Financial System Report (April 2025)

April 23, 2025

Bank of Japan

Motivations behind the April 2025 issue

Banks have been setting loan and deposit interest rates, taking into account changes in market interest rates that reflect the Bank of Japan's decisions to raise the policy interest rate and changes in market projections of interest rates. This Report provides updates on the impact of changes in the interest rate environment on banks, households, and firms. In addition, this Report examines developments in default rates of borrower firms, given that while Japan's economy has recovered moderately, default rates have been higher than before the pandemic, especially among firms whose profits have been improving only at a slow pace. Furthermore, with the increase of banks' real estate-related loans continuing, this Report analyzes the background to the rise in real estate prices.

Uncertainty has heightened in global financial markets regarding the formulation of trade and other economic policies in each jurisdiction. In addition, it has been pointed out in recent years that portfolio adjustments in the foreign non-bank financial intermediary (NBFI) sector, primarily investment funds that have been increasing their presence in domestic and foreign financial markets, are becoming more likely to contribute to the amplification of fluctuations in asset prices in Japan. This Report examines the implications of stress caused by global factors and its effects in terms of Japan's financial stability, including an analysis of the characteristics of the financial activities of the foreign NBFI sector.

Executive summary: Stability assessment of Japan's financial system*

Japan's financial system has been maintaining stability on the whole.

In the loan market, financial intermediation has continued to function smoothly as firms' demand for loans has continued to rise and banks' lending stance has remained active. Under such circumstances, no major financial imbalances have been seen in current financial activities.

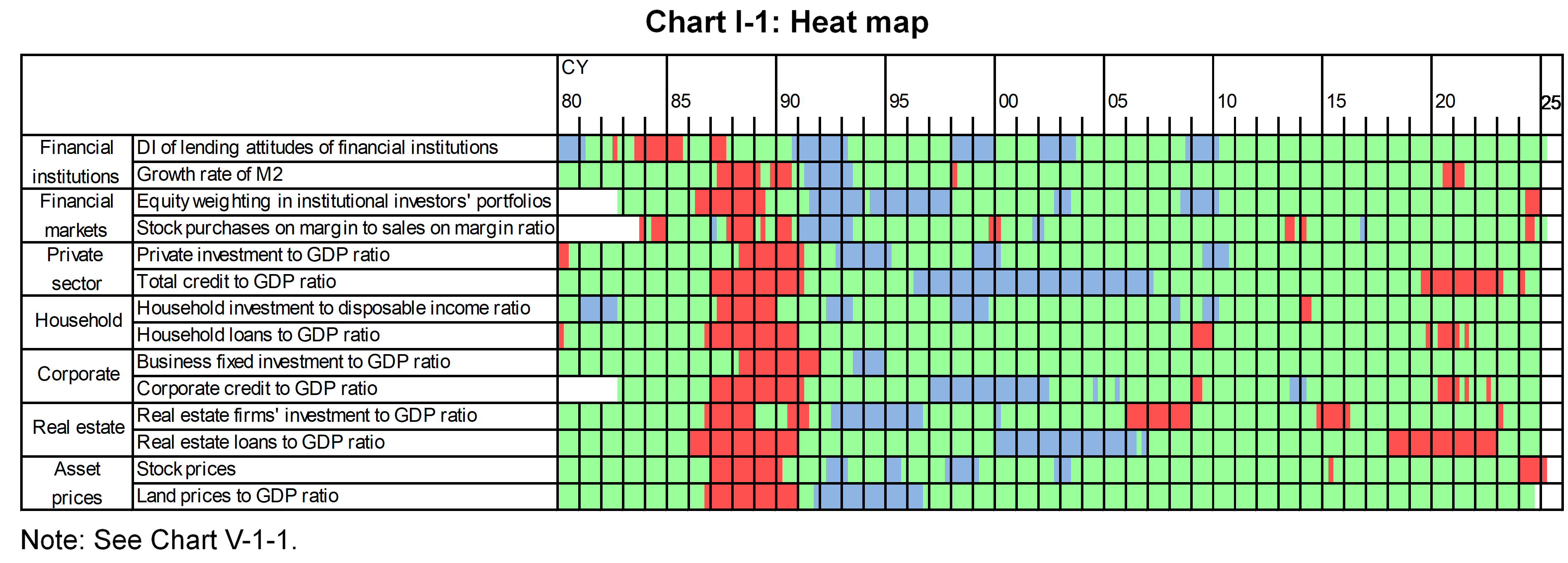

Japanese banks have sufficient capital bases and stable funding bases to withstand stress similar to the global financial crisis that causes a major correction in financial markets and the real economy at home and abroad and other stress events such as one where the materialization of geopolitical risks and other factors triggers a global surge in prices, and foreign interest rates rise further. However, since the beginning of April, financial markets at home and abroad have fluctuated significantly, while uncertainty has heightened regarding the formulation of trade and other economic policies in each jurisdiction, geopolitical risks, and developments in global financial markets. Financial institutions need to be vigilant against the materialization of various risks. From a long-term perspective, if the structural decline in firms' loan demand reflecting the shrinking population and other factors continues, depending on the supply and demand balance in the loan market, banks' profitability and loss-absorbing capacity could decline, and this could lead to a contraction of financial intermediation activities or an overheating, such as excessive search for yield. From the perspective of maintaining stability in Japan's financial system, close attention is warranted on future developments in the financial system, while examining both overheating and contraction risks (Chart I-1).

Developments in asset prices

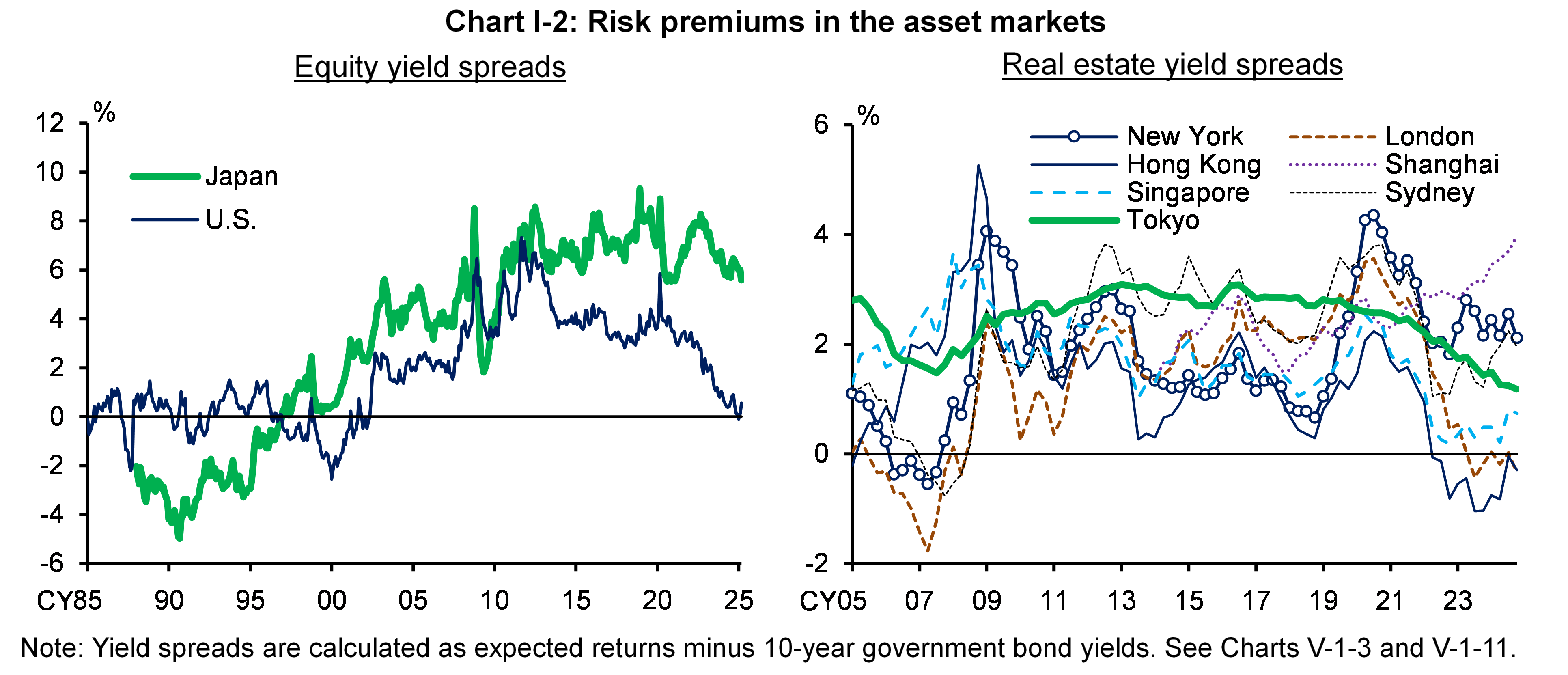

The heat map as of the end of March shows that stock prices and equity weighting in institutional investors' portfolios have been "red," which signals an upward deviation from the trend, since 2024 (Chart I-1). Price-earnings (P/E) ratios remained at their historical average and equity risk premiums in terms of yield spreads have generally been flat and there is no sign of significant overheating in terms of stock valuations (left panel of Chart I-2). Since early April, stock prices have been fluctuating substantially as uncertainty has been heightening regarding, for example, the effect on global economic and financial conditions of the trade policy in each jurisdiction. Considering that Japanese banks have a certain amount of market risk associated with stockholdings, developments in asset prices warrant attention.

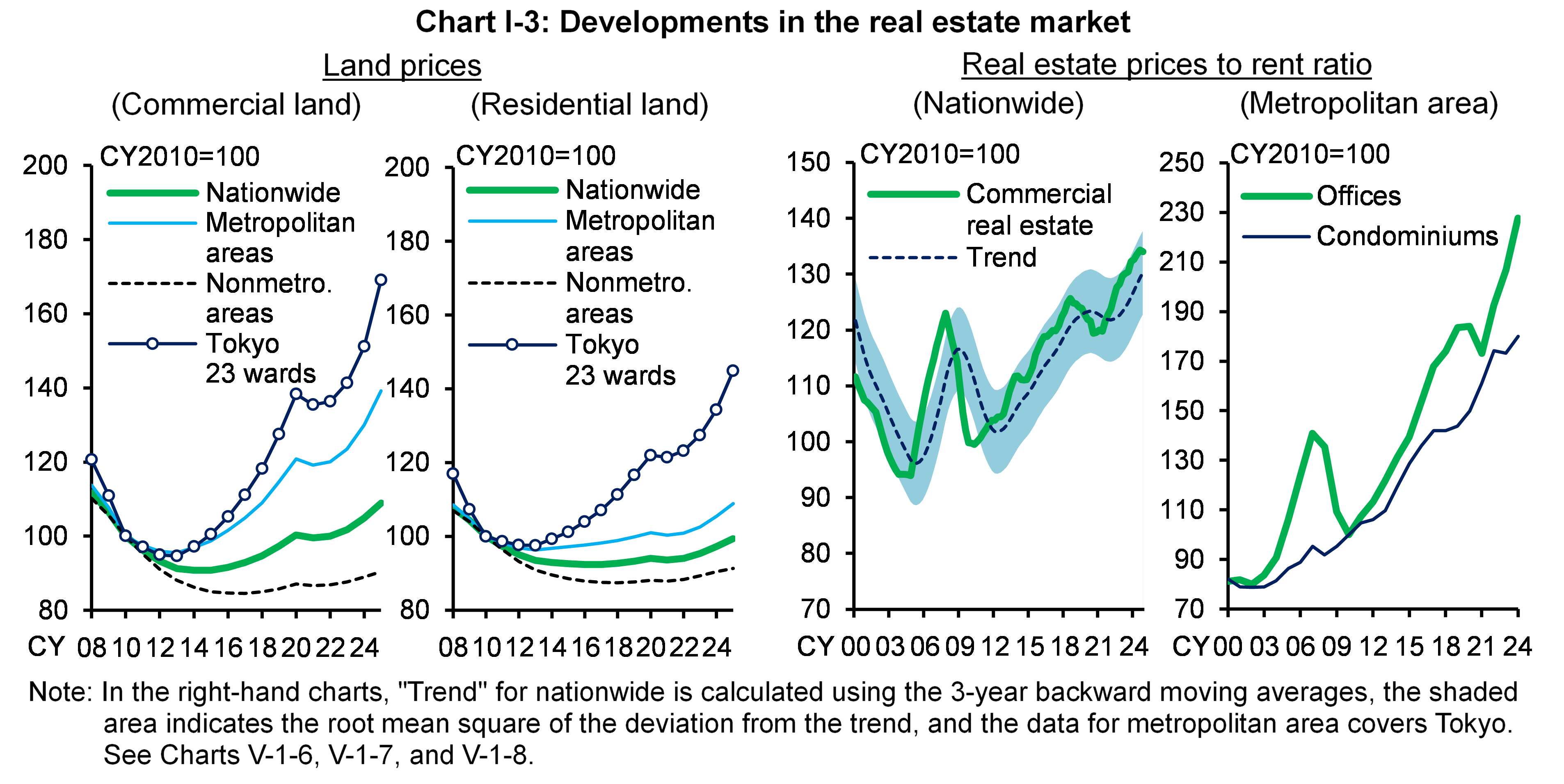

Real estate prices have been rising, particularly in major metropolitan areas (Chart I-3). Rises in property prices are led by robust property demand with the economy recovering moderately and by supply factors due to the effects of the surge in material costs and labor shortages. In addition, increases in large-scale land transactions for asset-holding and resale purposes, increases in transactions of condominiums for investment, and a recovery in acquisitions of commercial real estate by foreign investors seem to have contributed to a rise in real estate prices. Under these circumstances, the commercial real estate prices to rent ratio has continued to rise and expected returns and risk premiums on real estate investment have been declining (right panel of Chart I-2). Given that banks' real estate-related exposures have been on an uptrend, developments in real estate prices continue to warrant attention.

Corporate bankruptcies and defaults

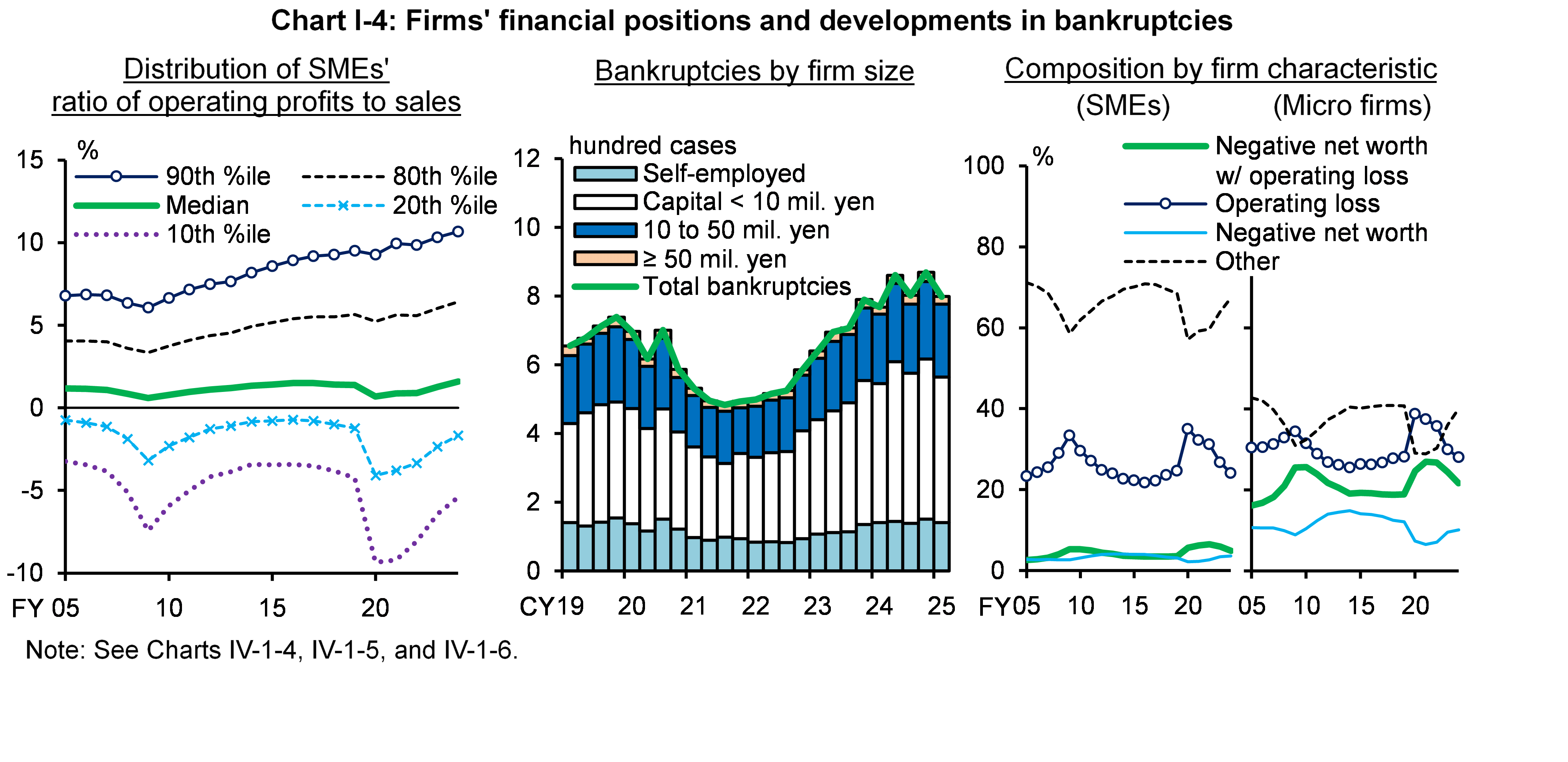

Amid the continuing moderate economic recovery, corporate profits in Japan have been improving on the whole (left panel of Chart I-4). However, compared to large firms, the pace of increase in corporate profits of small and medium-sized enterprises (SMEs) has been slow. In addition, although SMEs' ratio of operating profits to sales has been improving overall, its distribution shows that the skew of the distribution to the downside seen since the pandemic has remained. Against this background, the importance of business improvement support activities for firms by banks is growing.

There has recently been a slowdown in the rise in bankruptcies and defaults (middle panel of Chart I-4). Looking in detail at the financial characteristics of SMEs and micro firms that defaulted, more than half of those firms are making operating losses with negative net worth or are making operating losses; however, the share of financially vulnerable firms has recently been declining, approaching the pre-pandemic level (right panel of Chart I-4). However, it is necessary to pay attention to heightened uncertainty regarding trade policy in each jurisdiction and geopolitical risks. Depending on future developments, global financial and economic activity could be affected significantly, leading to a deterioration in firms' financial positions. Banks need to closely monitor the effect of these potential stresses.

The domestic and foreign non-bank financial intermediary (NBFI) sector's growing presence in Japan and banks' exposure to the NBFI sector

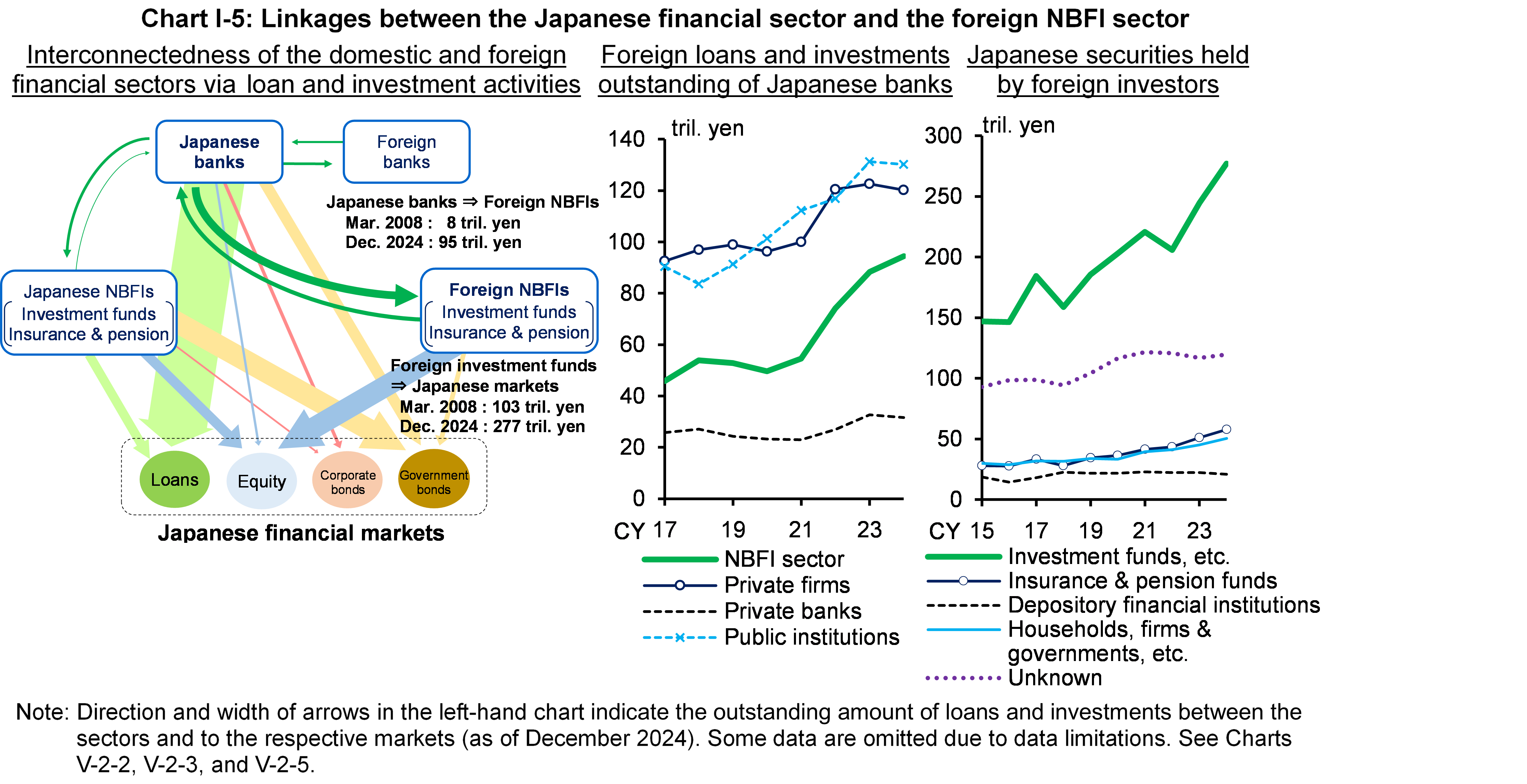

In Japan, where depository financial institutions are dominant in financial intermediation, the share of financial assets held by the domestic NBFI sector has been at about 30 percent, lower than the case in foreign jurisdictions. However, given the increasing trend in banks' exposure to the foreign NBFI sector with a focus on the investment fund sector, and in investments in Japanese stocks and bonds by foreign NBFIs, primarily investment funds, the links between (1) Japanese banks and financial markets and (2) the foreign NBFI sector have strengthened (Chart I-5).

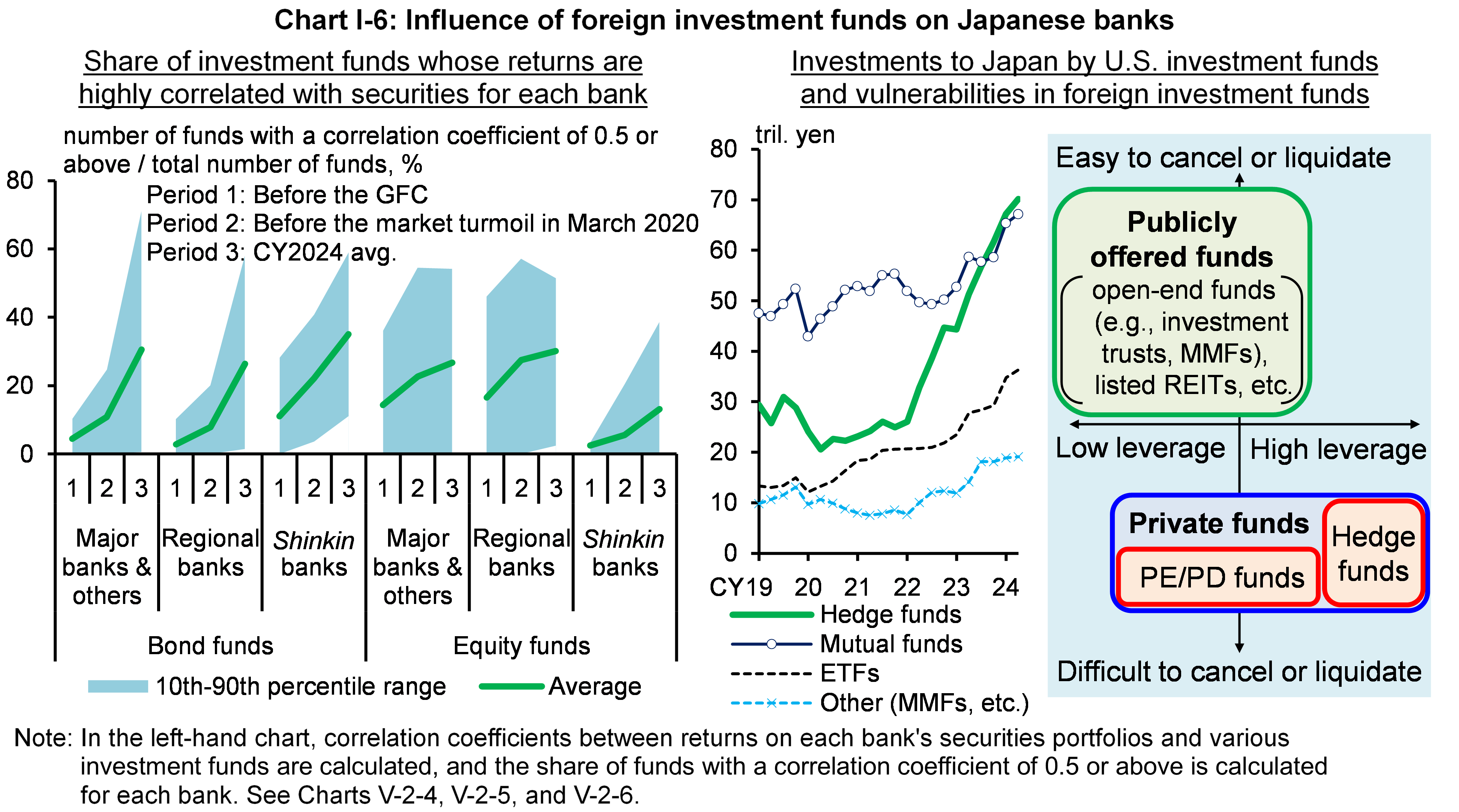

Looking at the correlation between the returns on the securities portfolios of Japanese banks and global investment funds, for an increasing number of banks, their portfolios have become much more correlated with those of investment funds since the global financial crisis (left panel of Chart I-6). This suggests that Japan's financial system may have become more susceptible to fluctuations in global financial markets and the influence of the foreign NBFI sector, both directly and indirectly. As a result, Japan's financial markets and Japanese banks' financial positions are likely to be more susceptible to, for example, a stress event in the global financial environment that could lead to portfolio adjustments on a global basis by foreign investment funds with vulnerabilities in their liability structure and leverage (right panel of Chart I-6). Keeping these points in mind, banks need to identify and manage risks associated with securities holdings.

Banks', firms', and households' resilience to rising interest rates

Regarding developments in lending rates since the previous Report, banks' average contract interest rates on new loans and discounts have been rising for both long-term and short-term ones, due to rises in market interest rates and short-term prime rates, both of which serve as base rates. Interest rates on ordinary and time deposits have both seen moderate increases. Many banks have recently raised interest rates on ordinary deposits to around 0.2 percent. The pass-through to loan and deposit interest rates could differ across banks due, for example, to differences in the timing of their interest rate renewals and their competitive environment and business strategies; thus, there is some uncertainty regarding the effects of changes in market interest rates on banks' profits. However, as seen in the past, increases in lending rates in response to an increase in market interest rates have tended to exceed increases in deposit rates; therefore, over a somewhat longer term, rising interest rates are likely to boost banks' profits in general.

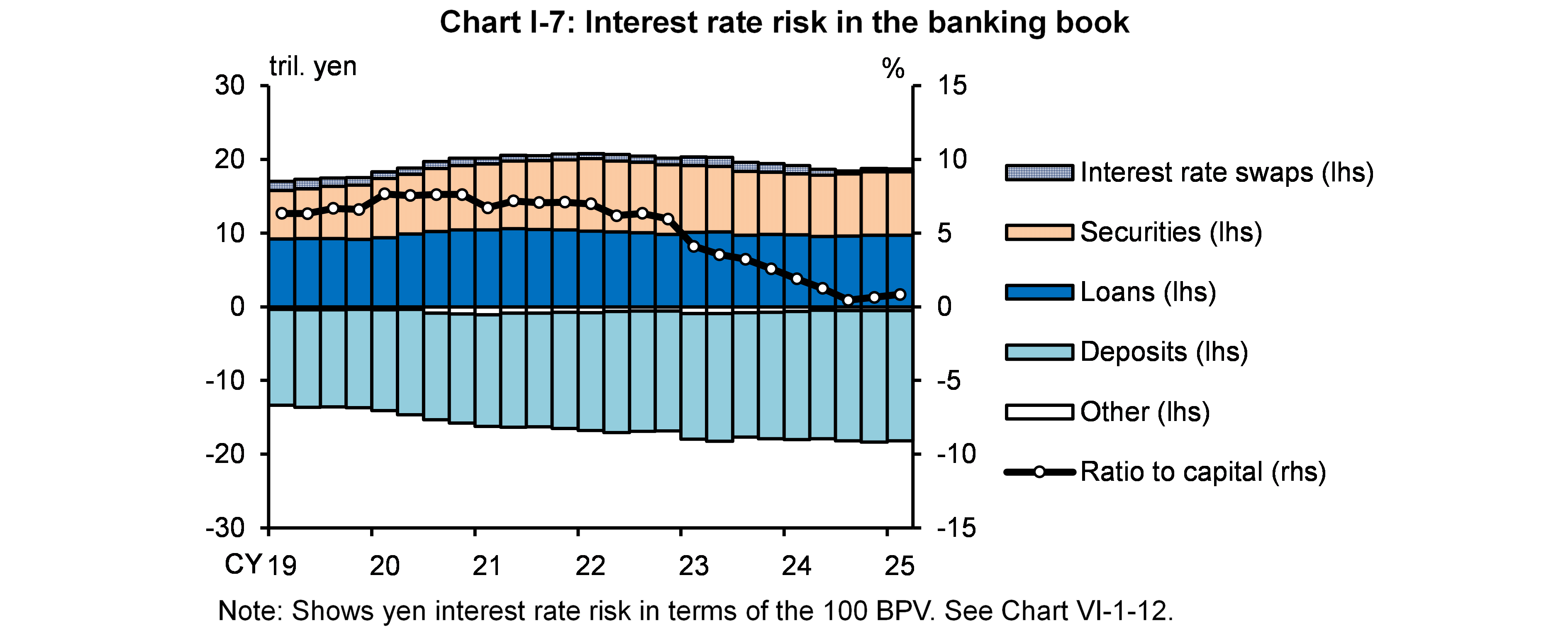

Banks' resilience to rising interest rates has improved compared to a while ago. Yen interest rate risk in the banking book (IRRBB) relative to banks' capital has remained low and banks overall have sufficient loss-absorbing capacity (Chart I-7). The amount of yen interest rate risk on the asset side (loans and securities) and the liability side (deposits) is more or less in balance. Regarding banks' rebalancing of yen-denominated bondholdings, banks overall have maintained a cautious stance toward interest rate risk-taking.

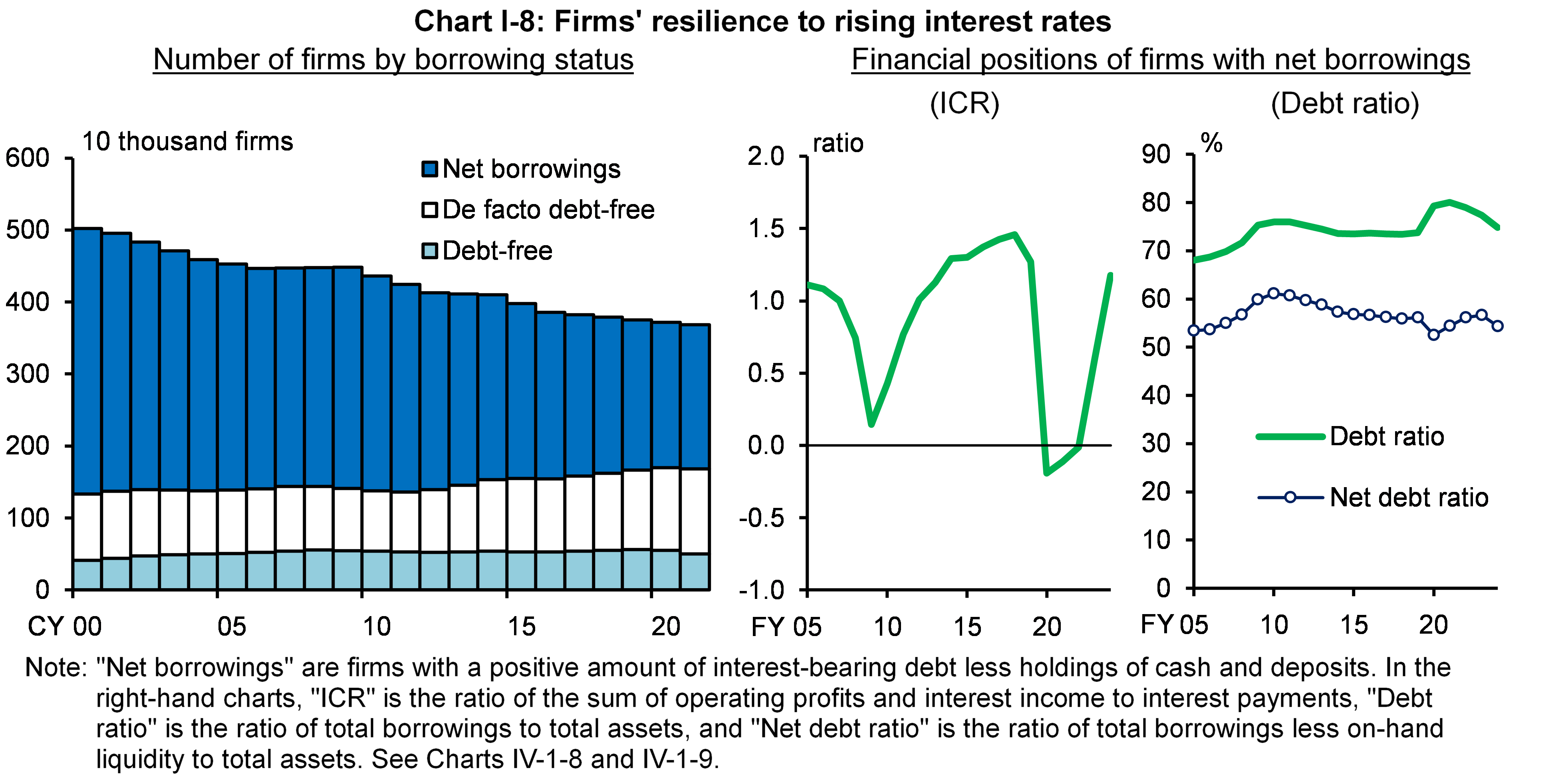

Firms' resilience to rising interest rates has generally been improving, reflecting the recovery in their profits, in addition to a rising trend in the number of de facto debt-free firms (left panel of Chart I-8). Regarding firms with their borrowings exceeding their cash and deposit holdings, the interest coverage ratio (ICR) -- which represents a firm's interest payment capacity -- is increasing overall and their leverage ratios have generally been declining as repayment of loans obtained during the pandemic has progressed (right panel of Chart I-8). However, given that the rise in default rates due to a decline in the ICR following a deterioration in the economic and financial environment could change in a nonlinear fashion, depending on the level of leverage and the amount of on-hand liquidity, the credit management of financially vulnerable firms continues to warrant attention.

Turning to households' resilience to rising interest rates, there has been an increase in the number of households with housing loans among younger age groups, for which the debt servicing ratio (DSR) -- the ratio of annual repayments to annual income -- tends to be high. However, young households have experienced relatively high wage increases recently, and even from a somewhat longer-term perspective, their repayment burden is likely to gradually decline since increases in income are likely to continue as their salary climbs up along the wage curve. Moreover, households' net worth will increase if real estate prices rise after the purchase of their homes, improving their actual ability to repay. That said, it warrants attention that the situation may change if a recession causes a simultaneous decline in incomes and housing prices.

The Bank will promote financial institutions' initiatives to address these potential vulnerabilities through on-site examinations and off-site monitoring. It will continue to closely monitor from a macroprudential perspective the impact on the financial system of various risk-taking moves by financial institutions.

- See the Report for more details on the analyses as well as notes and sources of the charts.

Notice

This Report basically uses data available as of end-March 2025.

Please contact the Financial System and Bank Examination Department at the e-mail address below to request permission in advance when reproducing or copying the contents of this Report for commercial purposes.

Please credit the source when quoting, reproducing, or copying the contents of this Report for non-commercial purposes.

With regard to economic and financial variables of each stress scenario in the macro stress testing, please see the scenario tables [XLSX 20KB] .

Inquiries

Financial System Research Division,

Financial System and Bank Examination Department

E-mail : post.bsd1@boj.or.jp