Financial System Report (April 2024)

April 18, 2024

Bank of Japan

Motivations behind the April 2024 issue

This issue of the Report takes a deep dive into real estate risk and interest rate risk, which should be closely monitored for the time being. On this basis, the Report assesses the resilience of and potential vulnerabilities in Japan's financial system.

Real estate risk is one of the risks that are discussed globally. Real estate markets in the United States and Europe have been experiencing a gradual correction, and this could affect Japan's financial system via Japanese banks that have exposures to these markets and real estate funds with globally diversified portfolios. So far, there has been no significant downward pressure on Japan's real estate market, but attention should be paid to changes in the commercial areas in central Tokyo. It is important to accurately assess the impact of domestic and foreign real estate risk on the financial system.

Interest rate risk is a fundamental risk for banks, which engage in maturity transformation. The significance of managing such risk has been increasing further in a situation of higher market interest rates. Moreover, interest rate risk profiles of not only banks but also households and firms have been changing under the prolonged low interest rate environment. In view of these changes, the Report examines in detail the resilience of each economic entity to rising interest rates, as well as the speed and size of the pass-through of rising interest rates to banks' investment income and funding costs.

Executive summary: Stability assessment of Japan's financial system *

Japan's financial system has been maintaining stability on the whole.

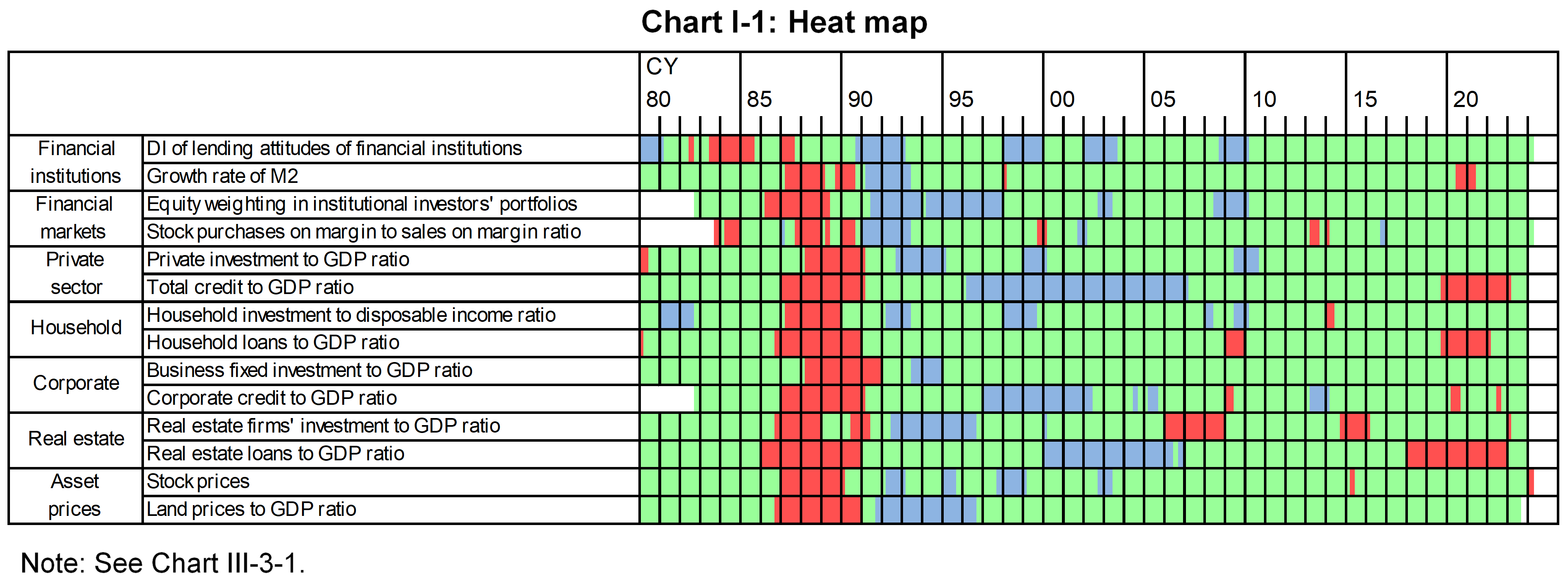

Financial intermediation has continued its smooth functioning. In the loan market, banks' lending stance has remained active and loans outstanding have continued to increase (see Box 4 for interest rate developments before and after the changes in the monetary policy framework in March 2024). No major financial imbalances can be observed in these financial intermediation activities (Chart I-1). 1

Japanese banks have sufficient capital bases and stable funding bases to withstand various types of stress. However, vigilance against tail risks continues to be warranted. The period of stress may be prolonged further with continuing global monetary tightening and the resultant concerns about a slowdown in foreign economies. From a long-term perspective, a decline in banks' loss-absorbing capacity could lead to a contraction of financial intermediation activities or an overheating, such as excessive search for yield. With these in mind, it is necessary to address the following potential vulnerabilities appropriately and ensure the stability of Japan's financial system into the future.

Domestic and foreign real estate risk and its impact

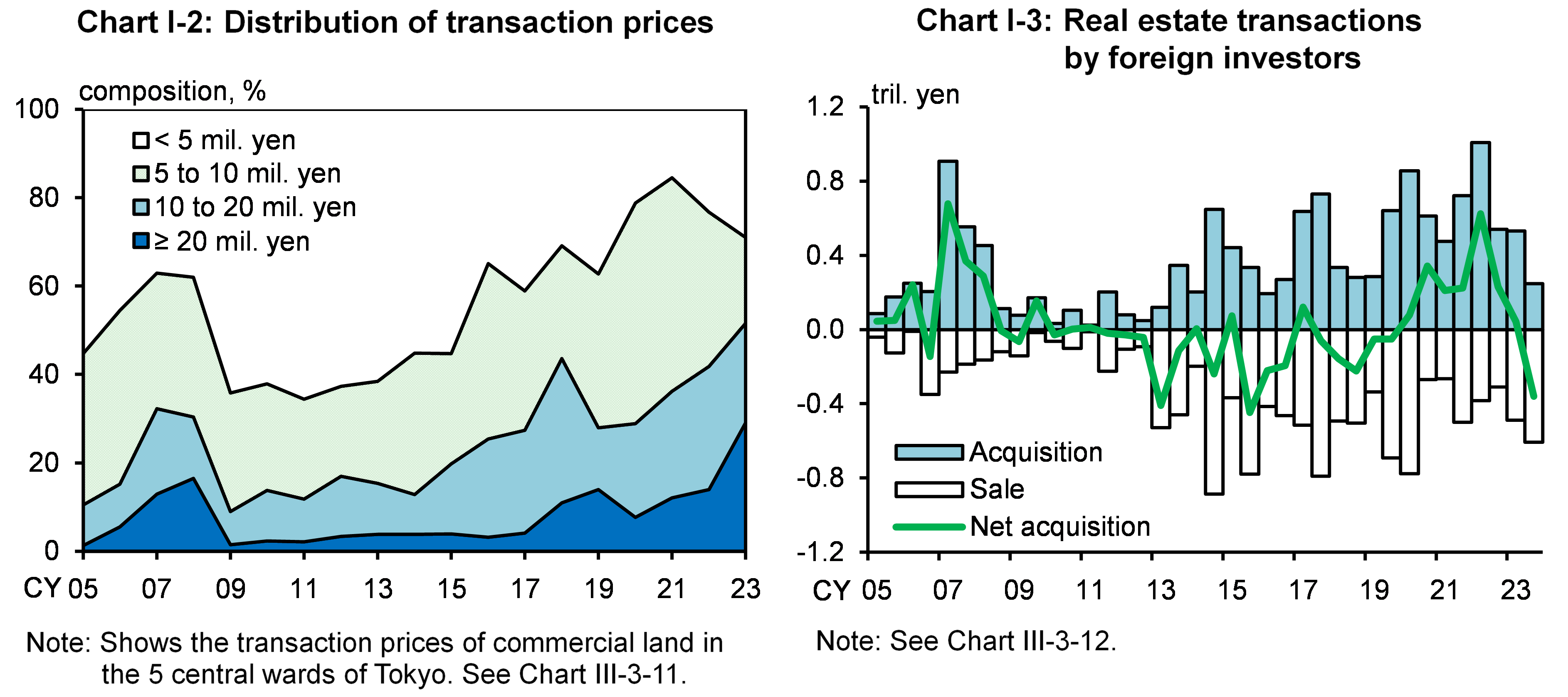

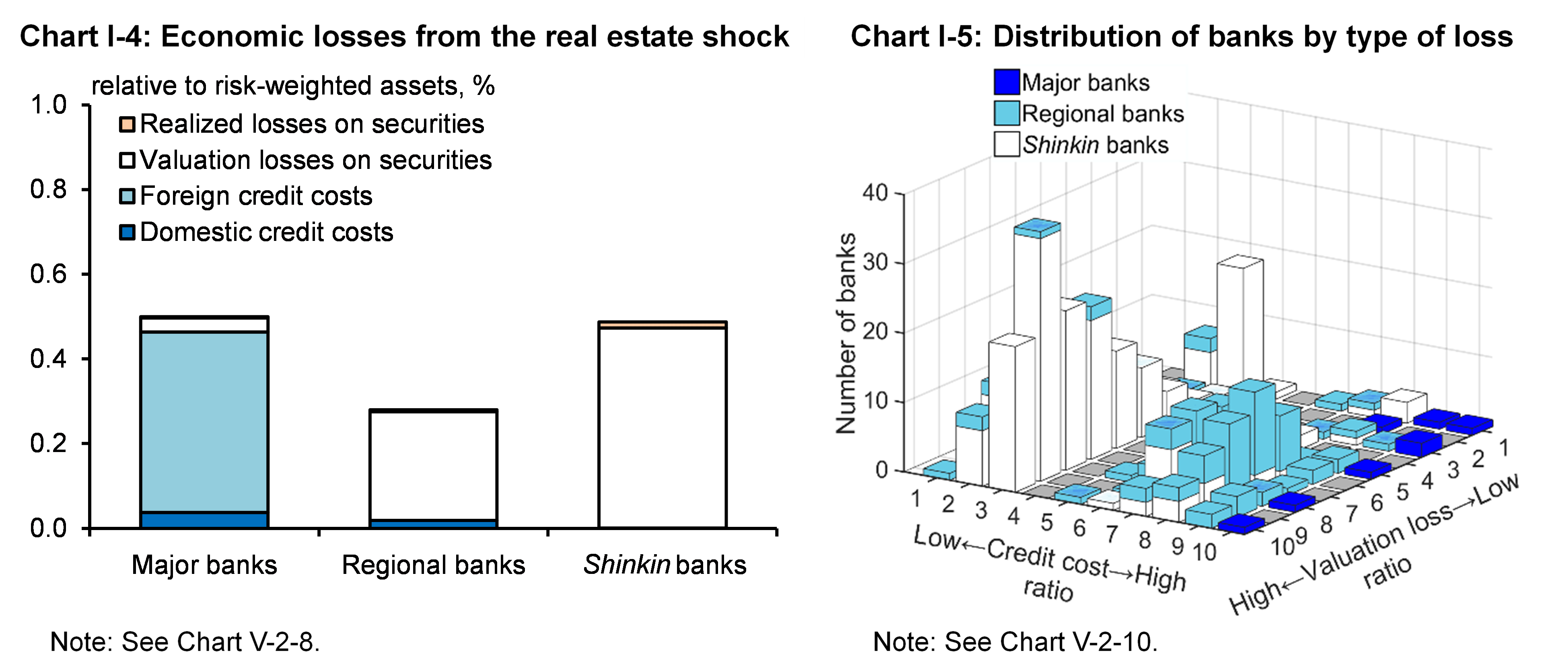

In Japan's real estate market, valuations of some properties seem relatively high. In some limited commercial areas in central Tokyo, transactions in higher price ranges have been increasing (Chart I-2). So far, a rise in office vacancy rates has been limited to parts of central Tokyo, unlike in the United States, where such a rise is observed in a wide range of areas. However, there have been changes in Japan's real estate market; foreign investors, who had been active in acquiring real estate in Japan, became net sellers in the second half of 2023 for the first time in four years (Chart I-3).

Meanwhile, the delinquency rate of loans for offices has risen further in the United States. Close attention should therefore continue to be paid to the possible impact of changes in the U.S. and other foreign real estate markets on Japan's real estate market via foreign investment funds that diversify their investment globally. Against this background, one of the assumptions in the macro stress testing in this Report is that there is a repricing of commercial real estate in some limited metropolitan areas triggered by a correction in foreign real estate markets. The results show that banks' economic losses (domestic and foreign credit costs as well as valuation and realized losses on securities) due to the real estate shock are limited on a macro basis (Chart I-4). Since Japanese banks' foreign real estate financing is small, additional economic losses would be limited even when assuming a considerable correction in the U.S. real estate market.

In Japan, however, as the expansionary phase of the financial cycle has become more prolonged, banks have built up real estate-related exposures (loans and securities investments). In particular, there has been an increase in common exposures to real estate in the metropolitan areas among banks. Therefore, even a shock limited to the commercial real estate market in the metropolitan areas could affect a wide range of banks nationwide, regardless of type of bank (Chart I-5).

See Chapters III-C, IV-A, IV-B, V-B, and Box 1 in the full text [PDF 1,999KB]

Resilience to rising interest rates by economic entity

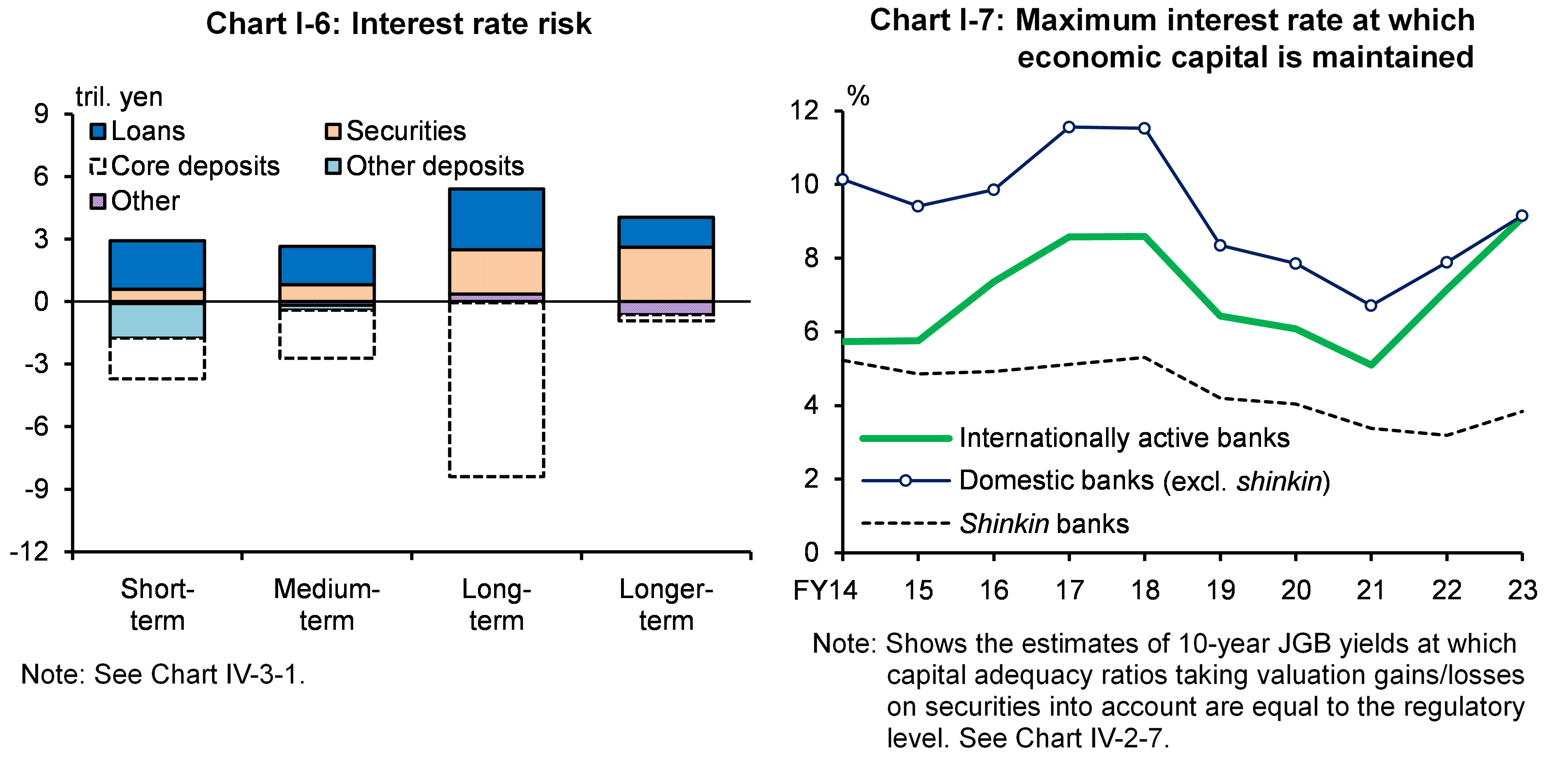

In the banking sector, interest rate risk in the banking book (IRRBB) for yen (in terms of the 100 BPV; taking core deposits into account) is generally in balance between assets and liabilities (Chart I-6). The duration gap -- the difference between repricing schedules of interest payments for assets and liabilities (not taking core deposits into account) -- has been shrinking recently, with the duration of securities shortening amid concerns over the risk of higher interest rates. Reflecting such rebalancing behavior, banks' resilience to rising interest rates has been on an improving trend. Chart I-7 shows estimates of the maximum interest rate on 10-year Japanese government bonds (JGBs) at which banks can maintain sufficient loss-absorbing capacity even if the rise in the interest rate increases their valuation losses on securities. The maximum interest rate, which had followed a declining trend under the low interest rate environment, has been increasing recently.

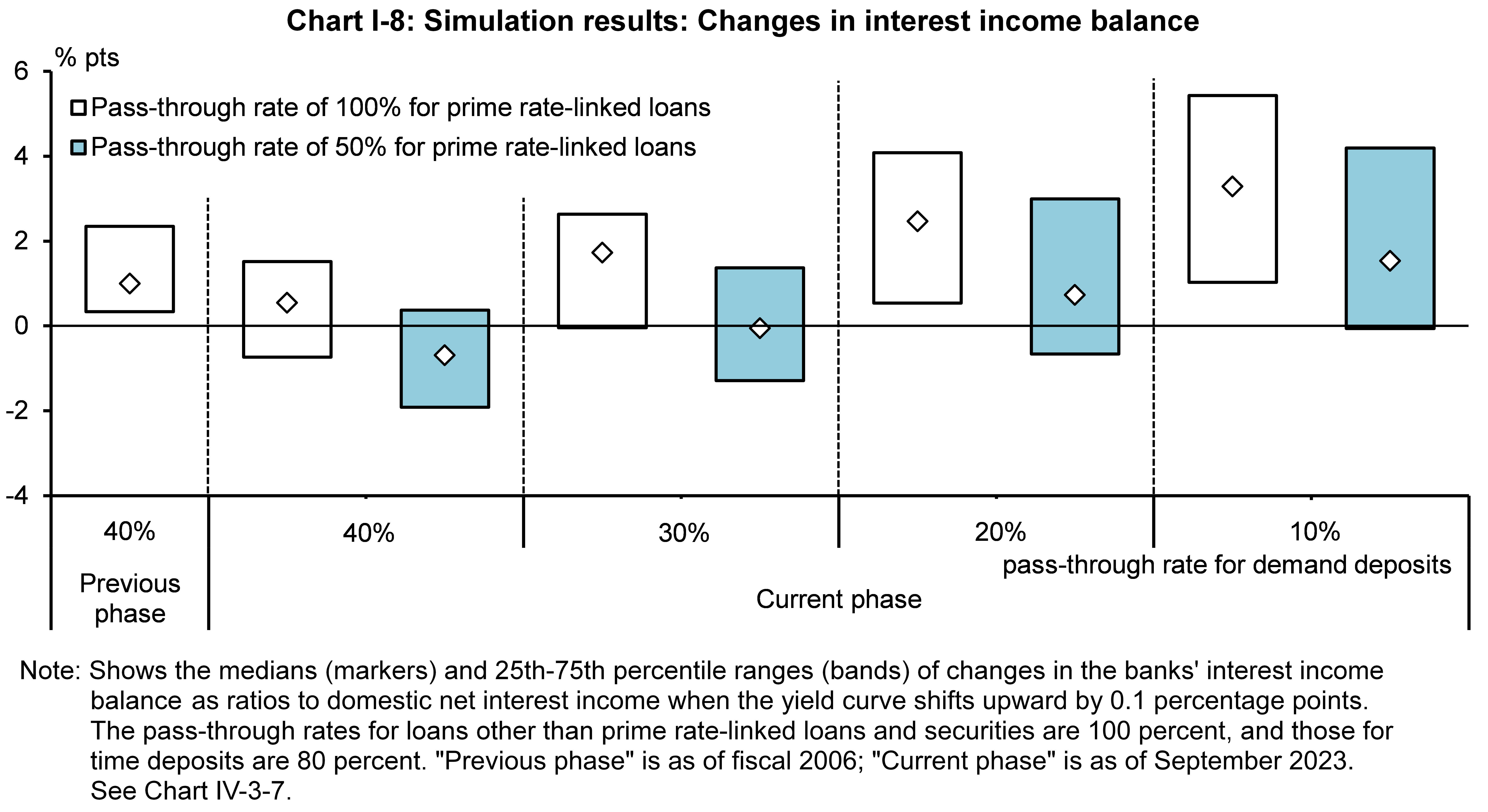

However, the impact of the rise in market interest rates on banks' profits depends on the interest rate pass-through to loans and deposits, as well as changes in the yield curve (Chart I-8). The pass-through rates are affected by the supply and demand balance and the competitive environment in the loan and deposit markets, as well as relationships with customers. In addition, it should be noted that the impact of the rise in market interest rates on banks' profits varies depending on their balance sheet structures, and there is uncertainty over the stickiness of deposits.

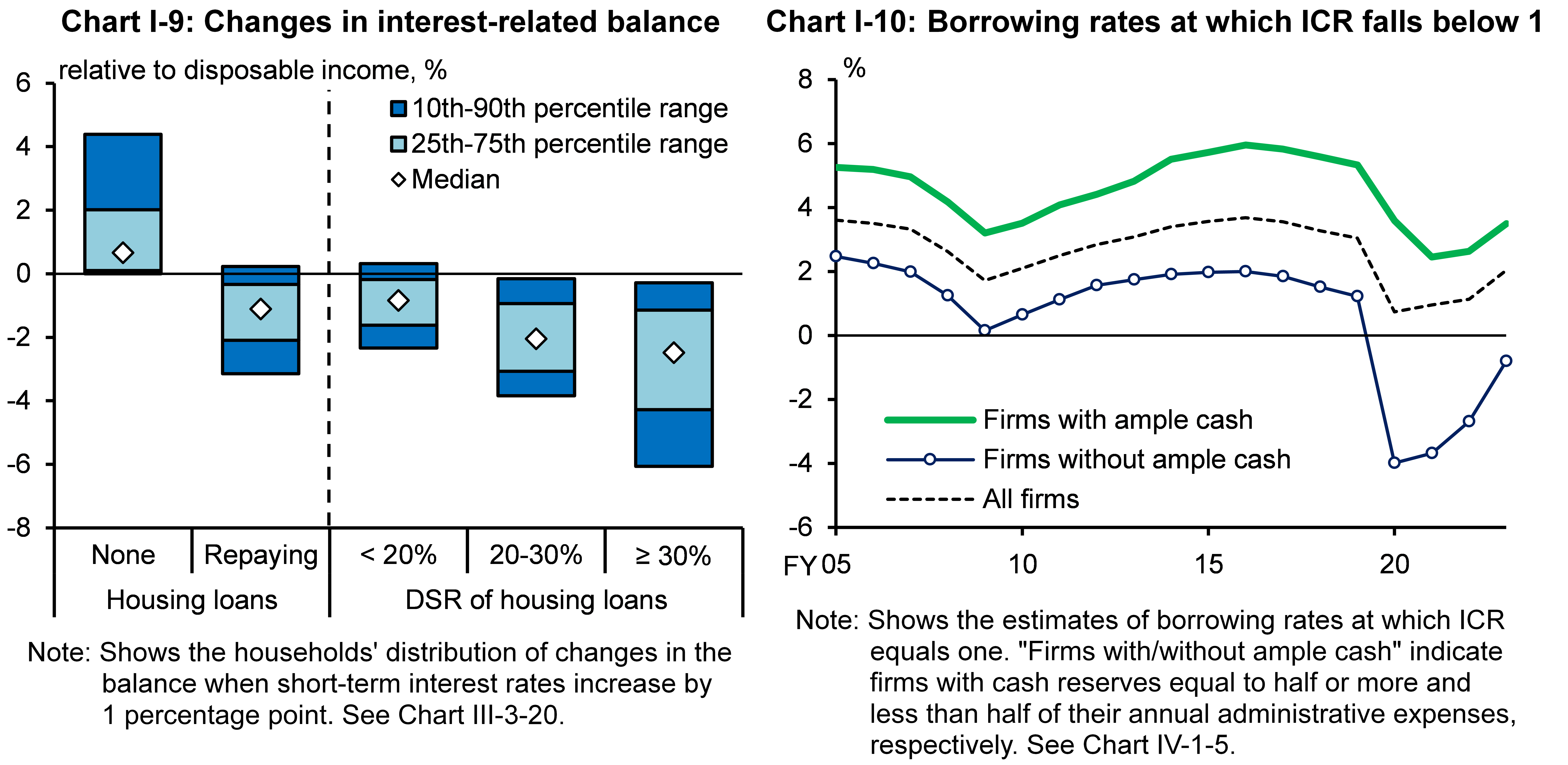

In the household sector, an improving economy and the resulting rise in interest rates can be expected to lead to an improvement in household income and in the interest-related balance on the whole. For borrowers of housing loans, the rules to prevent drastic changes in payments mean that the increase in principal and interest payments will be limited in the short term; the payment burden will be partially offset by the increase in interest income from deposits and other assets held by households (Chart I-9). In the corporate sector, firms' profits have been on an improving trend. Even with higher borrowing interest rates, many firms have sufficient profitability to withstand the interest payment burden (Chart I-10). That said, there is considerable heterogeneity in household and corporate finances. Among households with a high debt servicing ratio (DSR) -- the ratio of annual repayments to annual income -- and firms with low interest coverage ratios (ICRs), there are some that are less resilient to higher interest rates.

See Chapters III-C, IV-A, IV-B, and IV-C in the full text [PDF 1,999KB]

Other notable developments

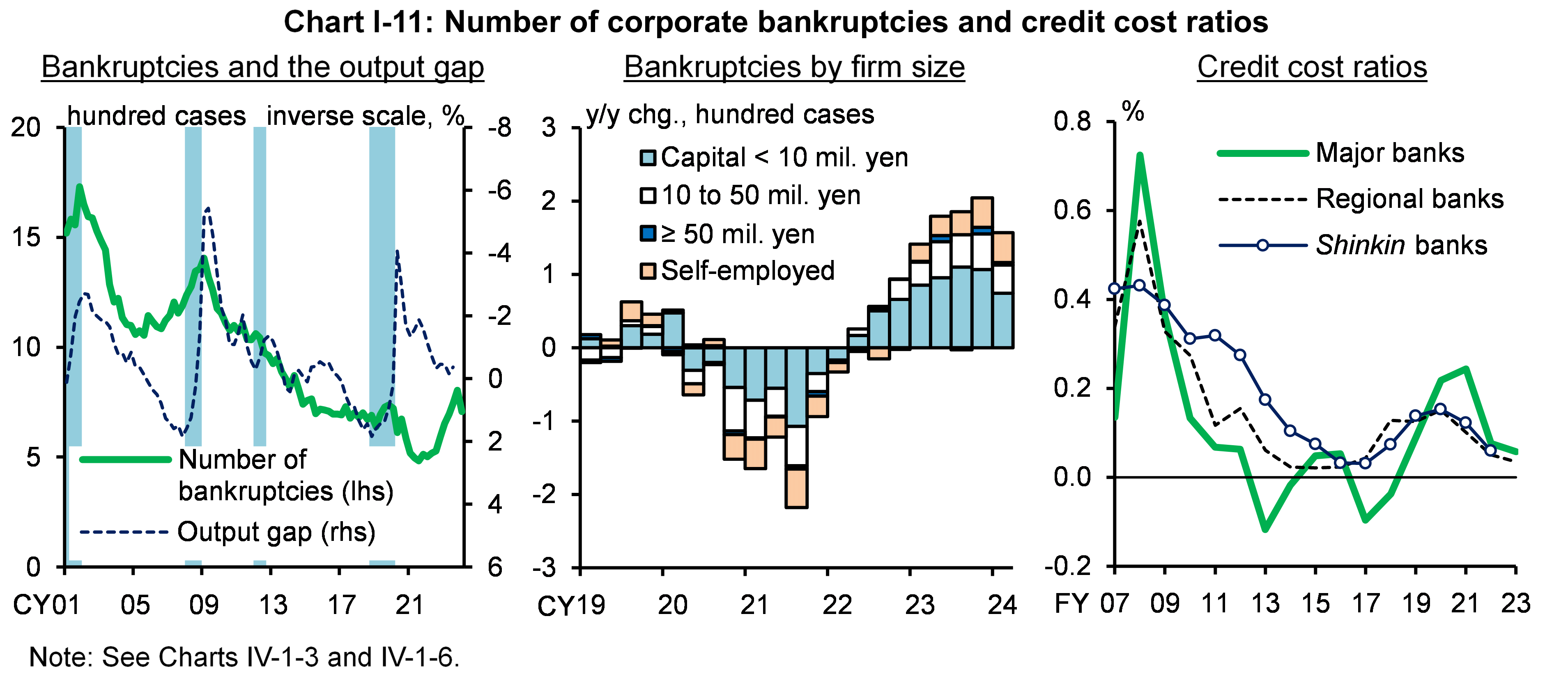

Corporate bankruptcies: The number of corporate bankruptcies and defaults has increased even though economic activity has been on a recovery trend (Chart I-11). With the labor market tightening, there have been bankruptcies resulting from labor shortages. Even in this situation, banks' credit costs have remained limited. This is partly because small-sized firms account for the overwhelming majority of recent bankruptcies and defaults. However, there have been some cases recently where banks have recorded large credit costs on "common exposures," i.e., loans to the same borrowers by multiple banks, such as so-called "cross-prefecture" lending. It is difficult for banks to obtain monitoring information on these borrower firms, and this is one reason why debt governance is unlikely to operate effectively. It is therefore essential for banks to minimize these information gaps.

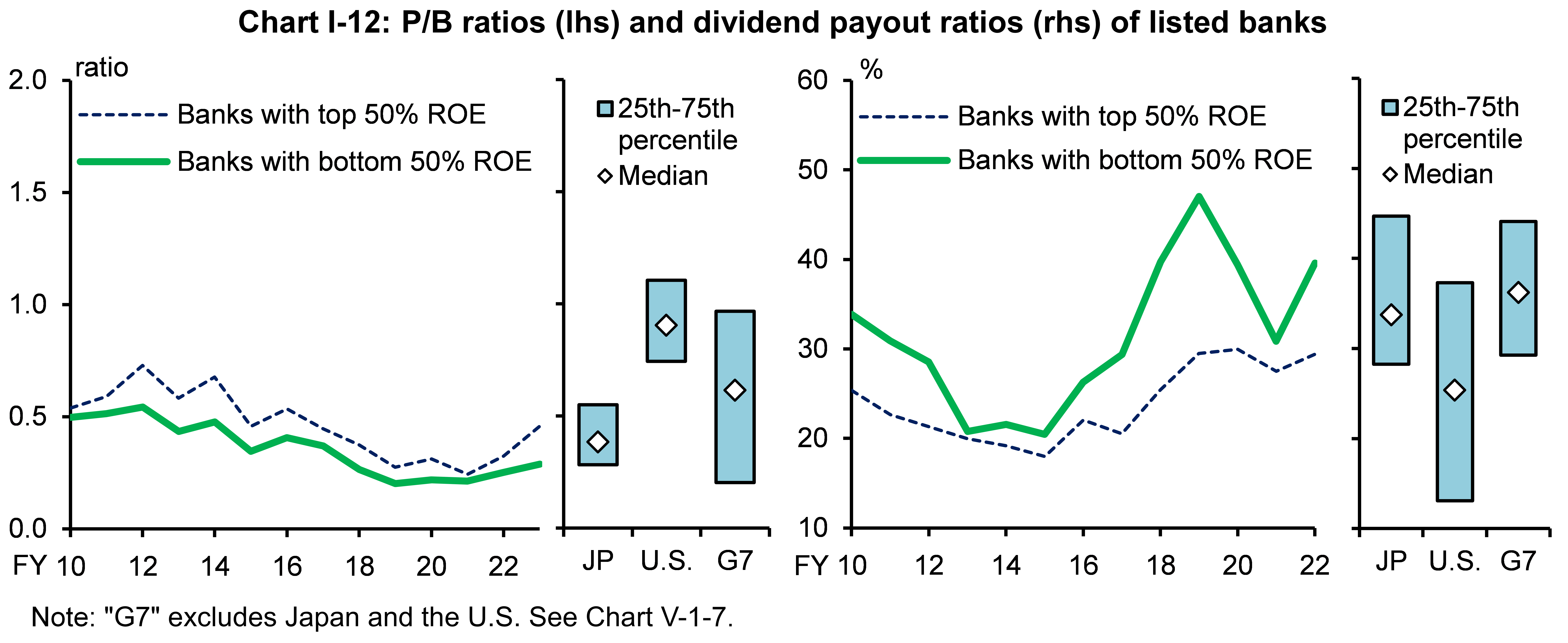

Stock prices: Stock prices have risen. The recent rise reflects market expectations for firms' solid business performance and corporate governance reforms. For banks, higher stock prices increase market risk associated with stockholdings, while they also improve room for realizing gains. Meanwhile, listed banks have been increasing dividends and raising their dividend payout ratios in an effort to improve their market valuation (Chart I-12). This tendency has also been observed among banks with low loss-absorbing capacity such as low profitability. The distribution of profits in banks' capital policies should be based on their capital bases and profitability.

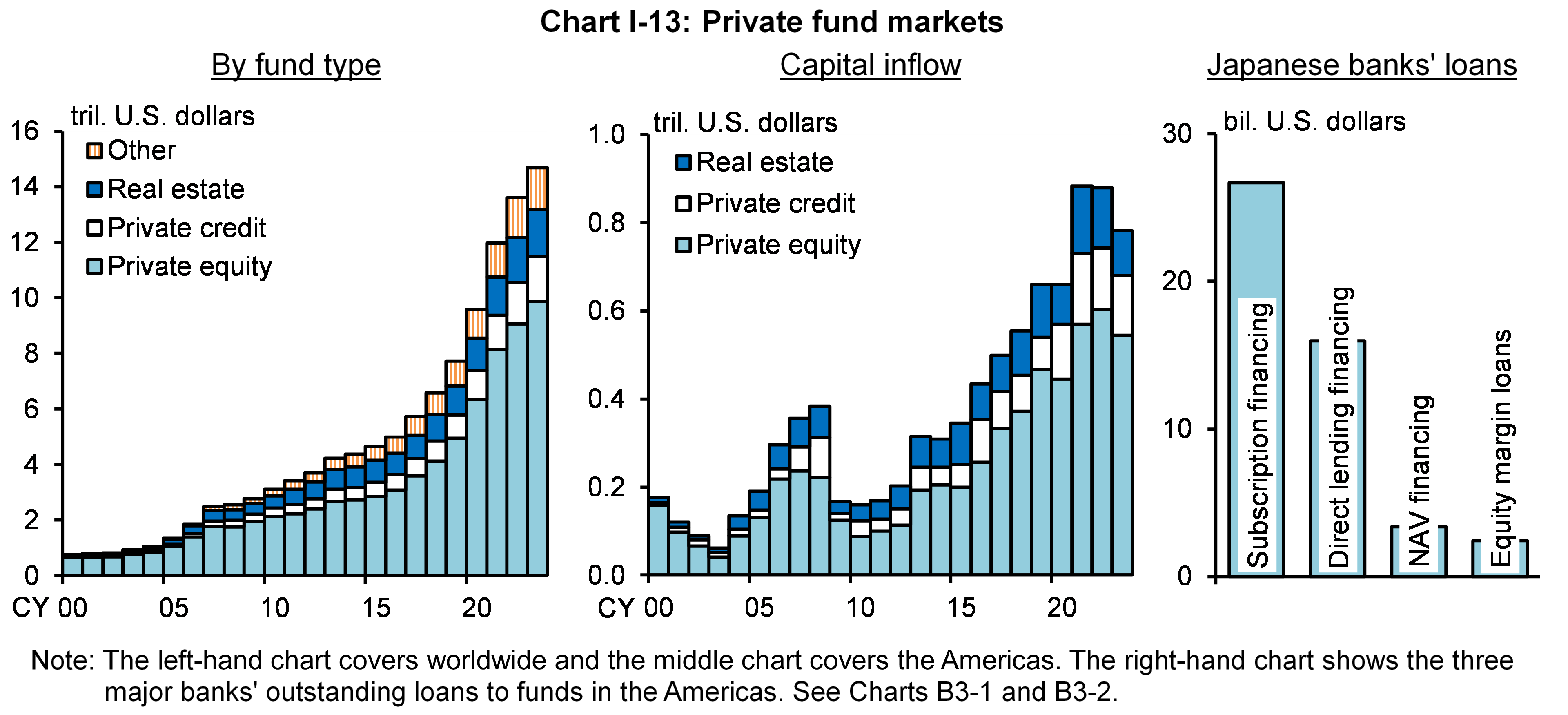

Foreign private funds: The foreign private fund market has been growing rapidly in recent years (Chart I-13). Private funds play the role of complementing and substituting for traditional financial intermediation based on investment capital from investors and funds borrowed from banks. Japanese banks also have exposures to private funds, although the size is small. In the private fund market, the growth pace has changed as the increase in the inflow of funds has peaked out. Moreover, the credit risks of private funds and banks that extend loans to them have been rising, as seen in the increase in the interest payment burden of firms in which these funds invest.

The Bank of Japan will promote financial institutions' initiatives to address these potential vulnerabilities through on-site examinations and off-site monitoring. 2 It will continue to closely monitor the impact of various risk-taking moves by financial institutions on the financial system from a macroprudential perspective.

- See the Report for more details on the analyses as well as notes and sources of the charts. Return to text

- The heat map in Chart I-1 shows that the stock prices indicator has turned "red," which signals an overheating. Stock prices have risen, reflecting expectations for firms' business performance and corporate governance reforms. So far, the impact of rising stock prices on the financial cycle has been limited; moreover, the uptrend in stock prices has been moderate compared to previous episodes when financial imbalances built up (see Section C of Chapter III). In addition, valuations of stock prices have remained at their past average. Return to text

- See On-Site Examination Policy for Fiscal 2024 (March 2024) for details on the basic approach in conducting on-site examinations in fiscal 2024. Return to text

Notice

This Report basically uses data available as of end-March 2024.

Please contact the Financial System and Bank Examination Department at the e-mail address below to request permission in advance when reproducing or copying the contents of this Report for commercial purposes.

Please credit the source when quoting, reproducing, or copying the contents of this Report for non-commercial purposes.

With regard to economic and financial variables of each stress scenario in the macro stress testing, please see the scenario tables [XLSX 44KB] .

Inquiries

Financial System Research Division, Financial System and Bank Examination Department

E-mail : post.bsd1@boj.or.jp