The Release of "The Bank of Japan's Approach to Central Bank Digital Currency"

October 9, 2020

Bank of Japan

Executive Summary

Digitalization has advanced in various areas at home and abroad on the back of rapid development of information communication technology. There is a possibility of a surge in public demand for central bank digital currency (CBDC) going forward, considering the rapid development of technological innovation. While the Bank of Japan currently has no plan to issue CBDC, from the viewpoint of ensuring the stability and efficiency of the overall payment and settlement systems, the Bank considers it important to prepare thoroughly to respond to changes in circumstances in an appropriate manner. With this in mind, the Bank decided that it would publish its approach to "general purpose" CBDC -- that is, CBDC intended for a wide range of end users, including individuals and firms.

I. Expected Functions and Roles of CBDC

There are two main variants of CBDC: "wholesale" CBDC and "general purpose" CBDC. Expected functions and roles of general purpose CBDC, if introduced in Japan, are summarized in the following.

A. Introducing a Payment Instrument alongside Cash

For the time being, it is unlikely that the cash in circulation would drop significantly. If, however, this should become the case, and if private digital money will not substitute for the functions of cash sufficiently, the Bank might provide general purpose CBDC as a payment instrument alongside cash. As long as there is public demand for cash, the Bank will stay committed to supplying it.

B. Supporting Private Payment Services

Even without the decline in cash circulation, if CBDC is needed from the viewpoint of enhancing the stability and efficiency of the overall payment and settlement systems, it might become appropriate to issue CBDC in order to support private payment services.

C. Developing Payment and Settlement Systems Suitable for a Digital Society

In addition, from a broader perspective, initiatives such as the issuance of CBDC by the Bank and innovative overlay services of private payment service providers (PSPs; e.g., banks and non-bank PSPs) could lead to stable and efficient payment and settlement systems suitable for a digital society.

II. Core Features Required for CBDC

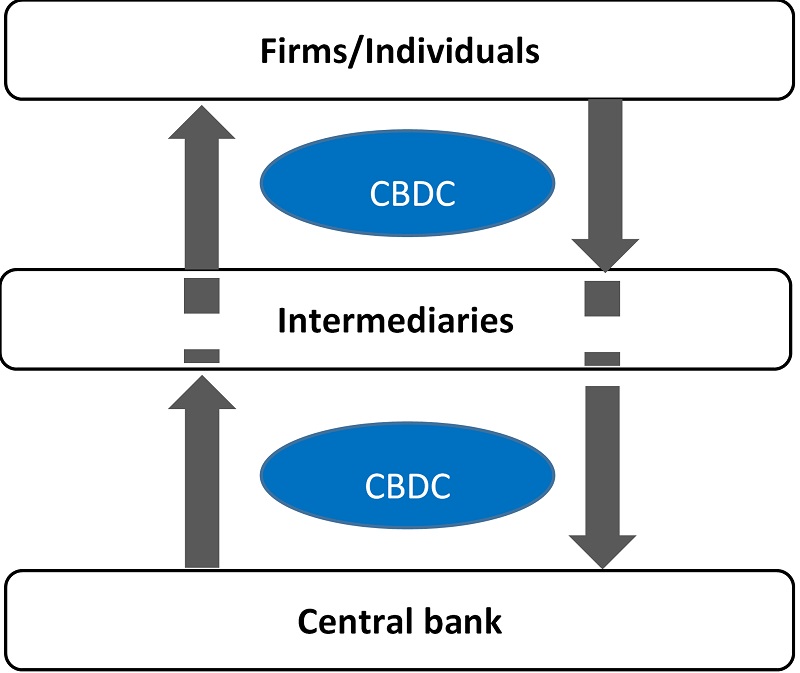

Even if the Bank were to issue general purpose CBDC, it would still be appropriate to maintain a two-tiered payment and settlement system of a central bank and the private sector. This means that CBDC would be issued indirectly through intermediaries.

If the Bank were to issue general purpose CBDC and adopt the indirect issuance model, CBDC would need to have the following instrument and system features.

A. Universal Access

To allow anyone to use CBDC and avoid excluding some individuals, devices or cards used for transfers and payments should provide ease of use and portability in their design.

B. Security

For secure CBDC payments, it is necessary to incorporate counterfeit deterrence technology and enhance security to prevent various illicit activities.

C. Resilience

To allow CBDC to be used anywhere anytime, the CBDC system should always be available 24/7/365 to the end user. A design that supports offline use in times of system and network failures as well as electrical outages is also important for Japan, given the frequent occurrence of natural disasters.

D. Instant Payment Capability

CBDC, as central bank money, should offer settlement finality of transactions and instant payment capabilities similar to cash. Moreover, in order to enable fast settlement of frequent payments by many end users, CBDC needs to have sufficient processing capability and scalability in preparation for future increase in the use of CBDC.

E. Interoperability

It is important that the CBDC system ensures interoperability with other payment and settlement systems and has a flexible architecture to adapt to changes in the future, including advances in private payment services.

When introducing CBDC, it might be appropriate to implement the features of universal access and resilience in a phased manner according to the use of cash.

III. Points to Be Considered

A. CBDC's Relationship with Price and Financial Stability

In issuing CBDC, careful consideration is required for the functional requirements and economic design of CBDC (e.g., limits on the amount of issuance/holdings and remuneration) from the perspective of the effectiveness of monetary policy and financial stability.

B. Promoting Innovation

The Bank would need to consider carefully cooperation and role-sharing arrangements between a central bank and PSPs -- namely, to what degree the Bank should set the CBDC framework and technical standards, and what the Bank should leave to the creativity of the PSPs -- from the viewpoint of promoting innovations.

C. Ensuring Privacy and Handling End-User Information

It is necessary to explore the role-sharing between a central bank and PSPs -- namely, who obtains and manages what data and under what conditions -- while taking into account various requirements regarding the handling of information.

D. Relationship with Cross-Border Payments

It is desirable to ensure that CBDC could be used for cross-border payments -- not only for domestic payments -- while thoroughly monitoring developments in each central bank.

IV. Next Steps

The Bank will continue to make necessary preparations to respond to changes in circumstances in an appropriate manner. The currently planned next steps are as follows.

A. Experiments

The Bank will explore general purpose CBDC in a more concrete and practical way by conducting experiments, rather than confining itself to conceptual research as before. The Bank will first test the technical feasibility of the core functions and features required for CBDC through a Proof of Concept (PoC). It will then consider the need for a pilot program if necessary.

- 1. PoC Phase 1

The Bank will develop a test environment for the CBDC system and conduct experiments on the basic functions that are core to CBDC as a payment instrument -- namely, issuance, distribution, and redemption. - 2. PoC Phase 2

The Bank will implement additional functions of CBDC in the test environment developed in Phase 1 and test their feasibility. - 3. Pilot program

Based on the PoC, if the Bank judges it necessary to step things up further, it will also consider a pilot program that involves PSPs and end users.

Among these phases, the Bank aims to start PoC Phase 1 in early fiscal year 2021.

B. Exploring Institutional Arrangements

In tandem with experiments, the Bank will proceed to successively explore topics such as (1) cooperation and role-sharing arrangements between a central bank and PSPs, (2) economic design of CBDC, including limits on the amount of issuance/holdings and remuneration, (3) privacy protection and handling of end-user information, and (4) standardization of information technology (IT) relating to digital currency.

C. Coordination with Stakeholders at Home and Abroad

The Bank will continue to deepen understanding on the core features of CBDC and their impact on practices while closely coordinating with other central banks, and use the information obtained in its CBDC exploration.

If a central bank were to issue CBDC, extensive and large-scale efforts would need to be made, including an exploration of IT systems and institutional arrangements. With this firmly in mind, the Bank will place emphasis on applying the knowledge of various stakeholders -- such as banks, non-bank PSPs, IT specialists, legal experts, and relevant public authorities -- in considering CBDC issuance.

Introduction

Digitalization has advanced in various areas at home and abroad on the back of rapid development of information communication technology. This trend is likely to accelerate rather than reverse in the post-Covid-19 era.

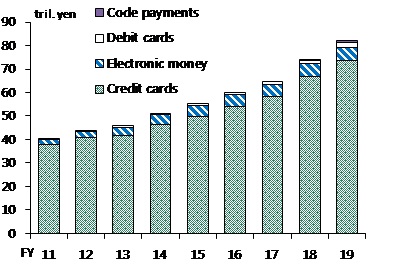

The field of payments is not an exception. In particular, the expansion of cashless payments is remarkable, reflecting technological innovation in recent years (Figure 1). More types of devices, such as smartphones or IC cards, are available for payment services, and FinTech firms have become involved in providing cashless payment services.

Figure 1: Cashless Transactions by Value

Notes:

- 1. The data for credit cards are on a calendar-year basis.

- 2. The data for debit cards through 2013 are based upon the survey on card issuers and figures published by J-Debit. The data source since 2014 is the Bank's Payment and Settlement Statistics.

- 3. The data for code payments are on a calendar-year basis (available since 2018).

Sources: Japan Consumer Credit Association; Payments Japan Association.

Meanwhile, the issuance of central bank digital currency (CBDC) as a new payment instrument has increasingly been discussed at home and abroad. There is a possibility of a surge in public demand for CBDC going forward, considering the rapid development of technological innovation. On the other hand, if CBDC were to be issued, extensive and large-scale efforts would need to be made, including an exploration of information technology (IT) systems and institutional arrangements. While the Bank of Japan currently has no plan to issue CBDC, from the viewpoint of ensuring the stability and efficiency of the overall payment and settlement systems, the Bank considers it important to prepare thoroughly to respond to changes in circumstances in an appropriate manner.

In the first place, the future payment and settlement systems suitable for a digital society need to be discussed with various stakeholders. In this regard, CBDC could have more of a function than merely as a substitution for cash. It could serve as the basis for innovation of private payment service providers (PSPs; e.g., banks and non-bank PSPs) to offer various new payment services. Given such potential, advancing discussion of CBDC would also provide an opportunity to reconsider future payment and settlement systems. With this in mind, the Bank decided that it would publish its approach to "general purpose" CBDC -- that is, CBDC intended for a wide range of end users, including individuals and firms.

I. Expected Functions and Roles of CBDC

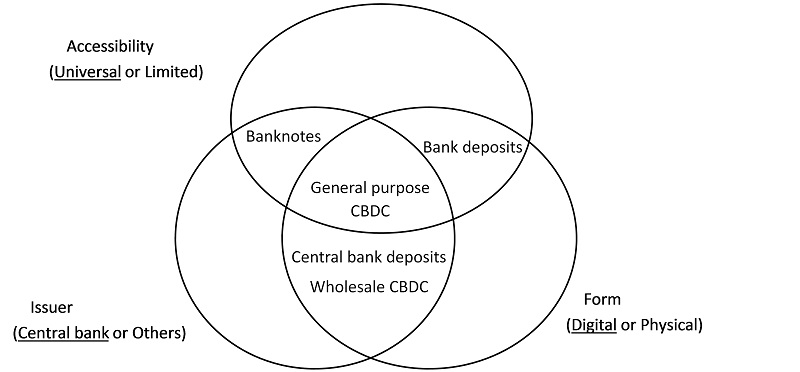

CBDC is a new form of digital central bank money that is different from current account deposits held by banks at a central bank (Figure 2). 1 CBDC is a payment instrument that is a direct liability of the central bank. It functions as a unit of account as it is denominated in legal tender.

- Figure 2: Classification of Currency

There are two main variants of CBDC. One is "wholesale" CBDC, in which a central bank provides to limited counterparties mainly for large-value payments among financial institutions. It has commonality with current account deposits held by banks at a central bank, in that it is digital central bank money available to a limited group of entities. Some view that, combined with the use of distributed ledger technology (DLT), wholesale CBDC could improve the efficiency of settling securities and derivatives transactions. Research has been conducted in Europe using wholesale CBDC and security tokens -- securities in the form of digital vouchers that are issued and managed on a DLT platform -- to enable faster settlement of funds and securities.

An alternative scheme would be for private enterprises to issue private digital money backed by central bank liability (e.g., central bank deposits) and based on the credibility of a central bank. Such digital money is not CBDC as it is not issued by a central bank. However, in pursuing such a scheme, initiatives that employ private token money on a DLT platform for funds settlement among banks have been pushed forward recently, mainly in Europe.

This paper focuses on the other variant, "general purpose" CBDC, which is intended for a wide range of end users, including individuals and firms. General purpose CBDC would have similar functions as cash (i.e., banknotes and coins), enabling the end users to make daily purchases with currencies issued by a central bank through the use of smartphones or IC cards anywhere anytime. In addition, it would be used to settle payments among firms or financial transactions among financial institutions. General purpose CBDC, in this case, would be considered as a complement to deposits at financial institutions.

While many central banks have proceeded with consideration of general purpose CBDC recently, their motivations differ according to their circumstances. In Japan, many do not see the need to introduce general purpose CBDC for the time being, mainly because the ratio of cash in circulation to nominal GDP is high, at around 20 percent. However, if cash in circulation drops sharply in the future, it might be necessary to make up for the decrease in cash by issuing CBDC. Regardless of the situation, it might be determined as appropriate to issue CBDC in order to improve Japan's payment and settlement systems.

Expected functions and roles of general purpose CBDC, if introduced in Japan, are summarized in the following.

- See, the Committee on Payments and Market Infrastructures and Markets Committee, "Central Bank Digital Currencies," March 2018, https://www.bis.org/cpmi/publ/d174.pdf.

A. Introducing a Payment Instrument alongside Cash

The Bank has widely supplied the public with a payment instrument that allows secure payments for anyone anywhere anytime -- namely, cash. This role will be unchanged in the digital society. For the time being, it is unlikely that the cash in circulation would drop significantly. If, however, this should become the case, and if private digital money will not substitute for the functions of cash sufficiently, the Bank might provide general purpose CBDC as a payment instrument alongside cash.

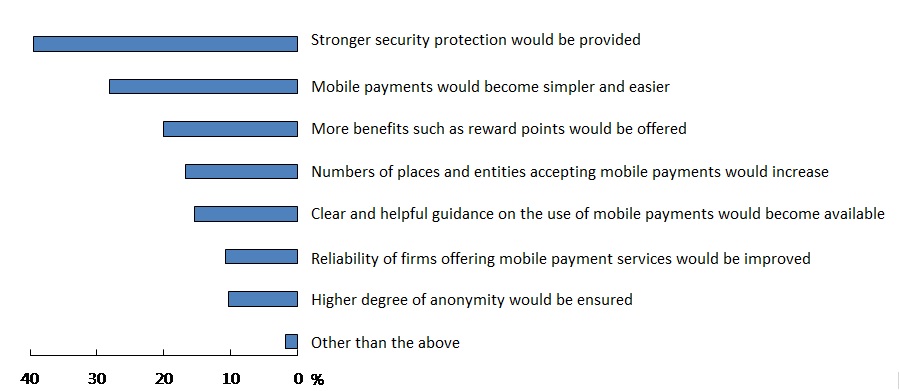

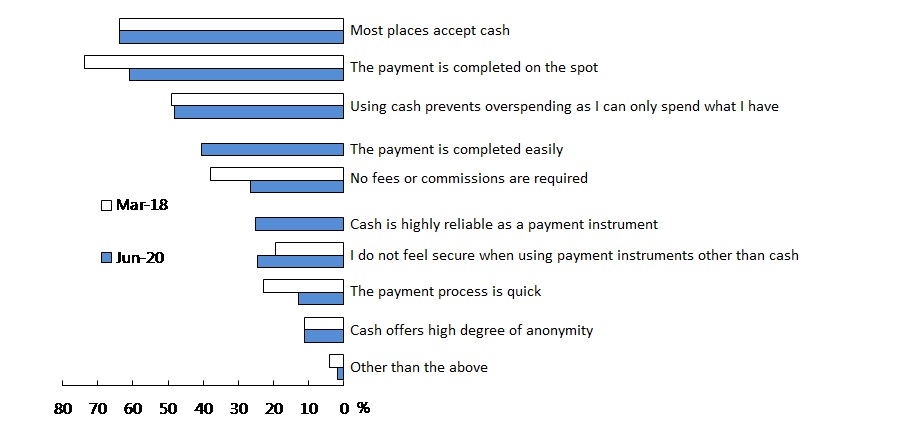

For example, the declining birthrate and aging population, as well as the population drain into urban areas, place upward pressure on cash distribution costs, thereby potentially making access to cash difficult depending on the region going forward. In this case, it is unclear whether private digital money can fully substitute for the functions of cash. In particular, it is not easy for private digital money to earn the same level of confidence in security as cash, for which sufficient anti-counterfeit measures are taken. In connection with this point, according to the Bank's Opinion Survey on the General Public's Views and Behavior, when asked for factor(s) that would encourage respondents to start using or make more use of mobile payments, the percentage of respondents who selected "stronger security protection would be provided" marked the highest among the choices offered (Figure 3). Moreover, cash seems to have an advantage over private digital money in terms of the geographic availability of services and settlement finality (i.e., settlement of an obligation becomes irrevocable and unconditional when the payment is made to the recipient). In addition, if, in the future, cash in circulation drops significantly and private digital money cannot sufficiently substitute the functions of cash, issues might arise in the central bank's continued provision of a stable unit of account through the issuance of legal tender.

Figure 3: Opinion Survey on the General Public's Views and Behavior

- Factor(s) that Would Encourage Respondents to Start Using or

Make More Use of Mobile Payments

- Reason(s) for Using Cash to Make Daily Payments

Note: Multiple answers were allowed.

Source: The Bank of Japan, Opinion Survey on the General Public's Views and Behavior (June 2020).

It should be noted that, public confidence in banknotes has been consistently high due to their cleanliness and the low number of counterfeit ones in Japan. As long as there is public demand for cash, the Bank will stay committed to supplying it. In this sense, CBDC would not be a substitute for cash but would co-exist and become a complement to it.

B. Supporting Private Payment Services

The motivation presented in A. assumes a decline in cash circulation. Even without such a decline, if CBDC is needed from the viewpoint of enhancing the stability and efficiency of the overall payment and settlement systems, it might become appropriate to issue CBDC in order to support private payment services.

Banks and various types of non-bank PSPs in Japan currently offer payment platforms to customers and compete with each other for their services. In view of these circumstances, end users point out issues such as discrepancies in services available in stores and incapacity to execute person-to-person transfers across payment platforms. There is a concern that, unless network effects are enhanced through cooperation among banks and non-bank PSPs, customer convenience will not improve and banks and non-bank PSPs will end up wearing themselves out in the process. On the other hand, CBDC could contribute to improving convenience for the public and the efficiency of payment and settlement systems by interlinking various types of private digital money to make the exchange between them easier.

Having said that, CBDC issuance is not the only solution to the challenges surrounding the interoperability among payment platforms. Interconnection among payment platforms or participation of non-bank PSPs in the common payment platforms with banks could also be a solution. Considering the private sector's comparative advantage in technological innovation, exploring this option could be the starting point to finding solutions.

Currently, payments among firms and financial transactions among financial institutions are settled using deposits at financial institutions. As pointed out earlier, using general purpose CBDC for settlements could be an option. It is considered more important, however, for the private sector to advance initiatives to provide safe and efficient payment services -- for example, through improvement in the existing payment instruments or sophistication in payment and settlement systems.

C. Developing Payment and Settlement Systems Suitable for a Digital Society

In addition to the arguments in A. and B., from a broader perspective, initiatives such as the Bank's issuance of CBDC and PSPs' innovative overlay services could lead to stable and efficient payment and settlement systems suitable for a digital society.

In this regard, discussions have been underway at home and abroad on various ideas such as attaching transaction information on CBDC when transacting among end users or coordinating the CBDC system with various government systems to provide public services. At any rate, it is important that the public sector, including the Bank, and the private sector work together to accumulate wisdom.

II. Core Features Required for CBDC

Ensuring the stability and efficiency of the overall payment and settlement systems requires appropriate role-sharing arrangements between a central bank and the private sector.

Currently, the Bank supplies banks and other institutions with current account deposits at the Bank as a payment instrument, while banks provide payment services through their bank deposits to firms and individuals. Also, the Bank supplies banks with cash in exchange for current account deposits, and banks provide cash to firms and individuals in exchange for bank deposits.

Even if the Bank were to issue general purpose CBDC, it would still be appropriate to maintain a two-tiered system of a central bank and the private sector. This means that CBDC would be issued indirectly through intermediaries (Figure 4). This is because the Bank's issuance of CBDC -- central bank money with finality -- and management of the overall framework as well as the intermediaries' (e.g., banks') initiatives in improving the interfaces with end users through their knowledge and technological innovation would lead to enhancement of the stability and efficiency in the overall payment and settlement systems. If banks and other institutions could utilize transaction data of their customers in new businesses and services, they may have merit in participating in CBDC intermediation.

- Figure 4: Indirect Issuance

If the Bank were to issue general purpose CBDC and adopt the indirect issuance model, CBDC would need to have the following instrument and system features.

A. Universal Access

To allow anyone to use CBDC and avoid excluding some individuals, devices or cards used for transfers and payments should provide ease of use and portability in their design. It is also important that the devices or cards be made available to the public free of charge or at sufficiently low cost to achieve universal access.

B. Security

If CBDC were to be issued, it would need to overcome the vulnerability inherent to online services using computer networks as it could encounter cyber-attacks aimed at counterfeiting and fraud. A loss of confidence in the currency caused by illicit activities also poses a significant risk to a central bank. Thus, for secure CBDC payments, it is necessary to incorporate counterfeit deterrence technology and enhance security to prevent various illicit activities.

C. Resilience

To allow CBDC to be used anywhere anytime, the CBDC system should always be available 24/7/365 to the end user. A design that supports offline use in times of system and network failures as well as electrical outages is also important for Japan, given the frequent occurrence of natural disasters.

D. Instant Payment Capability

CBDC, as central bank money, should offer settlement finality of transactions and instant payment capabilities similar to cash. Moreover, CBDC should be usable in many of the same type of transactions as cash, including person-to-business and person-to-person payments. To that end, in order to enable fast settlement of frequent payments by many end users, CBDC needs to have sufficient processing capability and scalability in preparation for future increase in the use of CBDC.

E. Interoperability

Serving as the basis for PSPs to offer various new payment services, CBDC could function as a payment platform unique to a digital society, different from cash or central bank deposits. It is therefore important that the CBDC system ensures interoperability with other payment and settlement systems and has a flexible architecture to adapt to changes in the future, including advances in private payment services.

These are the core features required for CBDC. It is, however, difficult to fully incorporate all of them into CBDC when actually designing it. For example, a design that supports offline payments with CBDC could deteriorate the security (e.g., effectiveness of counterfeit deterrence features), and one that aims to achieve universal access could push up the cost for developing and deploying devices accordingly. Enhancing the interoperability among CBDC and private payment and settlement systems could also have a negative impact on the stable operations of the systems. It is therefore necessary to appropriately deal with these tradeoffs while striking the right balance between features required for CBDC and their possible negative effects, in light of the Bank's responsibility for establishing stable and efficient payment and settlement systems.

When introducing CBDC, it might be appropriate to implement the features of universal access and resilience in a phased manner according to the use of cash. For example, the Bank could decide not to implement offline payment functions as long as a smooth shift in payment instruments from CBDC to cash continues to take place even in times of electrical outages due to natural disasters.

III. Points to Be Considered

A. CBDC's Relationship with Price and Financial Stability

In Japan, the Bank exclusively supplies the public with central bank money consisting of cash and current account deposits at the Bank, and banks provide bank money through credit creation based on the central bank money.

Under this two-tiered money system, if, as with banknotes, CBDC is issued as the Bank's liabilities in exchange for current account deposits at the Bank, the relationship between the central bank money (i.e., monetary base) and bank money is unchanged. In other words, the issuance of CBDC by itself would not immediately affect credit creation by banks.

If, however, a significant shift in funds from bank deposits to CBDC occurs through the CBDC issuance, this would impact the financial intermediary function of banks. For example, some point out that, if CBDC becomes more convenient than bank deposits, it will reduce bank deposits considerably, thereby leading to restraint in credit creation by banks. This potential impact requires consideration as it can affect monetary transmission channels.

Stable and efficient payment and settlement systems are infrastructures essential to daily life. At the same time, they serve as a policy basis for achieving the Bank's objectives of price and financial stability. Careful consideration is required for the functional requirements and economic design of CBDC (e.g., limits on the amount of issuance/holdings and remuneration) from the perspective of the effectiveness of monetary policy and financial stability.

B. Promoting Innovation

Banks and non-bank PSPs have provided new payment services, making full use of innovation. A central bank is in a position to support these positive initiatives.

As mentioned earlier, the Bank has a responsibility to provide most fundamental payment instruments to the public even in the digital society. At the same time, if PSPs, using CBDC as a new payment instrument, offer to their customers various services or build user-friendly interfaces while competing with each other, CBDC would contribute to creating more convenient payment and settlement systems for the public.

On the other hand, there are concerns that, if the growing presence of some PSPs and payment platforms with CBDC leads to an oligopoly or monopoly of the market, distortions in the service pricing mechanism and reduced incentives for innovation may arise in the long term.

Thus, if the Bank were to issue CBDC, it would need to consider carefully cooperation and role-sharing arrangements between a central bank and PSPs -- namely, to what degree the Bank should set the CBDC framework and technical standards, and what the Bank should leave to the creativity of the PSPs -- from the viewpoint of promoting innovations.

C. Ensuring Privacy and Handling End-User Information

Anonymity is one of the features of cash. This would be an important point to deal with if the Bank were to issue CBDC.

In order for CBDC to be widely used as a payment instrument, unwavering design and operation are required for privacy protection. In relation to the existing laws and regulations, personal transaction information must be properly protected in compliance with the Act on the Protection of Personal Information and other relevant laws and regulations.

Meanwhile, in a situation where adherence to anti-money laundering and counter-terrorism financing (AML/CFT) standards is expected worldwide, CBDC would be required to fulfill these regulatory requirements. In Japan, it is necessary to explore CBDC in relation to the Act on Prevention of Transfer of Criminal Proceeds and the Foreign Exchange and Foreign Trade Act, in addition to being consistent with international debate and standards in this field.

As mentioned earlier, information obtained from CBDC transactions can be the source of new services and businesses for PSPs. It would be undesirable to have a system where the Bank obtains the detailed data and keeps them to itself. It is essential to balance protecting privacy with leveraging information in the digital society.

Therefore, in considering CBDC issuance, it is necessary to explore the role-sharing between a central bank and PSPs -- namely, who obtains and manages what data and under what conditions -- while taking into account various requirements regarding the handling of information. As for privacy protection and AML/CFT compliance, public authorities are required to explore them from various perspectives, including fields other than payments and settlements. Accordingly, the Bank will coordinate closely with relevant authorities in dealing with these issues.

D. Relationship with Cross-Border Payments

Calls for more convenient and cheaper cross-border payments are on the rise recently, partly reflecting the progress of globalization and the emergence of global stablecoin initiatives. In this situation, discussions to enhance cross-border payments have progressed at the G20 and other forums. For example, while searching for potential roles of new payment and settlement infrastructures, ideas to leverage the CBDC framework for improving cross-border payments -- such as by facilitating the conversion of CBDCs issued by different jurisdictions -- have been explored.

For now, there are more views that place importance on improving the existing system of cross-border payments. However, a scheme that utilizes CBDC could emerge as an alternative, depending on the situation going forward. That said, it is important to first improve the stability and efficiency of payment and settlement systems in each jurisdiction. Nonetheless, in considering CBDC, it is also desirable to ensure that CBDC could be used for cross-border payments -- not only for domestic payments -- while thoroughly monitoring developments in each central bank, in order to respond flexibly to developments in discussion on cross-border payments.

Active discussions among jurisdictions on international standardization of data formats, among others, are also essential considering the importance of ensuring the interoperability of CBDC issued by each jurisdiction.

IV. Next Steps

Some countries are taking concrete steps toward issuing CBDC. These countries may have imminent issues specific to them, such as a significant decline in cash usage or immature infrastructures related to domestic currency and payments where rebuilding the payment and settlement systems from scratch using the latest digital technology is more efficient. The Bank currently has no plan to issue CBDC, as the situation is different in Japan.

Having said that, there is a possibility of a surge in public demand for CBDC going forward, considering the rapid development of technological innovation. Designing CBDC should be done carefully over time in view of the impact of CBDC on people's lives and economic activity. It is not an appropriate policy response to start considering this only when the need to issue CBDC arise in the future.

Based on such recognition, the Bank has vigorously conducted research and experiments on CBDC for several years. For example, it has conducted experiments exploring DLT, which could be used for wholesale CBDC, in a joint project with the European Central Bank since 2016. 2

As for general purpose CBDC, the Bank organized the Study Group on Legal Issues regarding Central Bank Digital Currency in its Institute for Monetary and Economic Studies in 2018. The group has discussed various legal issues regarding CBDC. 3 Moreover, the Bank continues dialogue with private enterprises and experts to discuss topics such as the benefits and risks of issuing general purpose CBDC as well as CBDC's relationship with private payment services at the Future of Payments Forums and other meetings. As acceleration in cashless technology was identified at these meetings, the Bank set up the Digital Currency Group in its Payment and Settlement Systems Department in July 2020 as a step-up in exploration including experiments. Basic Policy on Economic and Fiscal Management and Reform 2020 -- which was decided by the Cabinet of Japan in July -- also stipulates that the Bank will explore CBDC by, for example, conducting experiments on technical aspects while coordinating with other countries.

The Bank will continue to make necessary preparations to respond to changes in circumstances in an appropriate manner. The currently planned next steps are as follows.

- 2 Released on the Bank's website reports on Project Stella (Phases 1 through 4), a joint research project of the European Central Bank and the Bank of Japan.

- 3 Study Group on Legal Issues regarding Central Bank Digital Currency, "'Chuo Ginko Dejitaru Tsuka ni kansuru Horitsu Mondai Kenkyukai' hokokusho" [Report of the Study Group on Legal Issues regarding Central Bank Digital Currency], Kin'yu Kenkyu 39, no. 2, June 2020, https://www.imes.boj.or.jp/research/papers/japanese/kk39-2-1.pdf. Summary is available in English at https://www.boj.or.jp/en/research/wps_rev/lab/lab19e03.htm/.

A. Experiments

The Bank will explore general purpose CBDC in a more concrete and practical way by conducting experiments, rather than confining itself to conceptual research as before. Various issues require testing through experiments, and it is necessary to incorporate ever-progressing technological innovations. Thus, it is essential to utilize cutting-edge technology and knowhow of the private sector in the experiments.

To keep up with the pace, the Bank will carry out experiments in a phased and planned manner, as indicated below. The Bank will first test the technical feasibility of the core functions and features required for CBDC through a Proof of Concept (PoC). It will then consider the need for a pilot program if necessary.

- 1. PoC Phase 1

The Bank will develop a test environment for the CBDC system and conduct experiments on the basic functions that are core to CBDC as a payment instrument -- namely, issuance, distribution, and redemption. In this phase, it will explore basic functions and roles required for CBDC while also considering technical feasibility and challenges regarding, for example, the management entity of the ledger that records the total amount of issuance and transaction history, as well as ways to record. - 2. PoC Phase 2

The Bank will implement additional functions of CBDC in the test environment developed in Phase 1 and test their feasibility. In this phase, the Bank will conduct technical experiments on specific functions required for CBDC while taking account of the core features required for CBDC (see II.) and the points to consider in issuing CBDC (see III.). - 3. Pilot program

Based on the PoC, if the Bank judges it necessary to step things up further, it will also consider a pilot program that somewhat reflects the actual design and functions of CBDC and involves PSPs and end users.

Among these phases, the Bank aims to start PoC Phase 1 in early fiscal year 2021. In preparation, the Bank plans to specify basic requirements of the test environment, among others, as early as possible and then call for partners to join and collaborate in the experiments.

B. Exploring Institutional Arrangements

The Bank will deepen its exploration of institutional arrangements in tandem with experiments. In this regard, it released a report on technical challenges of enabling cash-equivalent functions in CBDC in July 2020. The report sets out views and challenges regarding universal access and resilience, which are the features expected for general purpose CBDC. 4

In addition to this, there are many points to take into account when designing CBDC as described in III. Thus, the Bank will proceed to successively explore topics such as (1) cooperation and role-sharing arrangements between a central bank and PSPs, (2) economic design of CBDC, including limits on the amount of issuance/holdings and remuneration, (3) privacy protection and handling of end-user information, and (4) standardization of IT relating to digital currency.

In the course of exploration, the Bank will actively exchange views with stakeholders and experts on these topics through channels including the Future of Payments Forums, in addition to continuing dialogue with relevant government authorities.

- 4 Bank of Japan Payment and Settlement Systems Department, "Chugin dejitaru tsuka ga genkin doto no kino o motsu tame no gijutsu-teki kadai" [Technical challenges of enabling cash-equivalent functions in central bank digital currency], Payment and Settlement Systems Report Annex Series, July 2020, https://www.boj.or.jp/research/brp/psr/psrb200702.htm/.

C. Coordination with Stakeholders at Home and Abroad

Other major central banks have also stepped up their exploration of general purpose CBDC. In this situation, the Bank has enhanced international coordination with other central banks by, for example, establishing a research group on CBDC with other major central banks and the Bank for International Settlements in January 2020. The group has assessed CBDC use cases and shared knowledge on emerging technologies, the results of which are published in the report. 5

As noted in the report, central banks are shifting their emphasis from conceptual research activities to practical policy analysis -- based on country-specific circumstances -- and technical experiments, regardless of whether they are exploring wholesale or general purpose CBDC. The Bank will continue to deepen understanding on the core features of CBDC and their impact on practices while closely coordinating with other central banks, and use the information obtained in its CBDC exploration.

Payment and settlement systems are established through cooperation among many stakeholders, not by a central bank alone. As mentioned earlier, if a central bank were to issue CBDC, extensive and large-scale efforts would need to be made, including an exploration of IT systems and institutional arrangements. With this firmly in mind, the Bank will place emphasis on applying the knowledge of various stakeholders -- such as banks, non-bank PSPs, IT specialists, legal experts, and relevant public authorities -- in considering CBDC issuance.

In addition, the Bank will continue to communicate elaboratively with the public about CBDC, considering that introducing CBDC eventually depends on whether the Bank could gain sufficient public understanding.

- 5 A group of central banks consisting of the Bank of Canada, the Bank of England, the Bank of Japan, the European Central Bank, the Sveriges Riksbank, the Swiss National Bank, and the Federal Reserve System, together with the Bank for International Settlements, released a report titled "Central Bank Digital Currencies: Foundational Principles and Core Features" in October 2020.