Highlights of the Outlook for Economic Activity and Prices (July 2023)

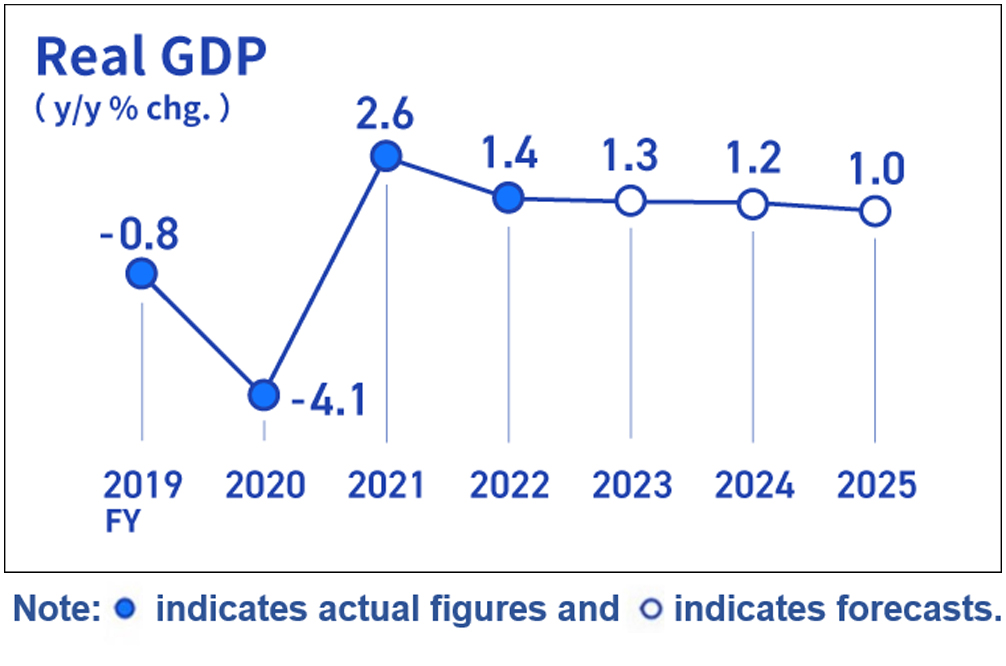

Japan's economy is likely to continue recovering moderately.

Japan's economy is likely to continue recovering moderately, supported by factors such as an increase in consumption, although it is expected to be pushed down by a slowdown in the pace of recovery in overseas economies.

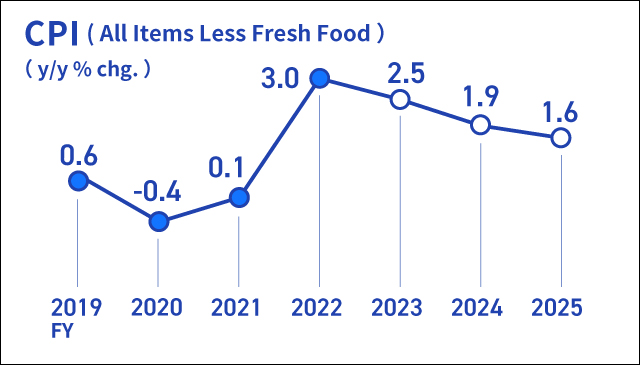

Inflation is likely to decelerate and then accelerate again moderately.

The year-on-year rate of increase in the CPI is likely to decelerate, with a waning of the effects of a pass-through to consumer prices of cost increases led by the past rise in import prices. Thereafter, the rate of increase is projected to accelerate again moderately on the back of economic improvement and a rise in wage growth.

There are high uncertainties for Japan's economic activity and prices.

There are extremely high uncertainties for Japan's economic activity and prices, including developments in overseas economic activity and prices, developments in commodity prices, and domestic firms' wage- and price-setting behavior. In addition, due attention is warranted on developments in financial and foreign exchange markets and their impact on Japan's economic activity and prices.

The Bank will continue with powerful monetary easing.

The Bank will patiently continue with monetary easing since sustainable and stable achievement of the price stability target of 2 percent, accompanied by wage increases, has not yet come in sight.

The Bank decided to conduct yield curve control with greater flexibility.

The Bank decided to enhance the sustainability of monetary easing under the current framework by conducting yield curve control with greater flexibility.

Policy Board Members' Forecasts

Outlook for Economic Activity and Prices

For further details, please see "The Bank's View" and the full text of the Outlook for Economic Activity and Prices (Outlook Report) on the following pages: