Financial System Report (April 2023)

April 21, 2023

Bank of Japan

Motivations behind the April 2023 issue

This issue of the Report assesses potential vulnerabilities in Japan's financial system and the effects of changes in banks' balance sheets during phases of rising foreign interest rates by analyzing them from the following two perspectives.

First, global tightening of financial conditions has exerted stress on Japan's financial system. Rises in foreign interest rates could contribute to pushing down banks' loss-absorbing capacity through shrinkage in interest margins and an increase in valuation losses on their securities holdings. Rising input costs and a slowdown in the global economy could push up banks' credit costs through a deterioration in financial conditions of domestic and foreign firms. Since March, uncertainty about the financial sector in the United States and Europe has increased. It is important to accurately assess the impact of these changes in the environment on the financial system.

Second, as pointed out in the previous issue of the Report, private debt has increased in Japan against the background of smooth functioning of financial intermediation. The increase in private debt since the outbreak of COVID-19, on the one hand, reflects firms' cautious cash management aimed at securing ample cash reserves. On the other hand, such an increase also reflects banks' active lending stance. Under these circumstances, it is important to monitor whether there has been an increase in lending to borrowers with relatively low debt repayment capacity, which entails high credit risk.

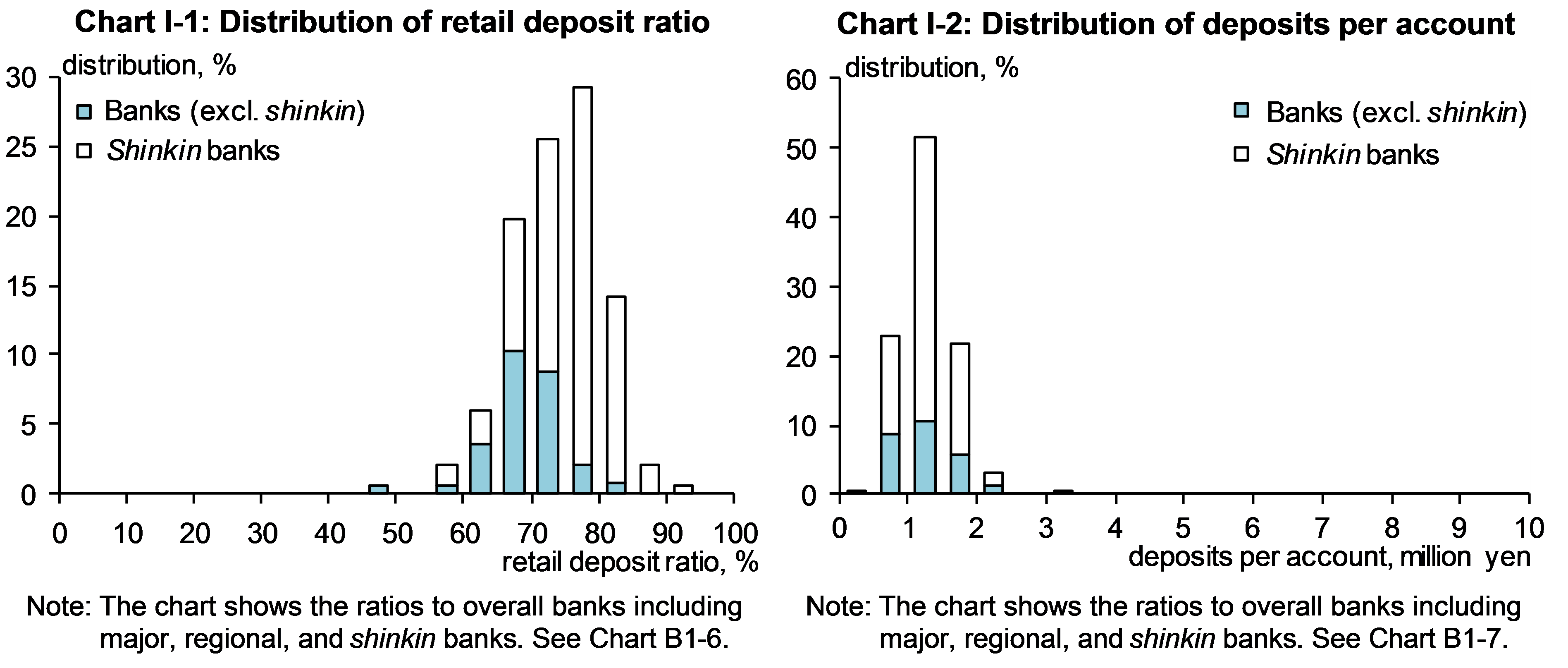

Executive summary: Stability assessment of Japan's financial system*

Japan's financial system has been maintaining stability on the whole. Japanese banks have sufficient capital bases to perform financial intermediation activities appropriately even amid the global tightening of financial conditions and the resultant various types of stress. They also have stable funding bases, especially small, sticky retail deposits (Charts I-1 and I-2). Despite heightened uncertainty about the financial sector in the United States and Europe, triggered by the U.S. bank failures in March, Japan's financial system has been sound and resilient (see Box 1 on the impact of the U.S. bank failures).

However, vigilance against tail risks continues to be warranted. Future developments remain highly uncertain as financial and capital markets have been nervous. Although the quality of banks' domestic and foreign loan portfolios has remained high on the whole, some loans entail high credit risk. From a long-term perspective, if banks' core profitability were to stagnate and capital accumulation were to stall, financial intermediation could be impaired due to a decline in loss-absorbing capacity, or vulnerabilities in the financial system could increase through excessive search for yield. To ensure the stability of Japan's financial system, it is necessary to examine these risks of contraction and overheating in the financial system and address potential vulnerabilities appropriately.

The current phase of the financial cycle

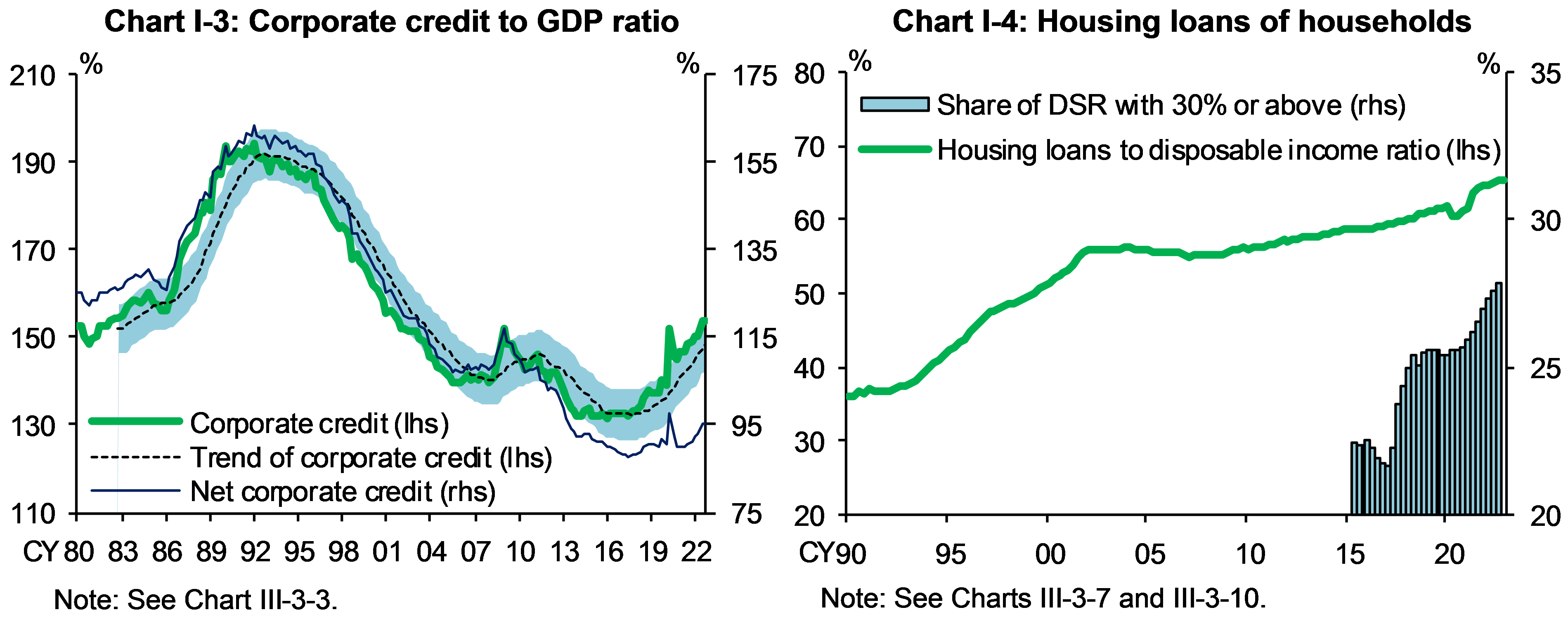

Although the current expansionary phase of the financial cycle has been prolonged, due mainly to the increase in private debt, no major financial imbalances can be observed in current financial activities. The increase in corporate credit, which is one of the reasons for the rise in private debt, reflects firms' cautious cash management, mainly by small and medium-sized enterprises (SMEs), aimed at securing ample cash reserves (Chart I-3). As suggested by the fact that net corporate credit (gross corporate credit minus firms' cash and deposits) has hardly expanded despite the increase in gross corporate credit, many SMEs have continued to secure cash reserves through borrowings.

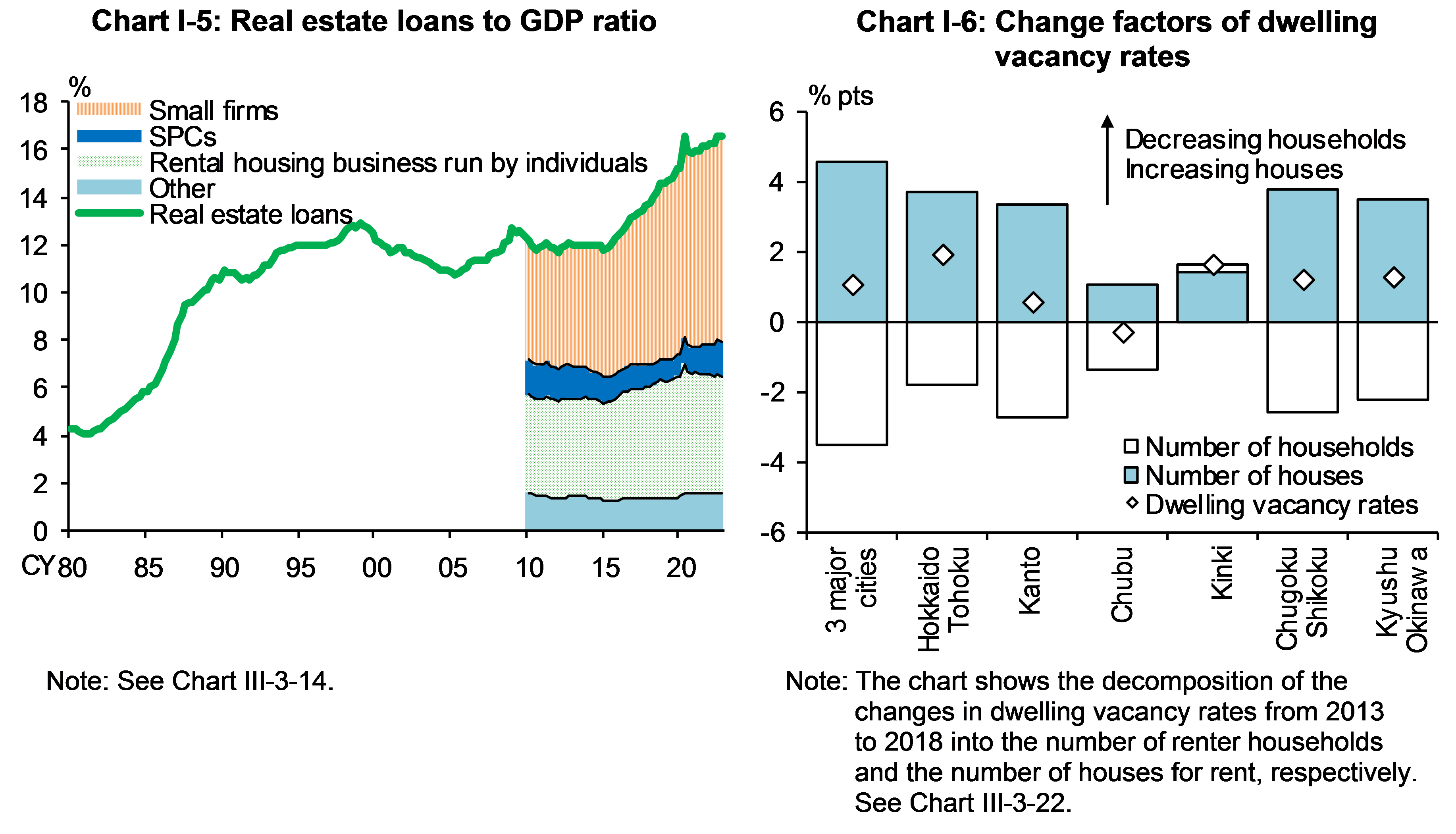

The increase in private debt partly reflects borrowing by those with relatively low debt repayment capacity. The household debt to disposable income ratio, which is equivalent to the loan-to-income (LTI) ratio on a macro basis, has continued to increase, reaching an all-time peak (Chart I-4). The share of housing loans with a high debt servicing ratio (DSR) -- the ratio of annual repayments to annual income -- has been increasing. Moreover, real estate loans have risen even amid the increase in dwelling vacancy rates across Japan (Chart I-5). Such an increase in vacancy rates for dwellings can be observed not only in areas where the number of renter households has declined but also in areas where the number of renter households has increased (Chart I-6). Attention should be given to these developments in private debt.

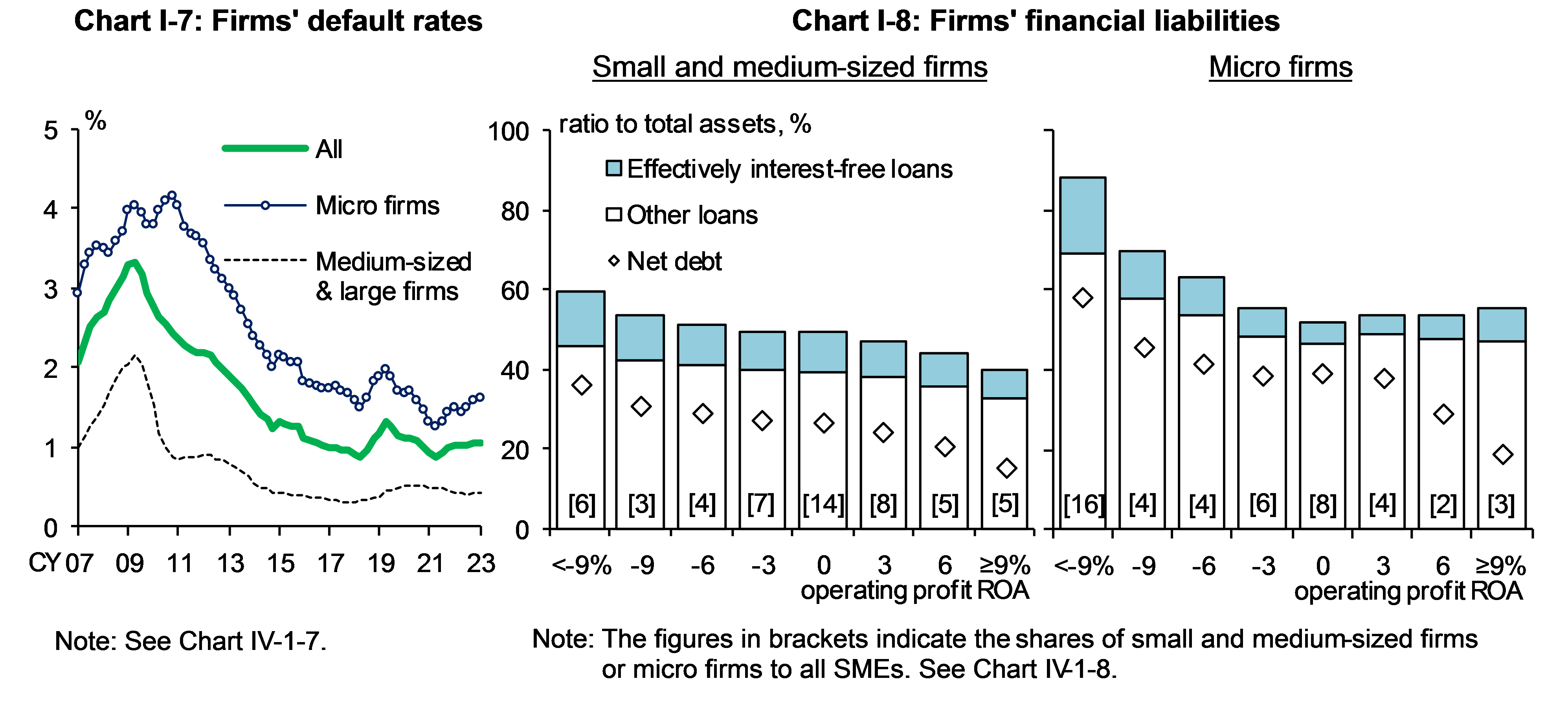

Domestic firms' default and cash reserves

So far, firms' defaults have remained at a low level (Chart I-7). Recent trends in firms' defaults depend largely on the amount of cash reserves. Firms with lower profit margins have larger debt relative to total assets and little cash reserves such as cash and deposits (Chart I-8). Micro firms in particular have higher financial leverage (loans/total assets) in both gross and net terms, making them more financially vulnerable. Indeed, default rates among smaller firms are beginning to rise gradually.

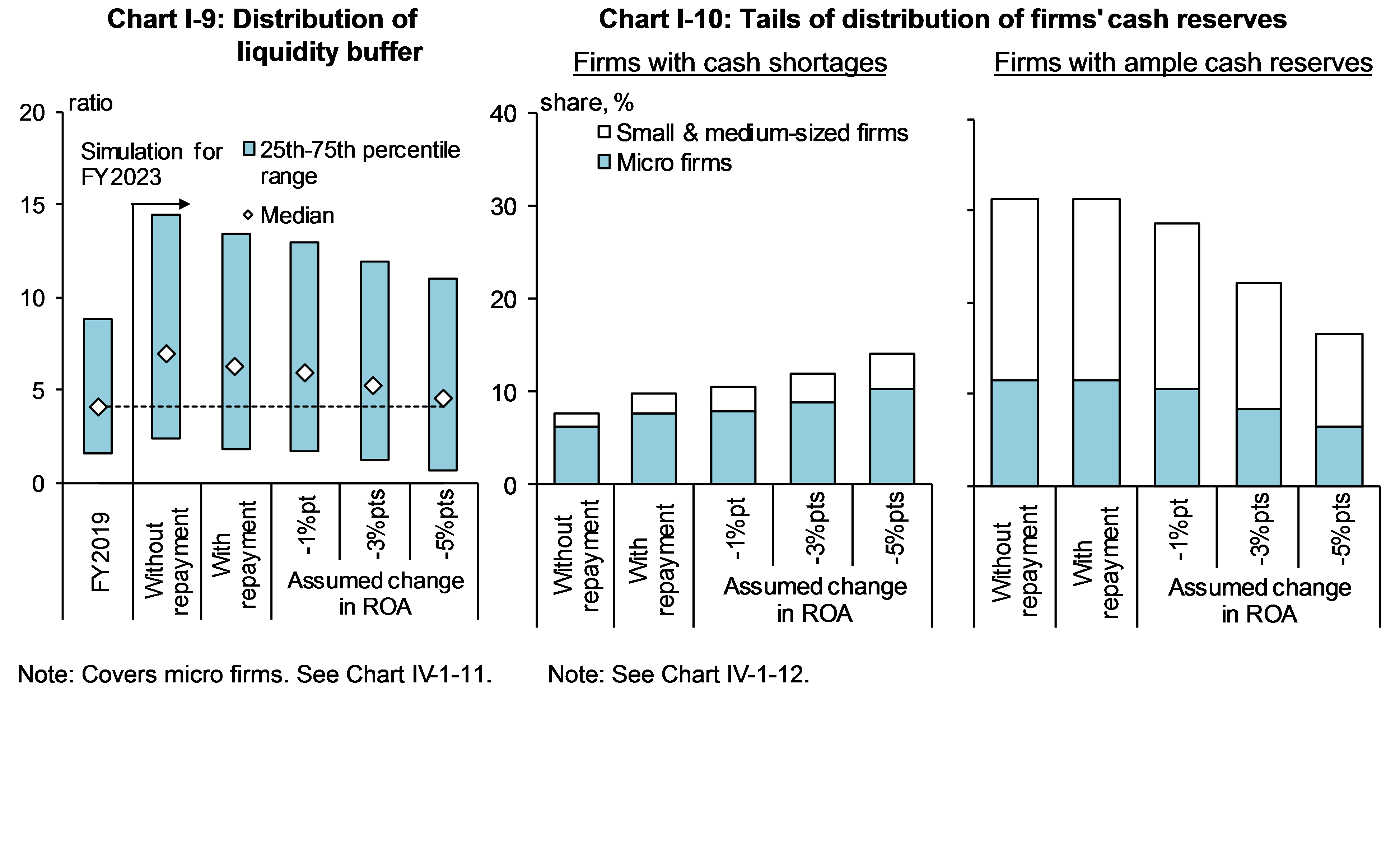

As principal and interest repayments on effectively interest-free loans begin in full, firms' debt servicing costs will increase. Estimating the impact of these repayments, even in the case where principal and interest repayments on such loans are made ("with repayment" in the chart), more than half of the firms have liquidity buffers equal to or greater than before the pandemic in fiscal 2019 (Chart I-9). It should be noted, however, that there are firms with cash shortages (left panel of Chart I-10). The default risk of these firms could be concentrated in banks that deal more with micro firms. On the other hand, there are firms that would be able to maintain a high liquidity buffer even after full repayment of their effectively interest-free loans (right panel of Chart I-10). If many firms prepay these loans, corporate loans and deposits will decline at the same time.

Changes in the risk profiles of foreign loans

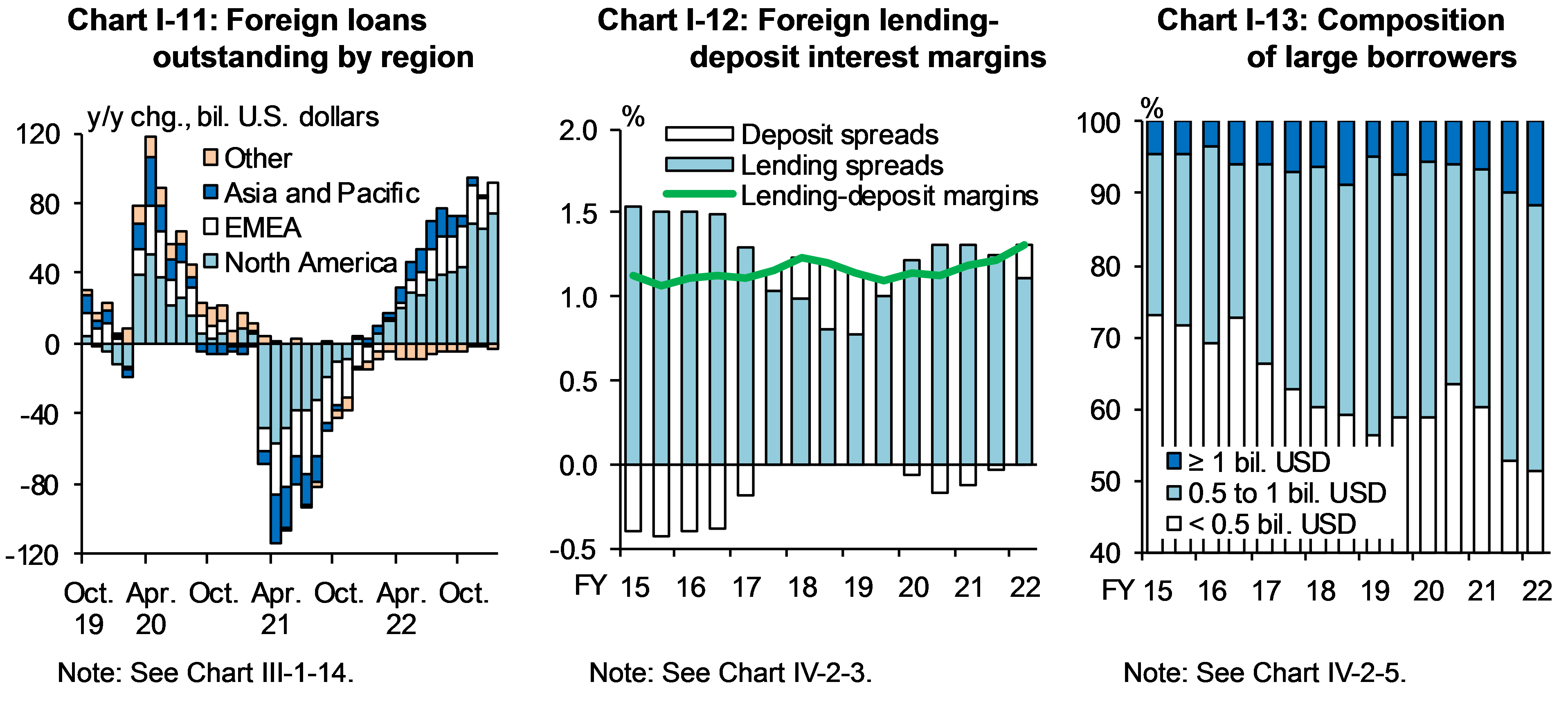

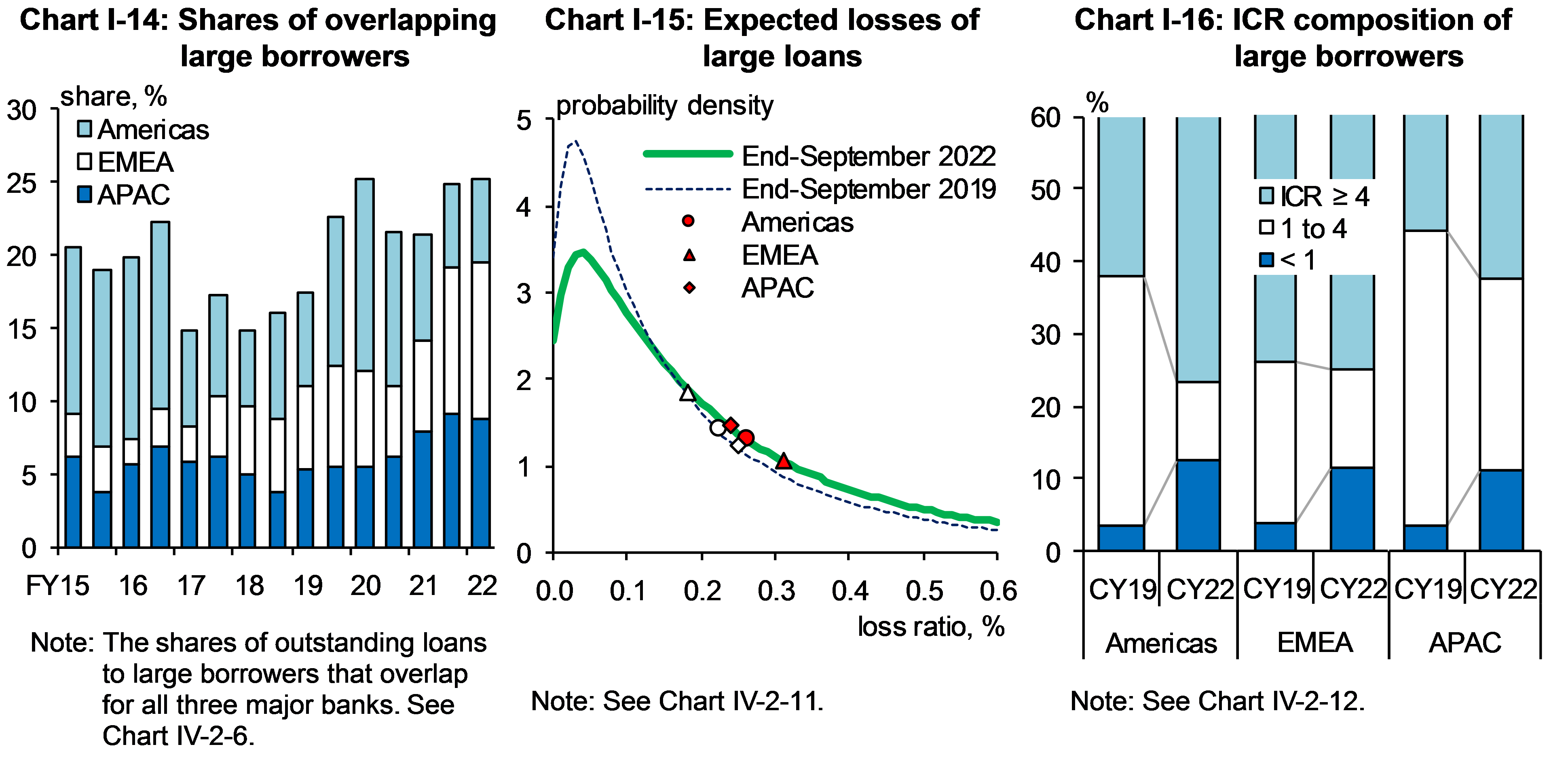

Foreign credit risk has remained low even amid the global tightening of financial conditions. However, there have been some changes in the risk profiles of foreign loans. First, banks have changed the composition of loans to reduce risks. By region, while major banks have been active in meeting demand for funds, particularly from the United States and Europe, they have been reluctant to extend loans to the Asia-Pacific region, where there are concerns over the Chinese real estate market (Chart I-11). Second, lending-deposit interest margins have improved somewhat together with the rise in market interest rates (Chart I-12). The improvement in lending-deposit interest margins has also led to an improvement in major banks' loss-absorbing capacity. Third, some foreign loans have become larger and more concentrated. The trend toward larger loans has been driven by the fact that major banks have been actively responding to the loan demand of their borrowers (Chart I-13). Moreover, there has been an increase in the number of borrowers overlapping among major banks with regard to loans to the Europe, Middle East, and Africa (EMEA) and Asia-Pacific (APAC) regions (Chart I-14). The foreign loan portfolios of major banks are more likely to be interconnected in response to a shock.

The credit risk associated with large foreign loans has increased somewhat, partly due to the growing trend toward larger loans (Chart I-15). As a whole, strong sales of firms have prevented a deterioration in their interest coverage ratios (ICRs) even as funding costs have risen. However, the percentage of firms with an ICR of less than one -- i.e., firms that cannot cover their interest payments with their profits from core business alone -- has been rising (Chart I-16). If there is a substantial slowdown in foreign economies going forward, putting downward pressure on firms' profits, a deterioration in ICRs is inevitable. In such a case, the probability of default (PD) would be likely to rise since large borrowers of major banks tend to have relatively high financial leverage.

Banks' resilience to foreign interest rate rises

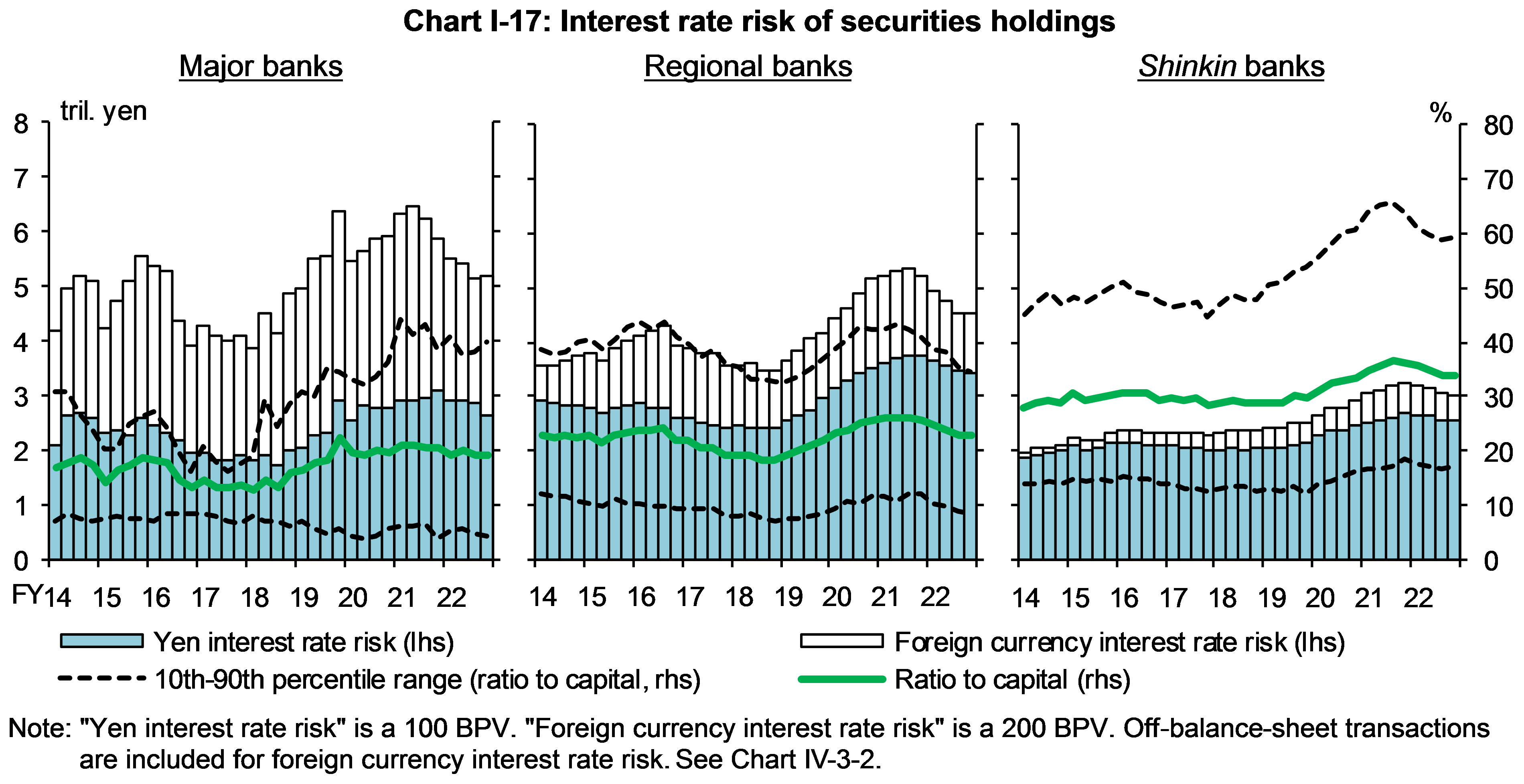

Amid concerns over rising interest rates, foreign currency interest rate risk associated with banks' securities investment has been on a clear declining trend not only for major banks but also for regional and shinkin banks (Chart I-17). Yen interest rate risk, which had been on an uptrend, has also started to decline. The results of the macro stress testing, which assumes that the yield curve in foreign markets remains substantially inverted, also indicate that changes in banks' balance sheets have contributed to improvements in their resilience against the risk of rising interest rates.

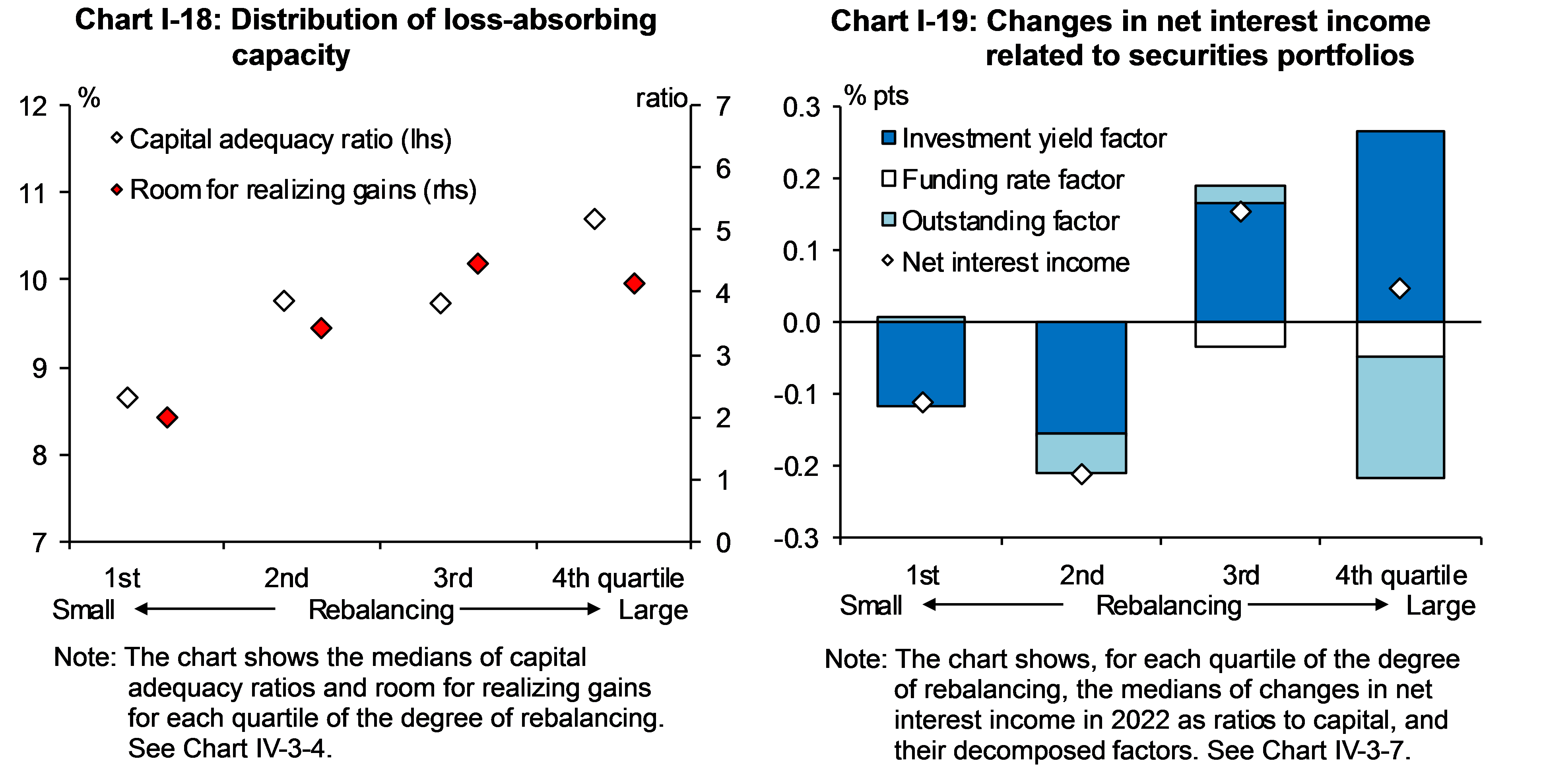

However, heterogeneity is large in terms of the amount of foreign currency interest rate risk and the underlying rebalancing behavior of individual banks. Banks that rebalanced significantly were those that had high loss-absorbing capacity to start with (Chart I-18). In addition, changes in risk profiles vary depending on the extent to which banks rebalanced (Chart I-19). Banks that rebalanced significantly (those in the third and fourth quartiles in the chart) have improved their yields on securities and contained the risk of negative interest margins. This is due to the realization of losses on selling some of their foreign currency interest rate risk positions. Among these banks, some that also realized gains in conjunction with sales to book losses saw a reduction in their valuation gains (i.e., room for realizing gains), while others that did not restore positions that they had reduced (e.g., banks in the fourth quartile) have lost profit opportunities; however, both groups of banks have lowered the risk of valuation losses as a result. Meanwhile, at some banks that maintained their positions (those in the first and second quartiles in the chart), the risk associated with rising interest rates has materialized in the form of negative interest margins and valuation losses. It should be noted that the increase in valuation losses, like realized losses, can affect banks' financial conditions through declines in allocated capital to market divisions and the income distributable to shareholders.

The Bank of Japan will promote financial institutions' initiatives to address these potential vulnerabilities through on-site examinations and off-site monitoring. It will continue to closely monitor the impact of various risk-taking moves by financial institutions on the financial system from a macroprudential perspective.

- See the Report for more details on the analyses as well as notes and sources of the charts.

Notice

This Report basically uses data available as at end-March 2023.

Please contact the Financial System and Bank Examination Department at the e-mail address below to request permission in advance when reproducing or copying the contents of this Report for commercial purposes.

Please credit the source when quoting, reproducing, or copying the contents of this Report for non-commercial purposes.

With regard to economic and financial variables of each stress scenario in the macro stress testing, please see the scenario tables [XLSX 39KB] .