Financial System Report (October 2024)

October 24, 2024

Bank of Japan

Motivations behind the October 2024 issue

Since summer 2024, domestic and foreign financial markets have shown unstable developments, and there remain concerns over the possibility that geopolitical risks could generate large fluctuations in the real economy and financial markets. In Japan, some real estate indicators warrant attention with real estate-related loans continuing to increase.

While Japan's economy has recovered moderately, defaults have been increasing especially among firms whose profits have been improving only at a slow pace. This Report attempts to analyze the reasons behind the recent rise in default rates by focusing on vulnerabilities present since before the pandemic and the impact of rising raw material and labor costs.

After changing its monetary policy framework in March 2024, the Bank raised the policy interest rate in July. Against this background, banks have been setting loan and deposit interest rates, taking into account changes in market interest rates. This Report provides updates on the impact of changes in the interest rate environment on banks, households, and firms, based on certain assumptions.

On this basis, the Report assesses the resilience of and potential vulnerabilities in Japan's financial system.

Executive summary: Stability assessment of Japan's financial system*

Japan's financial system has been maintaining stability on the whole.

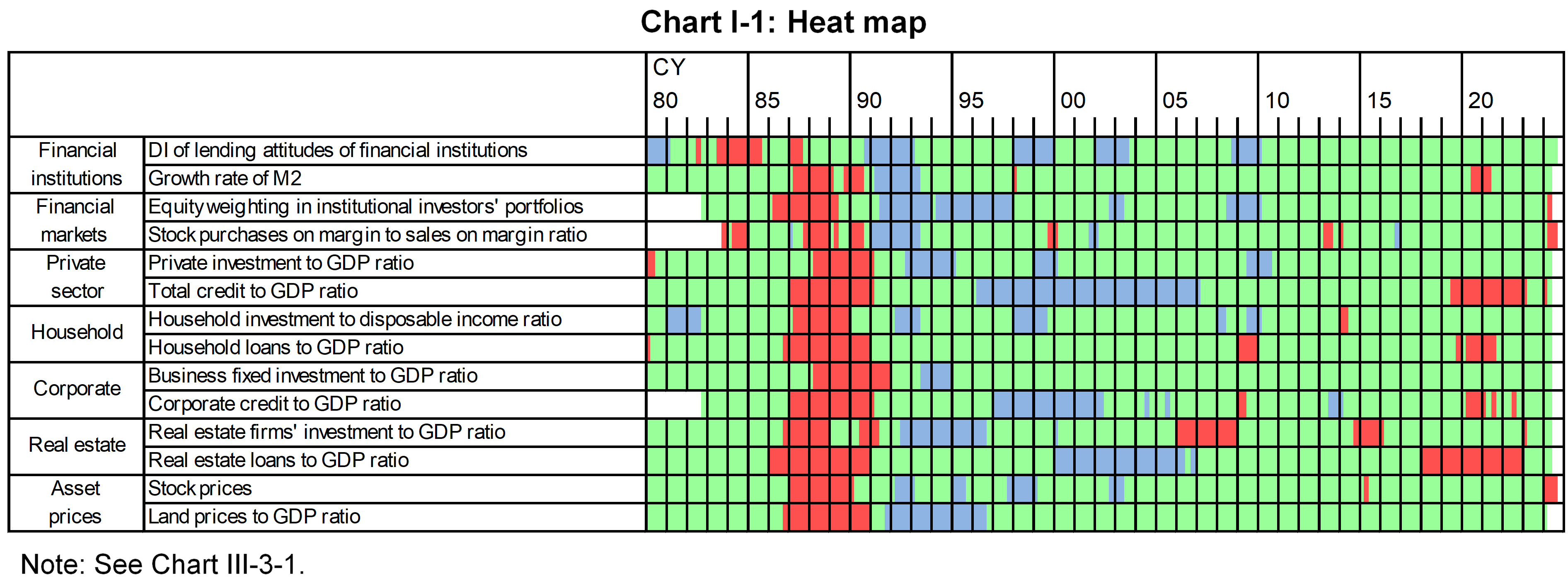

Financial intermediation has continued to function smoothly. In the loan market, despite the increase in lending rates, firms' demand for loans has risen. Banks' lending stance has also remained active. No major financial imbalances can be observed in these financial intermediation activities (Chart I-1).

Japanese banks have sufficient capital bases and stable funding bases to withstand stress similar to the global financial crisis that causes a major correction in financial markets and the real economy at home and abroad and stress in which rises in interest rates and a slowdown in the real economy on a global basis occur at the same time. However, vigilance against tail risks, including developments in global financial markets and geopolitical risks, continues to be warranted. From a long-term perspective, if the structural decline in firms' loan demand reflecting the shrinking population and other factors continues, depending on the supply and demand balance in the loan market, banks' profitability and loss-absorbing capacity could decline, and this could lead to a contraction of financial intermediation activities or an overheating, such as excessive search for yield. With these in mind, this Report examines risks regarding Japan's financial system and its vulnerabilities.

Developments in asset prices

In the stock market, stock prices, stock purchases on margin to sales on margin ratio, and equity weighting in institutional investors' portfolios in the heat map are "red," which signals an upward deviation from the trend (Chart I-1). There were fluctuations in asset prices globally at the beginning of August, mainly due to the effects of an unwinding of investors' positions triggered by concerns over the economic slowdown in the United States. However, price-earnings (P/E) ratios have remained at their historical average and in terms of stock valuations there is no significant overheating. That said, considering that Japanese banks have a certain amount of market risk associated with stockholdings, developments in asset prices warrant attention.

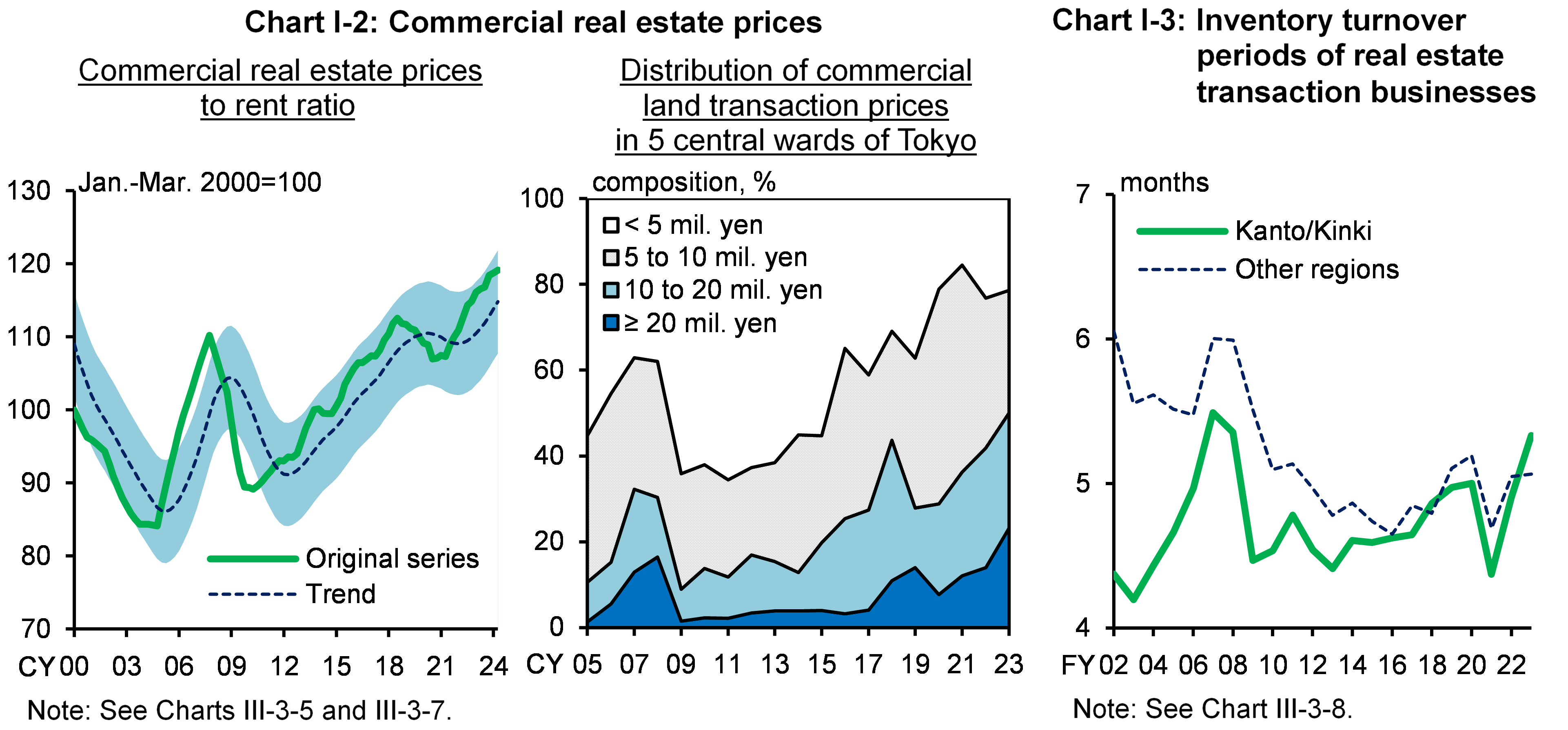

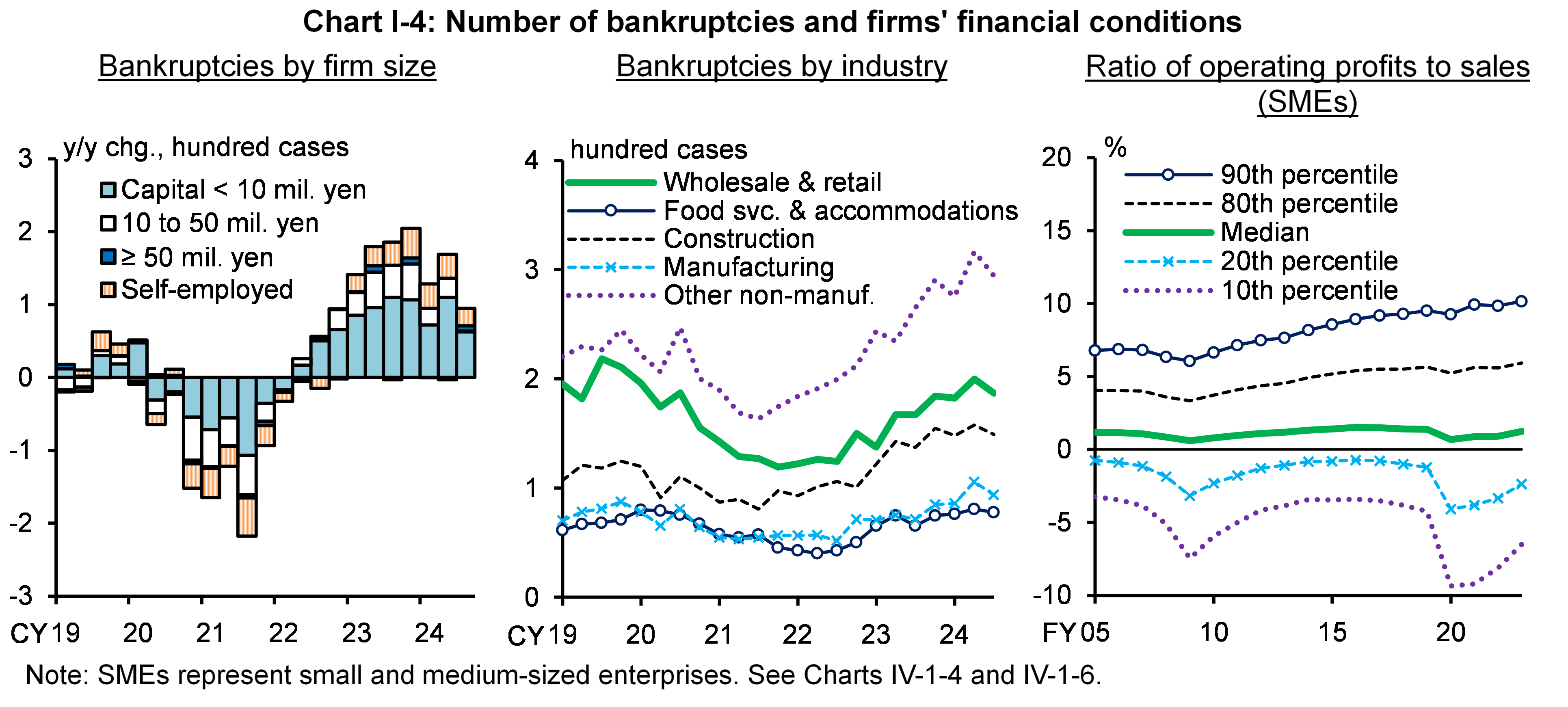

In addition, in Japan's real estate market, valuations of some properties seem relatively high as loans to real estate businesses have remained on an increasing trend. The commercial real estate prices to rent ratio has been above the level seen in the mini-bubble period and transactions in some limited commercial areas in central Tokyo have been at higher price ranges (Chart I-2). Inventories relative to sales have been elevated in some real estate transaction businesses (Chart I-3). Vacancy rates for office buildings in central Tokyo have recently begun to decline, real estate businesses' financial conditions have continued to improve in tandem with economic recovery, and default rates have been at low levels. However, attention is warranted to the fact that leverage ratios in the real estate sector are higher and businesses in the sector are more sensitive to interest rate changes than those in other sectors. In addition, given that foreign funds have continued to sell investment properties in Japan as part of their portfolio rebalancing, it is necessary to pay even more attention to the outlook for the real estate market.

Corporate bankruptcies and defaults amid economic improvement

Looking at banks' credit risks, the quality of banks' loan portfolios has been maintained overall as many firms' financial conditions have continued to show improvement amid the continued moderate recovery in Japan's economy. In addition, banks' credit cost ratios have remained low. However, there is considerable heterogeneity in firms' financial conditions, given that some firms' profits have been improving only at a slow pace due in part to the rise in raw material and labor costs, and the number of corporate bankruptcies and the default rate have exceeded the figures marked before the pandemic (Chart I-4).

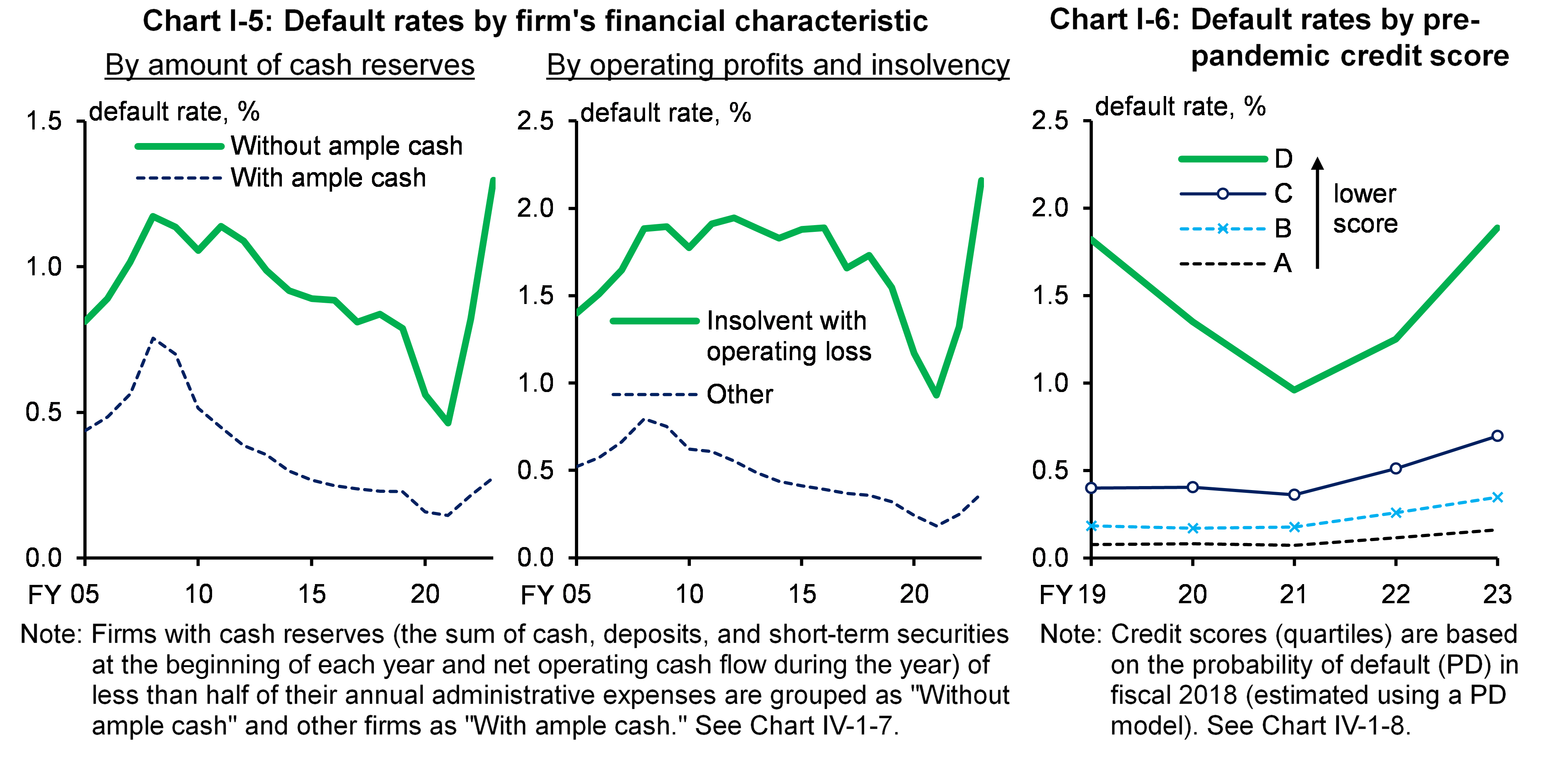

Looking in detail at the financial conditions of firms that defaulted, the default rate of firms that are financially vulnerable has been rising most recently -- i.e., firms with relatively little cash reserves and those that are both making operating losses and are insolvent (Chart I-5). After a temporary decline in the default rate of these firms, due in part to the various measures to support corporate financing since the pandemic, the default rate has risen again, suggesting the possibility that past vulnerability has materialized with a time lag. In fact, classifying defaulted firms into different groups by credit scores (with equal weight), based on their financial conditions before the pandemic, suggests that a considerable number of firms that defaulted in fiscal 2023 were already vulnerable before the pandemic (Chart I-6). However, the default rate of firms that were not vulnerable before the pandemic has also been rising slightly, and this might be due to the effects of shocks, including rises in costs that occurred since the pandemic.

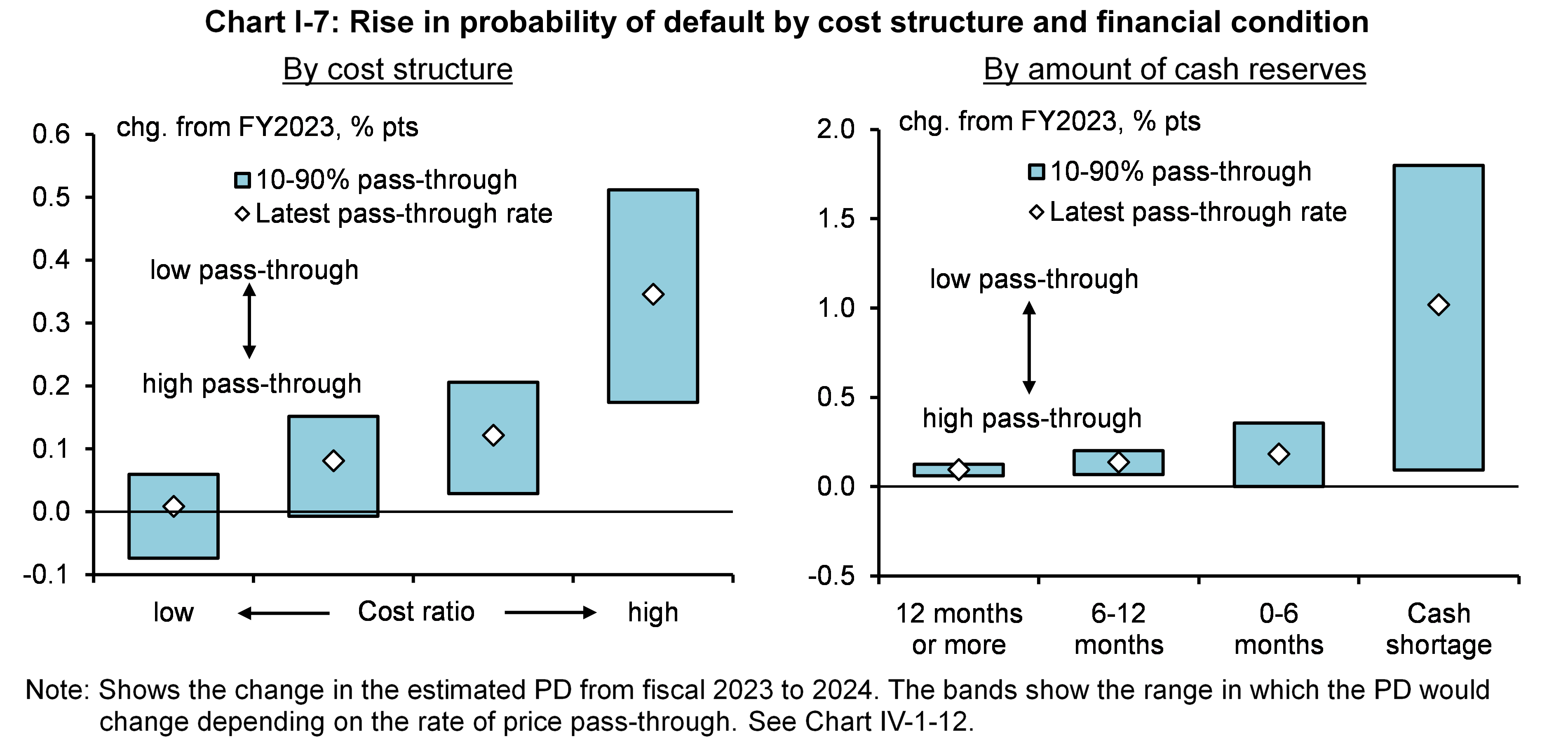

Estimating the impact of the recent upward pressure of costs on the probability of default shows that, in the event of a rise in costs, the probability of default increases nonlinearly for firms with larger variable and labor costs relative to their sales and for firms without ample cash reserves. It should be noted, however, that considerable variations in the probability of default could emerge depending on the size of the price pass-through rate (Chart I-7).

The effects of a rise in market interest rates on loan and deposit interest rates

The Bank of Japan changed its monetary policy framework in March 2024, and raised the policy interest rate in July. The uncollateralized overnight call rate was in the range of 0 to 0.1 percent from March, and rose after the policy rate hike in July, staying at around 0.25 percent. Given that banks take into account changes in market interest rates when setting loan and deposit interest rates, these developments in interest rates will continue to affect various economic entities.

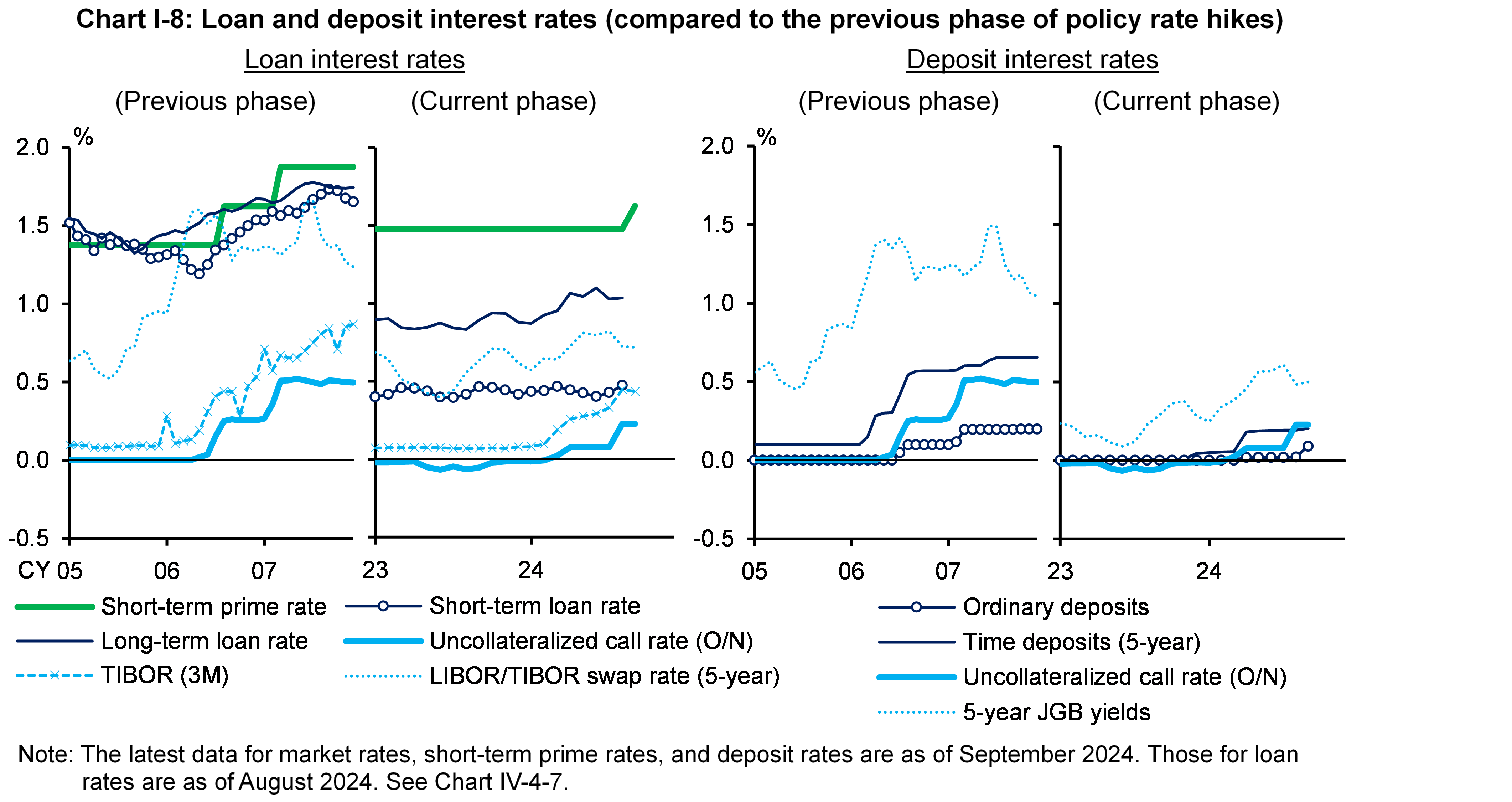

Looking at developments in loan interest rates since the previous Report, banks' average contract interest rates on new long-term loans and discounts have been rising moderately, given that a rise in market interest rates in the medium-term zone, which are the main base rates for these loans, preceded the change in policy interest rates (left panel of Chart I-8). Although short-term loan interest rates have been more or less unchanged so far, it is necessary to confirm the effect on loan interest rates of September's rise in short-term prime rates.

With regard to deposit interest rates, while interest rates on time deposits were raised before ordinary deposits, interest rates on ordinary deposits have risen to around 0.1 percent recently (right panel of Chart I-8). As was the case in the previous phase of policy rate hikes in 2006-2007, the increase in deposit interest rates is somewhat modest compared with the increase in the policy interest rate.

Banks', firms', and households' resilience to rising interest rates

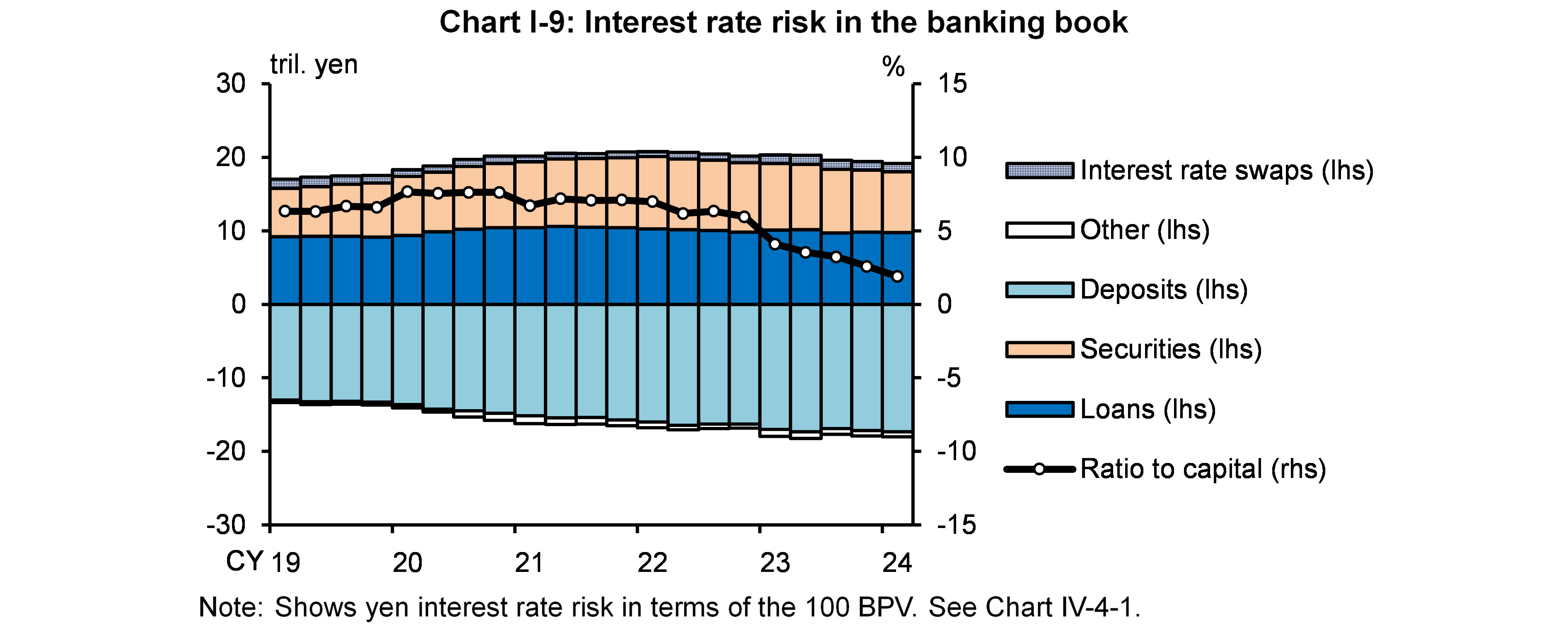

Banks have been rebalancing their securities portfolios, and the duration of their yen-denominated bondholdings has been getting shorter. Reflecting this rebalancing, banks' resilience to rising yen interest rates has been increasing (Chart I-9).

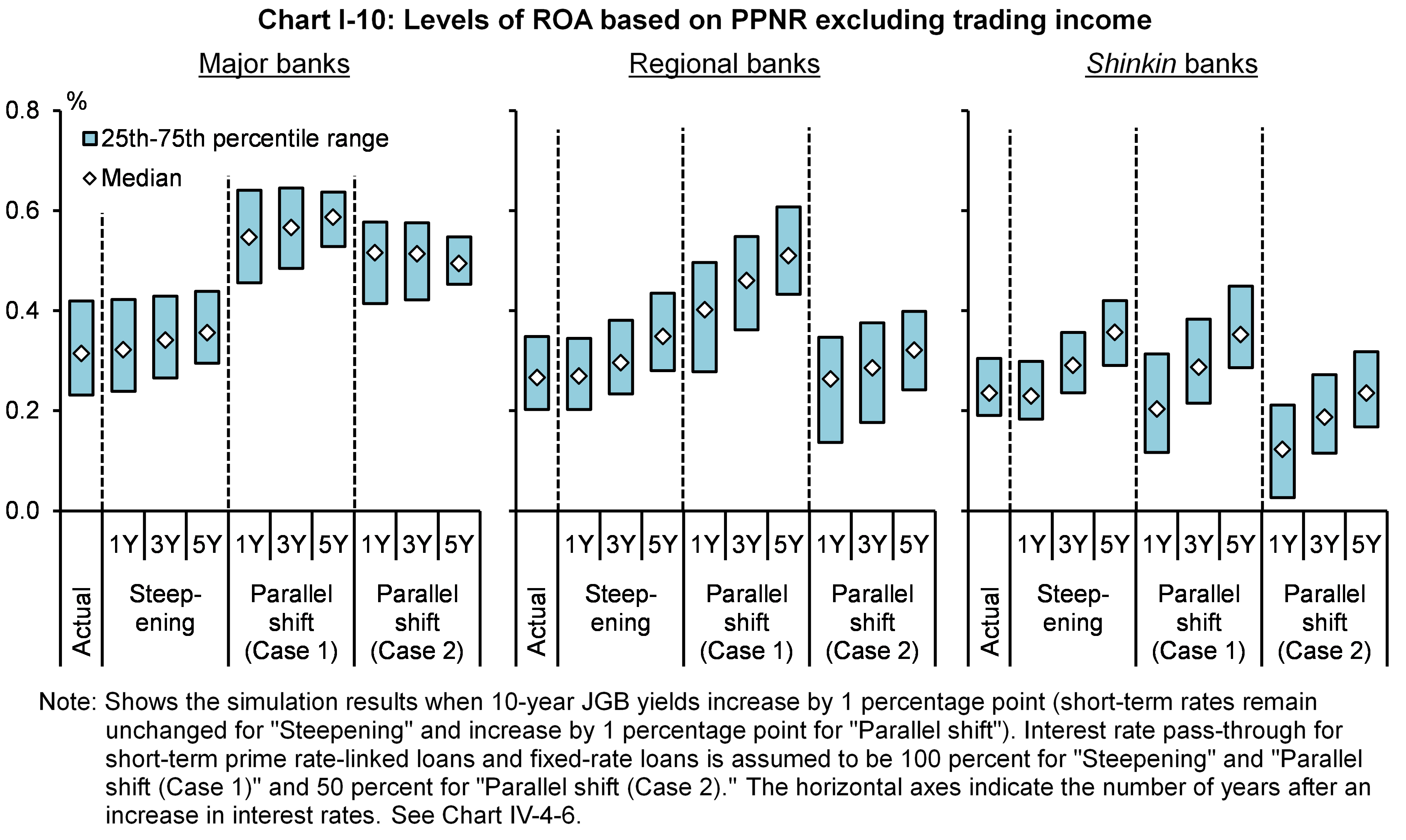

Rising yen interest rates are likely to improve banks' interest income balances overall from a somewhat longer-term perspective, including through changes in loan and deposit rates. However, there is some uncertainty regarding the impact on banks' profits, since the pass-through of interest rate rises to loan and deposit rates depends on the supply and demand balance and the competitive environment in the loan and deposit markets, on banks' capacity to provide financial services, and on banks' relationships with customers. When estimating the change in banks' pre-provision net revenue (PPNR) excluding trading income in response to rising yen interest rates, with some assumptions on the shape of the yield curve and interest rate pass-through to loan interest rates, there are cases where, depending on the scenario, banks' profits are suppressed downward temporarily, particularly among banks that have a large amount of fixed-rate loans and securities with a long maturity; however, PPNR excluding trading income is likely to increase subsequently for all types of banks (Chart I-10).

With regard to households' resilience to rising interest rates, in recent years, the number of households with housing loans has been increasing among younger age groups, for which debt servicing ratio (DSR) -- the ratio of annual repayments to annual income -- is generally high. That said, rules to prevent drastic changes in payments for housing loans, such as the "5-year rule" and the "125 percent rule," act to curb short-term increases in the repayment burden. In the somewhat longer run, the increase in the repayment burden will also be gradually mitigated as the economy continues to recover moderately and wages continue to increase.

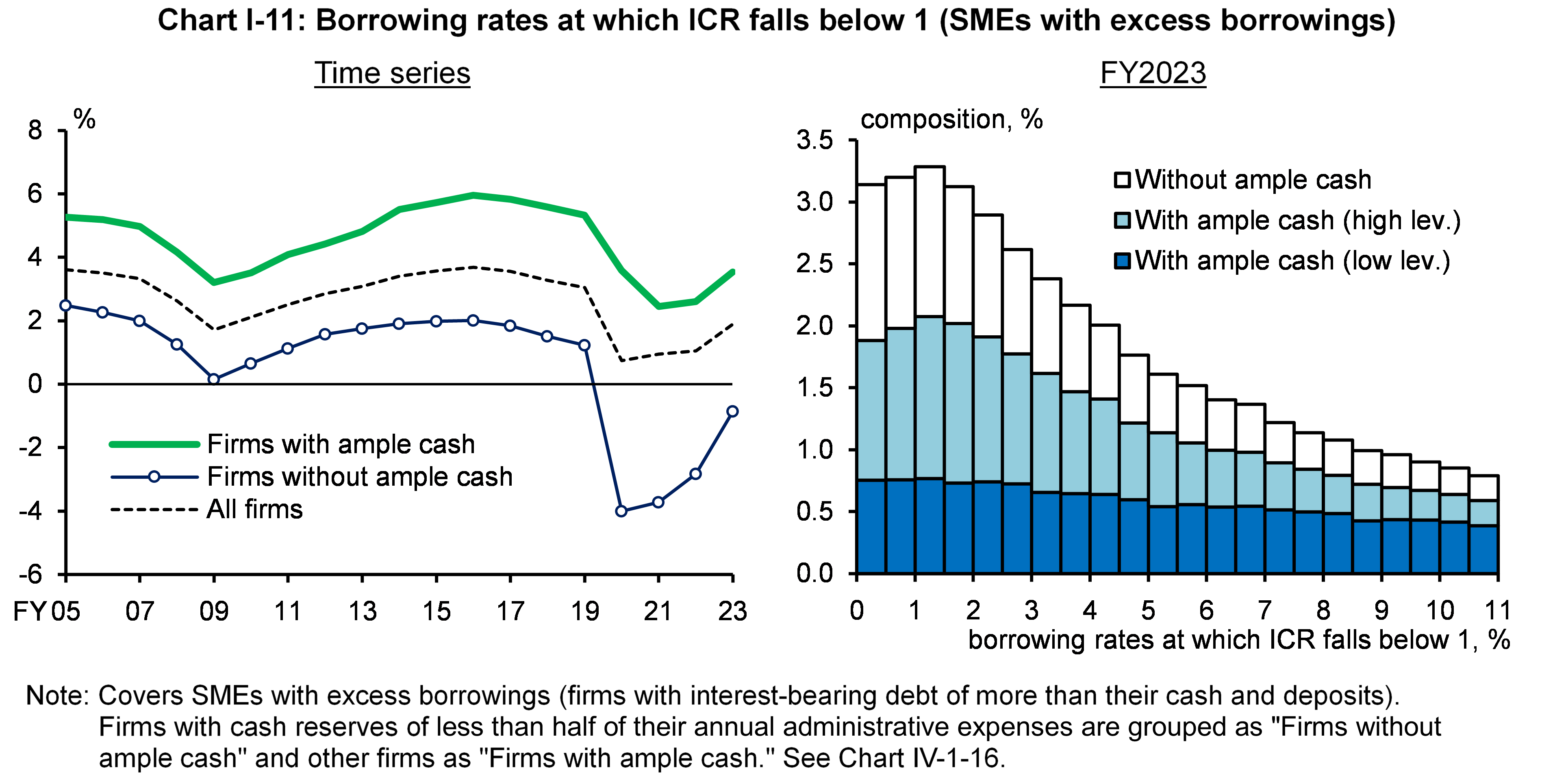

As for firms' resilience to rising interest rates, the level of borrowing rates at which the interest coverage ratio (ICR) -- representing a firm's interest payment capacity -- falls below one has risen for firms on the whole, reflecting the recent recovery in profits; firms with ample cash are sufficiently profitable to withstand the burden of interest payments even at considerably high interest rates (Chart I-11). On the other hand, among the limited number of firms whose ICR falls below one with a borrowing rate near the current level, there are firms that are vulnerable to the burden of interest payments, such as those without ample cash or those with high leverage ratios despite having ample cash.

The Bank will promote financial institutions' initiatives to address these potential vulnerabilities through on-site examinations and off-site monitoring. It will continue to closely monitor the impact of various risk-taking moves by financial institutions on the financial system from a macroprudential perspective.

- See the Report for more details on the analyses as well as notes and sources of the charts.

Notice

This Report basically uses data available as of end-September 2024.

Please contact the Financial System and Bank Examination Department at the e-mail address below to request permission in advance when reproducing or copying the contents of this Report for commercial purposes.

Please credit the source when quoting, reproducing, or copying the contents of this Report for non-commercial purposes.

With regard to economic and financial variables of each stress scenario in the macro stress testing, please see the scenario tables [XLSX 40KB] .

Inquiries

Financial System Research Division,

Financial System and Bank Examination Department

E-mail : post.bsd1@boj.or.jp