What Makes Post-Financial-Crisis Recoveries So Slow? An Investigation of Implications for Monetary Policy Conduct

Daisuke Ikeda, Takushi Kurozumi (Bank of Japan)

Research LAB No.15-E-2, March 24, 2015

Keywords:

Post-financial-crisis slow recovery; Slowdown in total factor productivity; Welfare-maximizing monetary policy

JEL Classification:

E52; O33

Contact:

takushi.kurozumi@boj.or.jp (Kurozumi)

Summary

The history of financial crises, including the recent global crisis, shows that post-financial-crisis recoveries tend to be slower than usual recoveries. Against this background lie various factors, one of which is a slowdown in productivity induced by a post-crisis deterioration in firms' financing. To avoid a post-crisis slow recovery in which this factor comes into play, how should monetary policy be conducted? Ikeda and Kurozumi (2014) [PDF 425KB] develop a model in which a tightening in firms' financing induces a productivity slowdown and hence a slow recovery, and conduct a monetary policy analysis. The analysis shows that (1) it is crucial for the post-crisis conduct of monetary policy to adopt a policy stance of responding strongly to output growth, while maintaining a response to inflation; and (2) such a policy stance toward output stabilization outperforms that toward inflation stabilization, because it facilitates recoveries in investment and productivity by improving firms' growth expectations.

1. Introduction

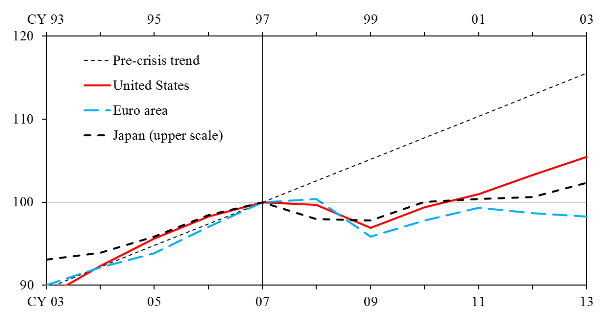

In the aftermath of the recent global financial crisis and subsequent recession, slow recoveries have been observed in many economies, as shown in Figure 1. Although more than five years have passed since the crisis, GDP in the United States has not recovered to its pre-crisis growth trend, and GDP in the euro area has not even returned to its pre-crisis level.

Figure 1. Developments in per capita real GDP around recent financial crises

Note: In the figure, the level of per capita real GDP is represented in terms of its logarithm. The 1997 level and the 2007 level are set at 100 for Japan and for the euro area and the United States, respectively. The scale of years at the top is for Japan only, while that at the bottom is for the other two economies. The pre-crisis trend is given by an average over the three economies during the five years up to each crisis.

Source: IMF.

Post-financial-crisis slow recoveries are not limited to those after the recent global financial crisis. According to previous studies on financial crises, such as Reinhart and Rogoff (2009), post-crisis recoveries tend to be slower than those during usual business cycles, resulting in a permanent loss of GDP. Indeed, in Japan, a similar tendency is observed in the recoveries after the collapse of asset price bubbles in the early 1990s and the banking crisis of 1997.

2. Factors behind post-financial-crisis slow recoveries

In general, output growth is determined by three factors: labor input, capital input, and total factor productivity (TFP). Here we follow Reifschneider, Wascher, and Wilcox (2013) -- a research paper by three economists at the Federal Reserve Board (FRB) -- and sort out the background of post-financial-crisis slow recoveries on the basis of the three factors.

Labor input factor

A potential main factor for post-crisis slow recoveries in terms of labor input is a hysteresis effect. This effect means that once economic agents' behavior changes in response to a large shock, it does not return to the original pre-shock pattern, even if the effects of the shock die out. In terms of labor input, a hysteresis effect means that the effect of firms' cutbacks in hiring in the aftermath of crises -- which discourages displaced workers from searching for jobs by prolonging the period of unemployment and eventually shifts them to the non-labor force population -- remains after the crises. Such an effect has been suggested for European labor markets. Recently, the potential of the hysteresis effect has also been raised for U.S. labor markets, against the background of a downward trend in the labor participation rate.

Capital input factor

A potential main factor for post-financial-crisis slow recoveries in terms of capital input is a slowdown in capital deepening. This captures a post-crisis deceleration in capital accumulation caused by firms' cutbacks in business investment due mainly to the deterioration in their outlook for revenue, an increase in uncertainty, and a tightening in their financing. Reifschneider, Wascher, and Wilcox (2013) indicate that a slowdown in capital deepening has contributed considerably to the post-crisis decline in U.S. GDP.

TFP factor

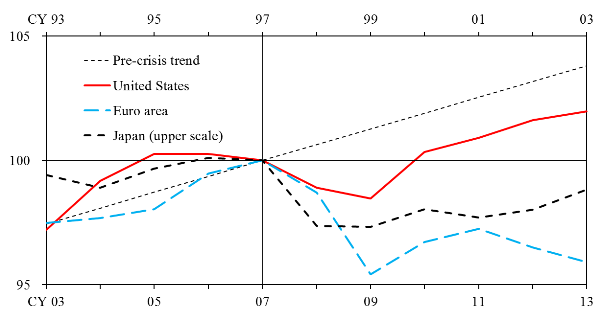

As for factors other than labor and capital input, a potential main factor for post-crisis slow recoveries is a slowdown in TFP. This factor captures a slowdown in economy-wide productivity due to a deceleration in technological progress, for instance. According to the estimate by the Conference Board presented in Figure 2, TFP slowed after the recent financial crisis, particularly in Europe. This was also the case in Japan after the banking crisis of 1997. In this context, a slowdown in TFP has been suggested as a main cause of the "lost decade" in Japan by Hayashi and Prescott (2002), among others. In addition, IMF (2009) investigated economic recoveries following banking crises around the globe during the past 40 years, reporting that slowdowns in TFP played a significant role in slow recoveries after the crises.

Figure 2. Developments in TFP around recent financial crises

Note: In the figure, the level of TFP is represented in terms of its logarithm. The 1997 level and the 2007 level are set at 100 for Japan and for the euro area and the United States, respectively. The scale of years at the top is for Japan only, while that at the bottom is for the other two economies. The pre-crisis trend is given by an average over the three economies during the five years up to each crisis.

Source: The Conference Board Total Economy Database.

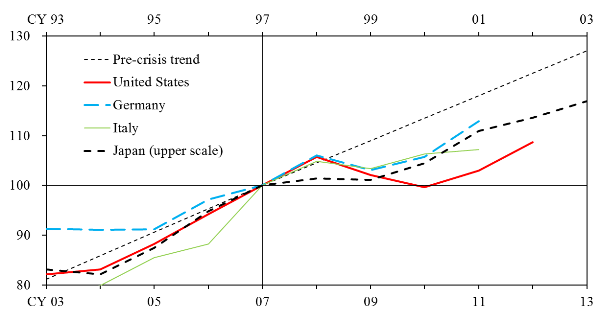

According to Reifschneider, Wascher, and Wilcox (2013), declines in new business formation and investment in research and development (R&D) are considered to be background factors in post-financial-crisis TFP slowdowns. Such a decline in new business formation interrupts revitalization of the economy's "metabolism" and causes a slowdown in economy-wide productivity. A decline in R&D investment brings about the same effect by preventing the adoption of new technology. Indeed, Reifschneider, Wascher, and Wilcox point to a decrease in U.S. new business formation after the recent crisis, and OECD statistics show that R&D investment has not recovered to its pre-crisis growth trend, as can be seen in Figure 3. Moreover, as background to Japan's TFP slowdown following the collapse of asset price bubbles in the early 1990s, previous studies point to (1) misallocation of resources caused by a deterioration in the functioning of financial intermediation (e.g., Nishimura, Nakajima, and Kiyota, 2005) and (2) a reduction in R&D investment (e.g., Ogawa, 2007).

Figure 3. Developments in R&D investment around recent financial crises

Note: In the figure, the level of R&D investment is represented in terms of its logarithm. The 1997 level and the 2007 level are set at 100 for Japan and for Germany, Italy, and the United States, respectively. The scale of years at the top is for Japan only, while that at the bottom is for the other three countries. The pre-crisis trend is given by an average over the four countries during the five years up to each crisis.

Source: OECD.

The above argument has thus far examined what makes post-financial-crisis recoveries so slow in terms of three factors: labor input, capital input, and TFP. Reifschneider, Wascher, and Wilcox (2013) also point out that this slowdown in the supply side of the economy reflects a weakening in the demand side. In this context, Summers (2014) argues that "lack of demand creates lack of supply," based on the observation that the estimates of U.S. potential GDP were revised downward several times after the recent financial crisis.

3. An investigation of implications for monetary policy conduct

We now address the question of how monetary policy should be conducted to avoid a post-financial-crisis slow recovery.

Previous studies, including Woodford (2003), lack a suitable analytical framework to address the question. The models used in previous studies presuppose that the model economy returns relatively quickly to an original growth trend after a shock hits the economy. In addition, the models consider mainly price rigidity as a source of social welfare losses that are measured approximately by a weighted sum of the variability of inflation and the output gap. In such a setting, a main feature of welfare-maximizing monetary policy is inflation stabilization to address price rigidity, which is a source of deterioration in social welfare.

On the other hand, Ikeda and Kurozumi (2014) develop a model in which a tightening in firms' financing induces a recession and causes a slow recovery, and conduct a monetary policy analysis. According to the results of their paper, it is crucial for the post-financial-crisis conduct of monetary policy to display a strong policy stance toward output stabilization rather than toward inflation stabilization.

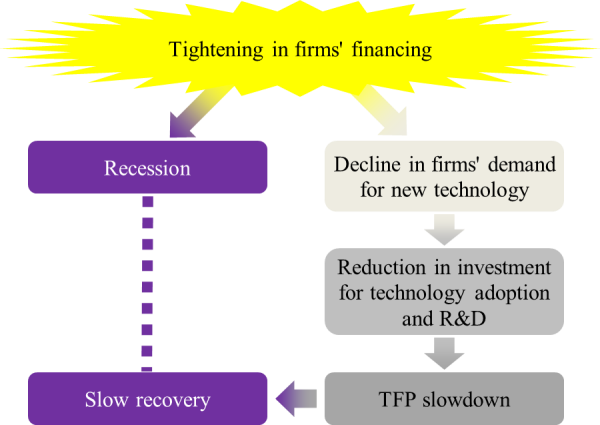

The Ikeda and Kurozumi (2014) model incorporates a mechanism in which a tightening in firms' financing induces a recession while also causing a reduction in investment for technology adoption and R&D arising from a decline in firms' demand for new technology, which results in a TFP slowdown and hence a slow recovery, as illustrated in Figure 4. Such a mechanism is also incorporated in recent research (e.g., Queralto, 2013) that develops a model of post-financial-crisis slow recoveries.

Figure 4. Overview of the Ikeda and Kurozumi (2014) model

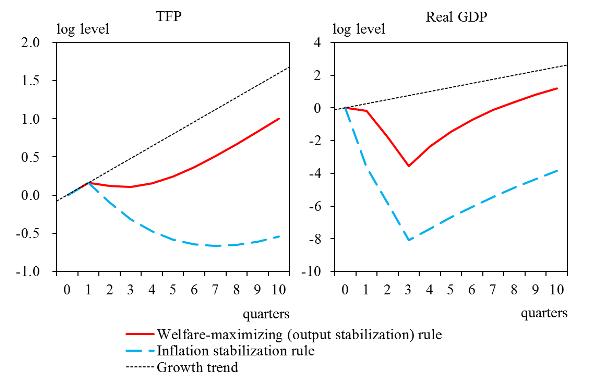

In the model, monetary policy rules adjust the policy rate in response mainly to the rates of inflation and output growth. In a situation where a tightening in firms' financing can cause a slow recovery, a welfare-maximizing policy rule features a strong response to output growth, while maintaining a response to inflation. This result follows from the fact that in the Ikeda and Kurozumi (2014) model, a recovery from a recession caused by a tightening in firms' financing remains to be slow, and thereby deterioration in social welfare due to the slow recovery is greater than that due to price rigidity. In addition, such a policy stance toward output stabilization facilitates recoveries in investment and productivity by improving firms' growth expectations. In fact, as can be seen in Figure 5, financial-crisis-scenario simulations show that a policy stance toward output stabilization facilitates a recovery in TFP more substantially than that toward inflation stabilization, which has been regarded as desirable in previous studies on monetary policy.

Figure 5. Financial-crisis-scenario simulations

A similar result is obtained by Reifschneider, Wascher, and Wilcox (2013), who analyze an optimal monetary policy in a version of the FRB/US model, a macroeconomic model of the FRB. They incorporate the hysteresis effect of labor input in the FRB/US model to describe a slow recovery. With this model, they demonstrate that an optimal monetary policy which minimizes a loss function reflecting the Federal Reserve's dual mandate of price stability and maximum employment has the characteristic of a vigorous policy response to a weakening in aggregate demand.

4. Concluding remarks

In the above argument, we have examined factors that lie behind post-financial-crisis slow recoveries. Then we have introduced the analysis of Ikeda and Kurozumi (2014) regarding monetary policy conduct that could prevent the economy from falling into such a slow recovery. According to the analysis, (1) it is crucial for the post-financial-crisis conduct of monetary policy to display a policy stance of responding strongly to output growth; and (2) such a policy stance toward output stabilization is more desirable in terms of social welfare than that toward inflation stabilization, because it facilitates a recovery in TFP and mitigates a permanent loss of GDP that would materialize in a slow recovery.

The analysis by Ikeda and Kurozumi (2014) restricts its attention to conventional monetary policy. After the recent financial crisis, however, central banks in advanced countries have underpinned post-crisis recoveries by using unconventional monetary policy tools, such as forward guidance and asset purchases, even after lowering the policy rate virtually to the zero lower bound. Analyses of the effects of these unconventional monetary policies in a model of a post-financial-crisis slow recovery are left for future research.

References

- Hayashi, Fumio, and Edward C. Prescott (2002), "The 1990s in Japan: A Lost Decade," Review of Economic Dynamics, 5 (1), pp. 206-235.

- Ikeda, Daisuke, and Takushi Kurozumi (2014), "Post-Crisis Slow Recovery and Monetary Policy," [PDF 425KB] IMES Discussion Paper Series, No. 2014-E-16, Institute for Monetary and Economic Studies, Bank of Japan.

- International Monetary Fund (2009), "What's the Damage? Medium-Term Output Dynamics after Financial Crises," [PDF 863KB] (Link to an external website) World Economic Outlook: Sustaining the Recovery, October 2009, pp. 121-151.

- Nishimura, Kiyohiko G., Takanobu Nakajima, and Kozo Kiyota (2005), "Does the Natural Selection Mechanism Still Work in Severe Recession? Examination of the Japanese Economy in the 1990s," Journal of Economic Behavior and Organization, 58 (1), pp. 53-78.

- Ogawa, Kazuo (2007), "Debt, R&D Investment and Technological Progress: A Panel Study of Japanese Manufacturing Firms' Behavior during the 1990s," Journal of the Japanese and International Economies, 21 (4), pp. 403-423.

- Queralto, Albert (2013), "A Model of Slow Recoveries from Financial Crises," [PDF 460KB] (Link to an external website) International Finance Discussion Paper Series, No. 2013-1097, Federal Reserve Board.

- Reifschneider, Dave, William Wascher, and David Wilcox (2013), "Aggregate Supply in the United States: Recent Developments and Implications for the Conduct of Monetary Policy," [PDF 1,140KB] (Link to an external website) Finance and Economics Discussion Paper Series, No. 2013-77, Federal Reserve Board.

- Reinhart, Carmen M., and Kenneth S. Rogoff (2009), This Time is Different: Eight Centuries of Financial Folly, Princeton, NJ: Princeton University Press.

- Summers, Lawrence H. (2014), "Reflections on the 'New Secular Stagnation Hypothesis,'" [PDF 3.95MB] in Coen Teulings and Richard Baldwin (eds.), Secular Stagnation: Facts, Causes, and Cures, A VoxEU.org eBook, London: CEPR Press, pp. 27-38.

- Woodford, Michael (2003), Interest and Prices: Foundations of a Theory of Monetary Policy, Princeton, NJ: Princeton University Press.

Notice

The views expressed herein are those of the authors and do not necessarily reflect those of the Bank of Japan.