices in an appropriate manner, the Bank may increase or decrease the amount of purchases depending on market conditions.

(b) As for CP and corporate bonds, the Bank will maintain their amounts outstanding at about 2.2 trillion yen and about 3.2 trillion yen, respectively.

At the April MPM, with a view to making clearer its policy stance to persistently continue with powerful monetary easing, the Policy Board decided upon the following.

(1) Clarification of forward guidance for policy rates

The Bank intends to maintain the current extremely low levels of short- and long-term interest rates for an extended period of time, at least through around spring 2020, taking into account uncertainties regarding economic activity and prices including developments in overseas economies and the effects of the scheduled consumption tax hike.

(2) Implementation of measures contributing to the continuation of powerful monetary easing

The Bank will implement measures contributing to the continuation of powerful monetary easing as follows.

(a) Expanding eligible collateral for the Bank's provision of credit

(i) The Bank will relax the eligibility standards concerning creditworthiness regarding debt of companies based on the following principal policy.

• With regard to debt of companies that have obtained an external credit rating, the companies should be rated BBB or higher by an eligible rating agency.

• With regard to debt of companies that have not obtained an external credit rating, the companies should be classified as "normal" borrowers in the self-assessment by financial institutions.

(ii) With respect to loans on deeds to municipal governments, the Bank will not require any procedures such as auction as the method of determining lending conditions. Regarding privately-placed municipal bonds, the Bank will not impose spread requirements on the coupon rates and issue prices in terms of differences from those of publicly-offered municipal bonds.

(iii) The Bank will accept collateral such as loans on deeds to the government that financial institutions have acquired in the secondary market as eligible collateral.

(b) Improving and promoting the use of the Fund-Provisioning Measure to Support Strengthening the Foundations for Economic Growth

(i) Regarding the Fund-Provisioning Measure to Support Strengthening the Foundations for Economic Growth, financial institutions will be able to receive the yen fund-provisioning within the limit set for each financial institution based on the amount of fund-provisioning in the past.

(ii) Regarding the Fund-Provisioning Measure to Support Strengthening the Foundations for Economic Growth and the Fund-Provisioning Measure to Stimulate Bank Lending, the deadline for new loan disbursements will be extended to June 30, 2021.

(c) Relaxation of the terms and conditions for the Securities Lending Facility (SLF)

The Bank will relax the terms and conditions for the SLF, including the reduction of the minimum fee rate and abolition of the upper limit on the amount of sales per issue.

(d) Introduction of ETF Lending Facility

The Bank will consider the introduction of ETF Lending Facility, which will make it possible to temporarily lend ETFs that the Bank holds to market participants.

With regard to the future conduct of monetary policy, the Policy Board confirmed the following at all the MPMs: "the Bank will continue with QQE with Yield Curve Control, aiming to achieve the price stability target of 2 percent, as long as it is necessary for maintaining that target in a stable manner. It will continue expanding the monetary base until the year-on-year rate of increase in the observed CPI (all items less fresh food) exceeds 2 percent and stays above the target in a stable manner. As for policy rates, the Bank intends to maintain the current extremely low levels of short- and long-term interest rates for an extended period of time, at least through around spring 2020, taking into account uncertainties regarding economic activity and prices including developments in overseas economies and the effects of the scheduled consumption tax hike. It will examine the risks considered most relevant to the conduct of monetary policy and make policy adjustments as appropriate, taking account of developments in economic activity and prices as well as financial conditions, with a view to maintaining the momentum toward achieving the price stability target." In addition, the Policy Board confirmed the following at the July and September MPMs: "in particular, in a situation where downside risks to economic activity and prices, mainly regarding developments in overseas economies, are significant, the Bank will not hesitate to take additional easing measures if there is a greater possibility that the momentum toward achieving the price stability target will be lost."

B. Second Half of Fiscal 2019 (October 2019-March 2020)

1. Economic developments

a. After the turn of the second half of fiscal 2019, Japan's economy maintained its moderate expanding trend, despite being affected mainly by the slowdown in overseas economies and natural disasters. However, it had been in an increasingly severe situation toward the end of the fiscal year due to the impact of the spread of COVID-19 at home and abroad.

Exports and industrial production had been somewhat weak, mainly affected by the slowdown in overseas economies and natural disasters. Toward the end of the fiscal year, however, with COVID-19 spreading, they had declined due to the decrease in external demand mainly from China and the effects on the global supply chain of weak production activity, also mainly in China. Supported by generally high corporate profits, business fixed investment continued on an increasing trend, albeit with fluctuations. However, the deceleration in its pace of increase had become evident toward the end of the fiscal year. Despite being affected mainly by the consumption tax hike, private consumption maintained its moderate increasing trend on the back of the improvement in the employment and income situation. With the growing impact of the spread of COVID-19, however, it had decreased significantly, mainly in services such as eating and drinking as well as accommodations. Meanwhile, housing investment had been more or less flat and public investment had increased moderately.

b. On the price front, the year-on-year rate of change in the CPI (all items less fresh food) had been at around 0.5-1.0 percent. Inflation expectations had been more or less unchanged from a somewhat longer-term perspective, but somewhat weak indicators had been observed toward the end of the fiscal year.

2. Developments in financial markets and conditions

a. In global financial markets, prices of risky assets generally had followed an uptrend through around mid-February, mainly reflecting a subsiding of uncertainties over political developments such as the progress in U.S.-China trade negotiations. Subsequently, these prices had declined significantly due to a rise in investors' risk aversion that was attributable mainly to the spread of COVID-19. In addition, amid a situation where demand for U.S. dollar cash had increased considerably worldwide due to investors' preference for safe assets, U.S. dollar funding premia had spiked and tension in U.S. money markets had intensified. In response to these market developments, central banks of major economies had implemented measures such as interest rate cuts, ample supply of liquidity, and asset purchases. A global cooperative action to enhance the provision of U.S. dollar liquidity also had been taken by major central banks including the Bank of Japan. Tension in financial markets, therefore, had eased somewhat toward the end of the fiscal year.

b. Turning to domestic financial markets, money market rates had been at low levels on the whole.

With regard to developments in the bond market, the long-term interest rate had been at the target level of around zero percent under QQE with Yield Curve Control. Looking at developments in more detail, the rate had increased somewhat temporarily in mid-March with global financial markets being unstable, due mainly to the spread of COVID-19, but declined toward end-March partly because the Bank had increased the amount and frequency of its JGB purchases. Meanwhile, issuance rates for CP had been at low levels on the whole. Those for corporate bonds had been at extremely low levels.

The Nikkei 225 Stock Average had increased temporarily, mainly reflecting the progress in U.S.-China trade negotiations, but started to decline since late February, mainly against the background of heightening uncertainties over the outlook for the global economy due to the spread of COVID-19, thereby being in the range of 18,500-19,000 yen at end-March.

In the foreign exchange market, the yen generally had been more or less flat against the U.S. dollar from October 2019 through February 2020. Subsequently, it had appreciated temporarily in early March, mainly reflecting heightening uncertainties over the global economy and a decline in U.S. interest rates, but started to depreciate since mid-March, due mainly to an increase in demand for U.S. dollar funds, thereby being in the range of 108-109 yen at the end of the month. The yen generally had been more or less flat against the euro throughout the second half of fiscal 2019.

c. As for corporate financing, growth in demand for funds had been supported thus far by, for example, rises in demand for funds for business fixed investment, as well as that related to mergers and acquisitions of firms. Toward the end of the fiscal year, however, there had been an increase in demand for funds that was mainly brought about by a decline in sales and the need to secure funds, both of which were due to the impact of the spread of COVID-19. In this situation, firms' financial positions had deteriorated, mainly reflecting the decline in sales brought about by the impact of the spread of COVID-19. Meanwhile, in terms of credit supply, financial institutions' lending attitudes as perceived by firms remained accommodative.

d. The monetary base continued to increase at a year-on-year growth rate of around 3-4 percent. The year-on-year rate of increase in the M2 had been at around 2-3 percent.

3. MPMs3

a. Four MPMs were held in the second half of fiscal 2019.

The Policy Board judged at the MPM held in October that Japan's economy had been on a moderate expanding trend, with a virtuous cycle from income to spending operating, although exports, production, and business sentiment continued to be affected by the slowdown in overseas economies. At the December and January MPMs, it deemed that the economy had been on a moderate expanding trend, with a virtuous cycle from income to spending operating, although exports, production, and business sentiment had shown some weakness, mainly affected by the slowdown in overseas economies and natural disasters. The Policy Board judged at the March MPM that Japan's economic activity had been weak recently due mainly to the impact of the outbreak of COVID-19.

b. In the conduct of monetary policy, at all the MPMs held in the second half of fiscal 2019, the Policy Board decided to continue with the following guideline for market operations under QQE with Yield Curve Control.

(1) Yield curve control

The Bank decided to set the following guideline for market operations for the intermeeting period.

The short-term policy interest rate:

The Bank will apply a negative interest rate of minus 0.1 percent to the Policy-Rate Balances in current accounts held by financial institutions at the Bank.

The long-term interest rate:

The Bank will purchase JGBs so that 10-year JGB yields will remain at around zero percent. While doing so, the yields may move upward and downward to some extent mainly depending on developments in economic activity and prices. With regard to the amount of JGBs to be purchased, the Bank will conduct purchases in a flexible manner so that their amount outstanding will increase at an annual pace of about 80 trillion yen.

The Policy Board decided to continue with the following guidelines for asset purchases at the MPMs held in October through January.

(1) Guidelines for asset purchases

With regard to asset purchases other than JGB purchases, the Bank decided to set the following guidelines.

(a) The Bank will purchase ETFs and J-REITs so that their amounts outstanding will increase at annual paces of about 6 trillion yen and about 90 billion yen, respectively. With a view to lowering risk premia of asset prices in an appropriate manner, the Bank may increase or decrease the amount of purchases depending on market conditions.

(b) As for CP and corporate bonds, the Bank will maintain their amounts outstanding at about 2.2 trillion yen and about 3.2 trillion yen, respectively.

At the March MPM, in light of the impact of the outbreak of COVID-19, the Policy Board decided upon active purchases of ETFs and J-REITs and an increase in purchases of CP and corporate bonds under the following guidelines for asset purchases.

(1) Guidelines for asset purchases

With regard to asset purchases other than JGB purchases, the Bank decided to set the following guidelines.

(a) In principle, the Bank will purchase ETFs and J-REITs so that their amounts outstanding will increase at annual paces of about 6 trillion yen and about 90 billion yen, respectively. With a view to lowering risk premia of asset prices in an appropriate manner, it may increase or decrease the amount of purchases depending on market conditions. For the time being, the Bank will actively purchase these assets so that their amounts outstanding will increase at annual paces with the upper limit of about 12 trillion yen and about 180 billion yen, respectively.

(b) As for CP and corporate bonds, the Bank will maintain their amounts outstanding at about 2.2 trillion yen and about 3.2 trillion yen, respectively. In addition, it will conduct additional purchases with the upper limit of 1 trillion yen for each until the end of September 2020.

At the October MPM, the Policy Board reexamined economic and price developments as presented in the policy statement of the September MPM and assessed the momentum toward achieving the price stability target. On this basis, it judged that, although there had been no further increase in the possibility that the momentum toward achieving the price stability target would be lost, it was necessary to continue to pay close attention to the possibility. With a view to clarifying this recognition, the Policy Board decided upon a new forward guidance for the policy rates as follows.

(a) As for the policy rates, the Bank expects short- and long-term interest rates to remain at their present or lower levels as long as it is necessary to pay close attention to the possibility that the momentum toward achieving the price stability target will be lost.

At the March MPM, in light of the impact of the outbreak of COVID-19, the Policy Board judged it appropriate to enhance monetary easing with a view to doing its utmost to ensure smooth corporate financing and maintaining stability in financial markets, thereby preventing firms' and households' sentiment from deteriorating, and thus decided upon the following.

(1) Further ample supply of funds

The Bank will provide more ample yen funds for the time being by making use of active purchases of JGBs and other operations as well as the measures to facilitate corporate financing and active purchases of ETFs and J-REITs.

As for U.S. dollar liquidity, coordinated with the Bank of Canada (BOC), the Bank of England (BOE), the European Central Bank (ECB), the Federal Reserve, and the Swiss National Bank (SNB), regarding the U.S. dollar funds-supplying operations, the Bank made public today to lower the loan rate by 0.25 percent and offer U.S. dollars weekly with an 84-day maturity, in addition to the 1-week maturity operations currently offered. Thereby, the Bank will do its utmost to provide U.S. dollar liquidity.

(2) Measures to facilitate corporate financing

(a) Introduction of the Special Funds-Supplying Operations to Facilitate Corporate Financing regarding the Novel Coronavirus (COVID-19)

The Bank will introduce a new operation to provide loans against corporate debt (of about 8 trillion yen as of end-February 2020) as collateral at the interest rate of 0 percent with maturity up to one year. Twice as much as the amount outstanding of the loans will be included in the Macro Add-on Balances in current accounts held by financial institutions at the Bank. This operation will be conducted until the end of September 2020.

(b) Increase in purchases of CP and corporate bonds

The Bank will increase the upper limit to purchase CP and corporate bonds by 2 trillion yen in total and conduct purchases with the upper limit of their amounts outstanding of about 3.2 trillion yen and about 4.2 trillion yen, respectively. The additional purchases will continue until the end of September 2020.

(3) Active purchases of ETFs and J-REITs

The Bank will actively purchase ETFs and J-REITs for the time being so that their amounts outstanding will increase at annual paces with the upper limit of about 12 trillion yen and about 180 billion yen, respectively.

With regard to the future conduct of monetary policy, including the aforementioned forward guidance for the policy rates, the Policy Board confirmed the following at the MPMs held in October through January: "the Bank will continue with QQE with Yield Curve Control, aiming to achieve the price stability target of 2 percent, as long as it is necessary for maintaining that target in a stable manner. It will continue expanding the monetary base until the year-on-year rate of increase in the observed CPI (all items less fresh food) exceeds 2 percent and stays above the target in a stable manner. As for the policy rates, the Bank expects short- and long-term interest rates to remain at their present or lower levels as long as it is necessary to pay close attention to the possibility that the momentum toward achieving the price stability target will be lost. It will examine the risks considered most relevant to the conduct of monetary policy and make policy adjustments as appropriate, taking account of developments in economic activity and prices as well as financial conditions, with a view to maintaining the momentum toward achieving the price stability target. In particular, in a situation where downside risks to economic activity and prices, mainly regarding developments in overseas economies, are significant, the Bank will not hesitate to take additional easing measures if there is a greater possibility that the momentum toward achieving the price stability target will be lost."

At the March MPM, the Policy Board confirmed the following: "the Bank will continue with QQE with Yield Curve Control, aiming to achieve the price stability target of 2 percent, as long as it is necessary for maintaining that target in a stable manner. It will continue expanding the monetary base until the year-on-year rate of increase in the observed CPI (all items less fresh food) exceeds 2 percent and stays above the target in a stable manner. As for the policy rates, the Bank expects short- and long-term interest rates to remain at their present or lower levels as long as it is necessary to pay close attention to the possibility that the momentum toward achieving the price stability target will be lost. The Bank will closely monitor the impact of COVID-19 for the time being and will not hesitate to take additional easing measures if necessary."

Notes:

- 2.The review provided here comprises excerpts from the summaries of the latest two issues of the Semiannual Report on Currency and Monetary Control submitted to the Diet in December 2019 and June 2020. The full texts of both issues in Japanese and summaries in English are available on the Bank's website.

- 3.Information related to MPMs is available on the Bank's website (https://www.boj.or.jp/en/mopo/mpmsche_minu/index.htm).

III. The Bank's Response to the Novel Coronavirus (COVID-19)

The Bank had taken the following actions since COVID-19 started to spread in Japan.

First, the Bank carried out measures to prevent the spread of COVID-19 in conducting its business operations. Namely, in light of, for example, the government's Basic Policies for Novel Coronavirus Disease Control decided by the Novel Coronavirus Response Headquarters on February 25, 2020, it promoted such infection control measures as handwashing, cough etiquette, staggered commuting hours, and teleworking. As for hosting meetings and events, the Bank carefully considered their necessity and responded accordingly, taking into account the request by the government. Specifically, it postponed a meeting with business leaders and local seminars organized by its Center for Advanced Financial Technology (CAFT) that had been scheduled for March, and canceled special in-house tours for families visiting with primary and junior high school children during school holidays in spring 2020. It also temporarily closed the Currency Museum and the Bank of Japan Otaru Museum.

Second, the Bank swiftly implemented necessary measures to maintain stability in financial markets and ensure smooth corporate financing. With global financial and capital markets experiencing instability as COVID-19 spread in the United States and Europe, the Bank released a statement by the Governor on March 2, 2020, indicating that it would strive to provide ample liquidity and ensure stability in financial markets. The Bank then announced on March 13 its market operations toward the end of March -- including provision of ample liquidity using market operations with long maturities, additional outright purchases of JGBs, and measures to maintain the stability of the repo market -- and on March 15 and 20 coordinated central bank actions to enhance the provision of global U.S. dollar liquidity. At the MPM held on March 16, the Bank decided to enhance monetary easing through the further ample supply of funds by conducting various operations including purchases of JGBs, measures to facilitate corporate financing including the introduction of a new funds-supplying operation, and active purchases of ETFs and J-REITs. Moreover, at the MPM held on April 27, it decided to further enhance monetary easing through an increase in purchases of CP and corporate bonds, strengthening of the Special Funds-Supplying Operations to Facilitate Financing in Response to the Novel Coronavirus (COVID-19), and further active purchases of JGBs and treasury discount bills (T-Bills).

Third, the Bank continued to provide central banking services, such as maintaining financial functioning and ensuring smooth settlement of funds. Specifically, in February 2020, when COVID-19 started to spread in Japan, it made necessary arrangements such as implementing split shifts -- for those engaged in, for example, market operations, settlement of funds and Japanese government securities (JGSs), services relating to treasury funds, banknote issuance, management of the Bank's computer systems, and administrative operations relating to the Bank's facilities -- to address the risk of possible infections among its staff. These arrangements enabled the Bank to conduct its business operations in a stable manner even after the spread of COVID-19 in Japan. On the organizational management side, in line with the March 14 enactment of the amendment to the Act on Special Measures for Pandemic Influenza and New Infectious Diseases Preparedness and Response, the Bank, on the same day, organized a COVID-19 response team headed by the Governor and strengthened its business continuity arrangements. Thereafter, in response to the government's declaration of a state of emergency based on the aforementioned act and to the Basic Policies for Novel Coronavirus Disease Control, the Bank, from April 8, reduced some operations and the number of office staff commuting into its Head Office, branches, and local offices in the areas subject to the declaration. While taking these preventive measures, the Bank did its utmost to continue providing essential central banking services as a designated public institution.

The Bank's Major Responses to COVID-19

Since mid-February

• Promoted such infection control measures as handwashing, cough etiquette, staggered commuting hours, and teleworking in light of, for example, the Basic Policies for Novel Coronavirus Disease Control decided on February 25

Wednesday, February 26

• Canceled special in-house tours for families visiting with primary and junior high school children during school holidays in spring 2020

• Announced a temporary suspension of Head Office tours from March 2

Thursday, February 27

• Postponed local seminars organized by the Bank's CAFT scheduled for March in Fukuoka and Sendai

Friday, February 28

• Postponed a meeting, scheduled for March, with business leaders in Fukushima

• Announced a temporary closing of the Currency Museum and the Bank of Japan Otaru Museum

Monday, March 2

• "Statement by the Governor"

Announced that the Bank would strive to provide ample liquidity and ensure stability in financial markets

Friday, March 13

• "Market Operations toward the End of March"

Announced the decision to provide ample liquidity (market operations with long maturities and additional outright purchases of JGBs) as well as to implement measures to maintain the stability of the repo market

• Announced that the April 2020 meeting of general managers of the Bank's branches would be held via videoconferencing

Saturday, March 14

• Organized a COVID-19 response team headed by the Governor

Sunday, March 151

• Released "Coordinated Central Bank Action to Enhance the Provision of Global U.S. Dollar Liquidity"

Monday, March 16

• "Enhancement of Monetary Easing in Light of the Impact of the Outbreak of the Novel Coronavirus (COVID-19)"

At the March 16 MPM, decided on (1) the further ample supply of funds by conducting various operations including purchases of JGBs and the U.S. dollar funds-supplying operations, (2) the introduction of a new funds-supplying operation, as well as an increase in purchases of CP and corporate bonds, with a view to facilitating corporate financing, and (3) active purchases of ETFs and J-REITs

Friday, March 20

• Released "Coordinated Central Bank Action to Further Enhance the Provision of U.S. Dollar Liquidity"

Friday, March 27

• Canceled a welcome ceremony for new graduates joining the Bank on April 1

Monday, March 30