Financial System Report (October 2017)

October 23, 2017

Bank of Japan

Features of this Report

In this October 2017 issue of the Report, regarding the potential vulnerabilities of the financial system, structural factors underlying financial institutions' low profitability and intensified competition as well as their impact are analyzed with particular focus, in addition to a regular assessment of financial institutions' risk profile and financial bases and macro stress testing assuming a tail event. More specifically, through an international comparison of financial institutions' profits and business resources, the Report (1) shows that Japanese financial institutions have little non-interest income and depend on net interest income as a profit source; and (2) examines the possibility that the number of employees and branches is excessive relative to demand. Furthermore, we review how, through competition among financial institutions, a nationwide and persistent decline in population and the number of firms will affect the relationship between firms and financial institutions, and the systemic risk.

Executive summary

Developments in financial markets

In global financial markets, volatilities have remained at historically low levels amid the continued moderate growth of the global economy and solid corporate performance, despite concerns over geopolitical risks such as the situation in North Korea. No significant changes have been observed in global capital flows, including those of emerging markets, even as the Federal Reserve continued to raise its policy rate. While investors have maintained their risk-taking stance, stock prices have risen globally and credit spreads have also tended to narrow. Meanwhile, in Japan, the financial conditions have remained highly accommodative under the Bank of Japan's Quantitative and Qualitative Monetary Easing (QQE) with Yield Curve Control.

Examination of financial intermediation

Looking at financial institutions' loans, while the pace of growth in overseas loans has tended to slow against the backdrop of an increase in the cost of foreign currency funding, domestic loans outstanding have been growing at a moderately faster pace on a year-on-year basis, recently at around 3 percent. With financial institutions' active lending stances, demand for funds, especially by small firms, has been increasing. As for securities investment, financial institutions have maintained their stance of active risk taking, as some have restarted to increase their outstanding holdings of foreign bonds after reducing them somewhat, and the outstanding amount of their investment trusts has been on an upward trend. Institutional investors -- such as insurance companies and pension funds -- have continued to accumulate risky assets, particularly foreign bonds, amid the prolonged environment of low interest rates. Meanwhile, the issuance rates in the CP and corporate bond market have hovered at extremely low levels, and firms' debt financing has increased.

On the whole no imbalances in financial and economic activities can be observed while the funding conditions for the non-financial private sector have been highly accommodative. Against the background of financial institutions' active lending attitude and favorable issuing conditions for corporate bonds, total credit (measured as a ratio to GDP) has been increasing. In this environment, the corporate sector has been maintaining an active business fixed investment stance, supported by an expectation of improved corporate profits. The real estate market does not seem overheated on the whole, although transaction prices remain high in some places such as the Tokyo metropolitan area. In the commercial real estate market, it seems that the increase in real estate prices has been leveling off given the prospect of a supply increase in the future. In the real estate investment trust (REIT) market, there is no sign of further bullish expectations among investors. However, if stress arises in the global financial markets and a risk-off attitude spreads, this may possibly affect the domestic real estate market. Therefore, developments in the real estate market continue to warrant vigilance.

Stability of the financial system

No major imbalances have been observed in financial and economic activities, and financial institutions on the whole have generally strong resilience in terms of both capital and liquidity. Thus, it can be judged that Japan's financial system has been maintaining stability. Financial institutions have sufficient capital bases, which allow them to continue risk taking even if profitability faces downward pressure for the time being. Financial institutions' portfolio rebalancing through more active lending has been contributing to an improvement in economic developments, and if this leads to more proactive economic activities by firms and households, this in turn is likely to bring about a recovery in financial institutions' profitability. However, there is a possibility that financial imbalances will build up and financial system stability will be impaired, if financial institutions shift toward excessive risk taking in order to maintain profitability as deposit and lending margins continue on a narrowing trend. On the other hand, if there is an increase in the number of financial institutions whose loss-absorbing capacity declines due to the continued weakening of their profitability, the financial intermediation function could weaken, adversely affecting the real economy.

Potential vulnerabilities due to the decline in financial institutions' profitability

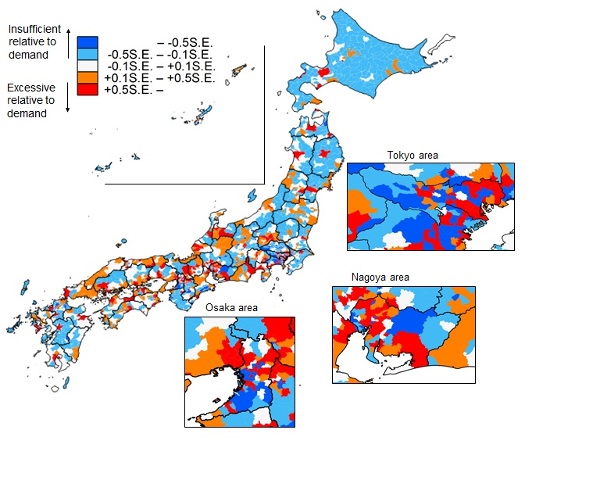

The decline in financial institutions' profits is a phenomenon that can be observed not only in Japan but commonly in advanced economies, where the low interest rate environment has prevailed. However, even in this situation, the low profitability of Japanese financial institutions is striking from an international perspective. The number of financial institutions' employees and the number of branches may be in excess (overcapacity) relative to demand. This structural factor in turn leads to a decline in financial institutions' profitability through the intensified competition among financial institutions in Japan. As the firm exit rate has exceeded the firm entry rate, and thus the number of firms has decreased across Japan, bank branches' efforts to look for new transaction opportunities and boost their corporate business have led to an increase in the number of financial institutions that each firm transacts with. For firms, this means that they have been able to obtain more favorable loan conditions by increasing the number of financial institutions that each of them transacts with. However, if it becomes common for firms to choose the financial institution offering the lowest loan interest rate among a number of financial institutions when taking out a loan, regardless of whether the financial institutions have any transaction history or capacity to support businesses, this may lower the efficiency of capital allocation by discouraging financial institutions' information production activities in the medium to long run.

Excess in the number of financial institutions' branches for each municipality

Challenges from a macroprudential perspective

The decline in population and the number of firms is a common shock occurring across Japan. In this situation, the intensification of competition among regional financial institutions would affect the systemic risk by increasing the effects of a common exposure, that is, by decreasing net interest income. In order to ensure both the efficiency and stability of Japan's financial system in the future, it is important for financial institutions to improve their profitability under the appropriate competitive environment. Specifically, it is important for financial institutions to (1) make efforts to strengthen their profitability by utilizing their core competence, that is, differentiating the financial intermediation services they offer and diversifying their profit sources through an increase in net non-interest income, (2) more closely manage their profitability and review the services they offer and the efficiency of their branch configuration taking into account, for example, the competitive pressure they face from other financial institutions, and (3) improve labor productivity through operational reforms and the appropriate allocation of equipment and employees. Moreover, another option to improve profitability could be through mergers, consolidations, and cooperation among financial institutions. The Bank of Japan will support such efforts of financial institutions through, for example, its off-site monitoring and on-site examinations and will continue to closely monitor, from a macroprudential perspective, the impact on the financial system of changes in the competitive environment.

Notice

This Report basically uses data available as at September 30, 2017.

Please contact the Financial System and Bank Examination Department at the e-mail address below to request permission in advance when reproducing or copying the contents of this Report for commercial purposes.

Please credit the source when quoting, reproducing, or copying the contents of this Report for non-commercial purposes.

For details of the stress scenario in the macro stress testing, please see the scenario table [XLSX 27KB].

Inquiries

Financial System Research Division, Financial System and Bank Examination Department

E-mail : post.bsd1@boj.or.jp