Costs and Benefits of Inflation: A Model Analysis of Japan and the U.S.

Tomohide Mineyama, Wataru Hirata, Kenji Nishizaki (Bank of Japan)

Research LAB No.19-E-2, July 9, 2019

Keywords: Inflation; Social welfare; New Keynesian model; Downward nominal wage rigidity; Zero lower bound; Forward guidance

JEL Classification: E31, E43, E52

Contact: wataru.hirata@boj.or.jp (Wataru Hirata)

Summary

Analyzing the costs and benefits of inflation has been a primary subject in monetary economics. This article presents a summary of Mineyama, Hirata, and Nishizaki (2019) [PDF 673KB], which investigates the relationship between inflation and social welfare expressed as the economic satisfaction of households for Japan and the U.S. The authors' analysis employs a New Keynesian model which embeds the major factors affecting the costs and benefits of inflation.

The analysis suggests (1) social welfare is maximized when the steady-state inflation rate, the level to which the inflation rate converges in the long run, is close to two percent for both Japan and the U.S.; and (2) around one percentage point absolute deviation from the close-to-two-percent rate induces only a minor change in social welfare. Note, however, that the estimates are subject to a considerable margin of error due to parameter uncertainty in the zero lower bound of nominal interest rates.

Introduction

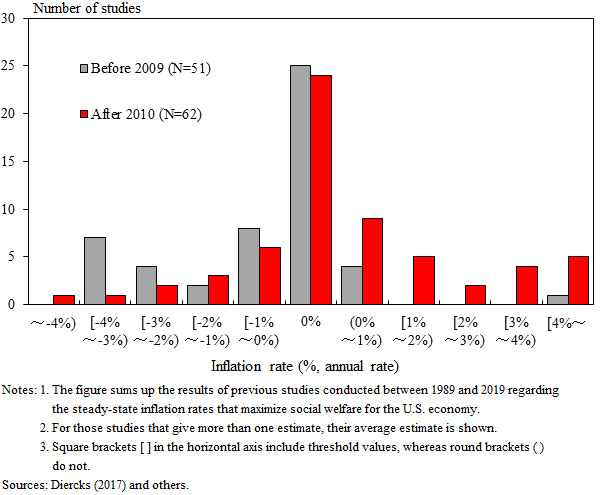

Analyzing the costs and benefits of inflation has long been a primary subject of study in monetary economics. When discussing the costs and benefits of inflation, monetary economists often evaluate the steady-state inflation rate, the level to which the inflation rate converges in the long run, that maximizes social welfare expressed as the economic satisfaction of households. Figure 1 shows the distribution of estimates of the steady-state inflation rates that maximize social welfare for the U.S. economy. The figure shows that the estimates are centered around zero, but there is a significant dispersion both in the positive and negative direction, revealing that there is no clear consensus. One reason for the variation is that each study focuses on different factors affecting the costs and benefits of inflation.

Figure 1 : Distribution of estimates of steady-state inflation rates that maximize social welfare

This article presents a summary of Mineyama, Hirata, and Nishizaki (2019, MHN hereafter), which investigates the steady-state inflation rate that maximizes social welfare1 for Japan and the U.S. using a New Keynesian model that embeds four major factors affecting the costs and benefits of inflation: nominal price rigidity, money holdings, downward nominal wage rigidity (DNWR), and the zero lower bound of nominal interest rates (ZLB).

- Specifically, social welfare is defined as the unconditional expected utility of the representative household, and the steady-state inflation rate is the level of inflation rate when the economy is at the deterministic steady state.

A summary of four major factors affecting the costs and benefits of inflation

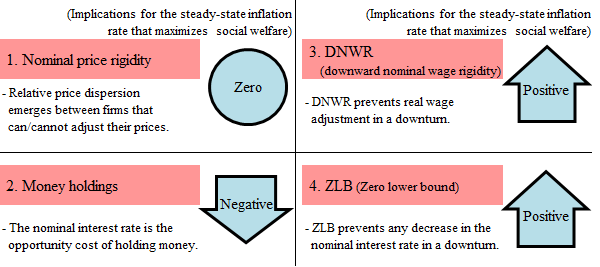

We first summarize the implications of four major factors affecting the costs and benefits of inflation on the steady-state inflation rate that maximizes social welfare. (Figure 2)

The first factor is nominal price rigidity. Under the situation where only a proportion of firms can adjust their prices in response to current economic conditions, both inflation and deflation lead to dispersion of the relative price of individual goods. Relative price dispersion makes individual goods demand ununiform, and results in the misallocation of resources in the economy. Therefore, the presence of nominal price rigidity implies that zero inflation maximizes social welfare.

The second factor is money holdings. While they do provide benefits, such as facilitating the purchase of goods, money holdings come at the cost of the lost opportunity to earn the nominal interest that would be paid on risk-free bonds. In this regard, Friedman (1969) argued that the inflation rate should be negative so as to bring the nominal interest rate, the opportunity cost of holding money, down to zero.

The third factor is downward nominal wage rigidity (DNWR). In the presence of DNWR, an adverse shock leads to misallocations in the labor market due to the lack of sufficient real wage adjustments. Tobin (1972) argued that positive inflation acts as the "grease of the wheels" in the labor market, i.e., it facilitates real wage adjustment in a downturn.

The fourth factor is the zero lower bound of nominal interest rates (ZLB). The nominal interest rate is usually bounded at zero. The ZLB can be a constraint on the conduct of monetary policy that uses control of the nominal interest rate as a policy instrument. To this end, Summers (1991) argued that positive inflation provides a safety margin for cutting the nominal interest rate in a downturn.

Figure 2 : Four major factors affecting costs and benefits of inflation

The framework of the model analysis and calibration to reflect differences between the Japanese and U.S. economies

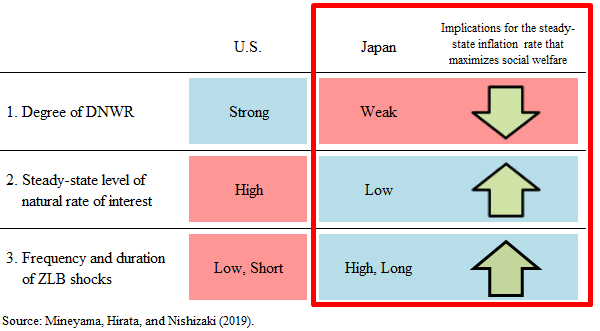

MHN constructs a model that embeds the four major factors above based on a New Keynesian model employed in previous studies, such as Coibion, Gorodnichenko, and Wieland (2012). When calibrating model parameters, MHN takes into account the differences in the economic structure and the experience of ZLB episodes between Japan and the U.S. (Figure 3)

For example, MHN sets the degree of DNWR to be weaker in Japan than in the U.S. This is consistent with the evidence that the DNWR that was measured using the total annual earnings of full-time employees in Japan disappeared after the late 1990s when the Japanese economy experienced a prolonged recession, while the nominal wages of individual workers were downwardly rigid in the U.S. even in the severe downturn after the global financial crisis.

As for the parameters associated with ZLB, MHN assigns a lower value in the steady-state natural rate of interest in Japan than in the U.S., based on an estimation result using the Laubach and Williams (2003) model. In addition, MHN defines "ZLB shock" as an exogenous shock that brings the economy to ZLB given the steady-state level of the natural rate of interest. Reflecting the difference in the experience of ZLB episodes, the calibrated value suggests that ZLB shocks hit more often and remain longer in Japan than in the U.S.2

The lower degree of DNWR in Japan would contribute to decreasing the steady-state inflation rate that maximizes social welfare in Japan relative to the U.S. On the other hand, the lower steady-state value of the natural rate of interest, and the frequent and long-lasting ZLB shocks in Japan would contribute to raising the steady-state inflation rate that maximizes social welfare in Japan relative to the U.S.

Figure 3 : Parameter differences in Japan and the U.S. economies (example)

- 2When formulating the ZLB shock, MHN introduces a regime switching shock that can generate prolonged recessions, which is also introduced in Carreras et al. (2016).

The result of the model analysis on the steady-state inflation rate that maximizes social welfare

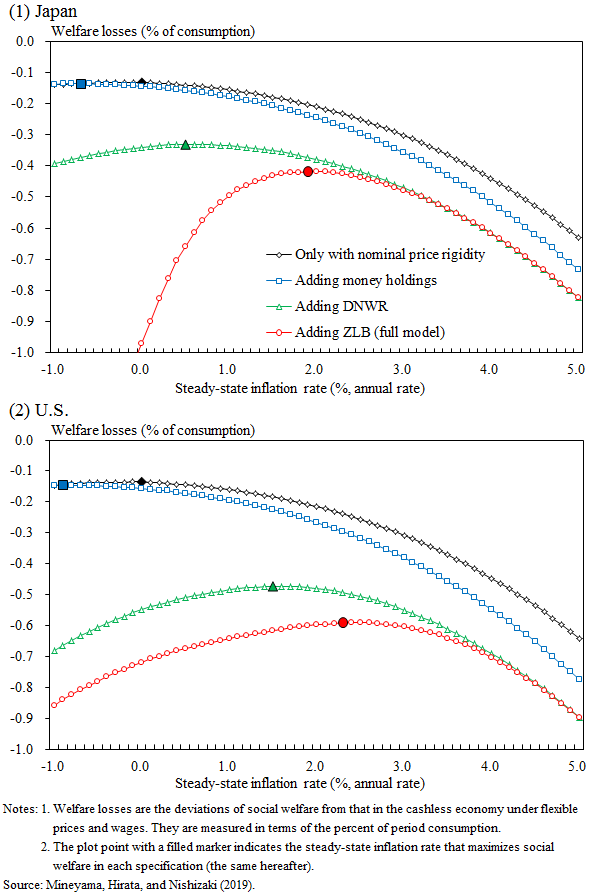

The steady-state inflation rate that maximizes social welfare also depends on monetary policy rules. Below, we first examine the case where the central bank follows the Taylor rule, assuming an environment in which it conducts conventional monetary policy.

Figure 4 shows the welfare losses under different levels of the steady-state inflation rate when the central bank is assumed to follow the Taylor rule. The welfare losses when only nominal price rigidity is present in the model serve as the benchmark for the effect of the four major factors on the steady-state inflation rate that maximizes social welfare. The welfare losses after adding money holdings, DNWR, and ZLB are then shown sequentially. First, in the specification that includes only nominal price rigidity, zero percent inflation in the steady state maximizes social welfare since both inflation and deflation generate welfare losses through the relative price dispersion. Second, when adding money holdings, a negative steady-state inflation rate maximizes social welfare because the lower nominal interest rates resulting from the lower steady-state inflation rates reduce the opportunity costs of holding money. Third, incorporating DNWR and ZLB leads to a positive steady-state inflation rate because positive inflation reduces the probability that these constraints bind. When all four major factors are taken into account, the steady-state inflation rate that maximizes social welfare is close to two percent for both Japan and the U.S. In the meantime, the main driver that supports the close-to-two-percent inflation rate in the steady state differs by country: for Japan the main driver is ZLB, but for the U.S. it is DNWR.

Figure 4 : Welfare losses under Taylor rule

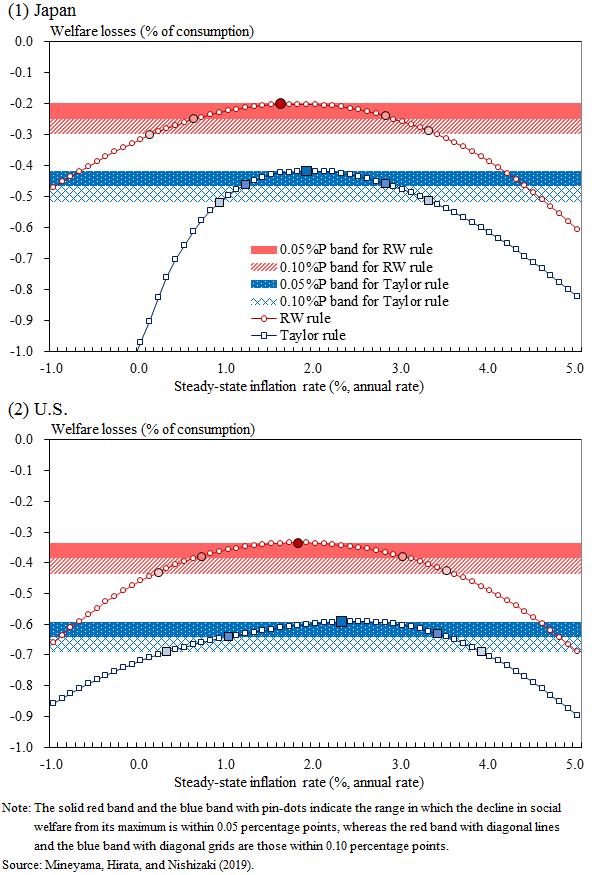

The Taylor rule assumes an environment in which central banks conduct conventional monetary policy. However, major central banks in developed economies have conducted unconventional monetary policies to overcome the ZLB problem. Hence, we next examine the effects of forward guidance proposed by Reifschneider and Williams (2000, the RW rule hereafter) in which the central bank makes a commitment to continue a low interest rate policy at future dates once the economy is constrained at the ZLB.

Figure 5 shows the welfare losses under different levels of the steady-state inflation rate when the RW rule is implemented.3 Under the RW rule, the welfare losses are smaller than those when the central bank follows the Taylor rule because the RW rule mitigates the adverse effects of the ZLB. Since the benefits of holding the safety margin in the nominal interest rate provided for the ZLB are weakened under the RW rule, the steady-state inflation rate that maximizes social welfare is slightly reduced, compared with the case under the Taylor rule. That being said, the estimates of the inflation rate under the RW rule do not deviate too far from the conventional wisdom of two percent.

Figure 5 also shows the range of the steady-state inflation rates at which the decline in social welfare from its maximum remains within 0.05 and 0.10 percentage points in terms of the consumption-equivalent losses. It shows the range under both the Taylor rule and the RW rule. We can see from this figure, for example, that around one percentage point absolute deviation from the close-to-two-percent rate induces only a minor change in social welfare under both rules, because the shape of the welfare loss is relatively flat around the maximum point.

Figure 5 : Welfare losses under RW rule

- 3Figure 5 considers the case when all four factors are introduced.

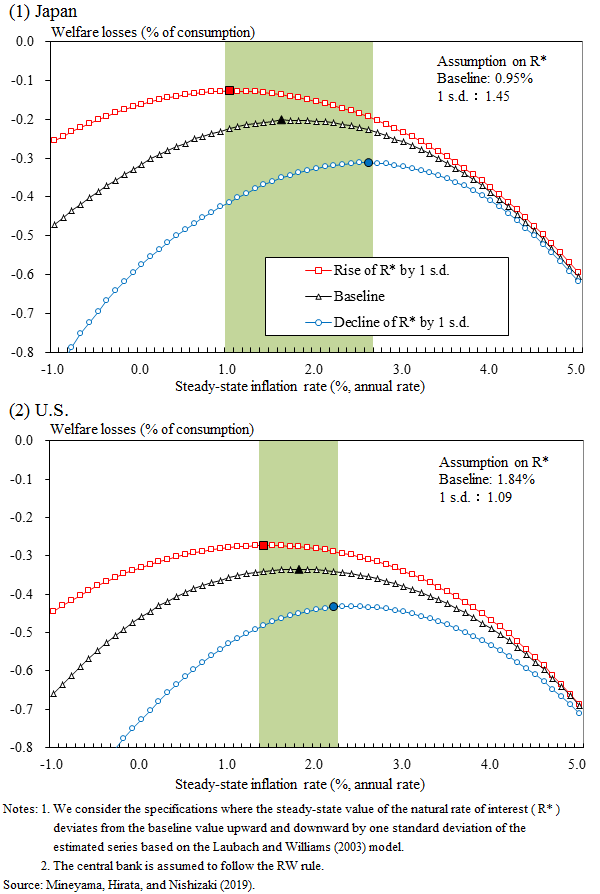

Parameter uncertainty regarding ZLB

As previously mentioned, the calibration of the model in MHN takes into account the differences in the economic structure and the experience of ZLB episodes between Japan and the U.S. Nonetheless, parameter uncertainty regarding ZLB in particular is considerably high because of the limited instances of ZLB episodes, both in Japan and the U.S. For example, it is well known that the measurement of the natural rate of interest, one of the factors that determine the distance of nominal interest rates from ZLB, is subject to considerable uncertainty.4 To this end, Figure 6 shows the welfare losses under different levels of the steady-state inflation rate when the steady-state level of the natural rate of interest deviates either upward or downward by one standard deviation from the estimated value employed in the analysis above. According to this exercise, the uncertainty regarding the level of the natural rate of interest forms a considerable range of the steady-state inflation rate that maximizes social welfare for both countries.

Figure 6 : Effects of parameter uncertainty regarding steady-state level of natural rate of interest

- 4See, for example, Beyer and Wieland (2019).

Conclusion

This article presents a summary of Mineyama, Hirata, and Nishizaki (2019), which investigates the steady-state inflation rate that maximizes social welfare for the Japanese and the U.S. economies in a New Keynesian model.

Many of the previous studies on this topic focused on nominal price rigidity and money holdings. In addition to these two factors, MHN also takes into account DNWR and ZLB. As a result, the authors show that the steady-state inflation rate that maximizes social welfare is close to two percent for both Japan and the U.S. At the same time, they show that around one percentage point absolute deviation from the close-to-two-percent rate induces only a minor change in social welfare. Last but not least, the estimates of the steady-state inflation rate are subject to a considerable margin of error due to parameter uncertainty, such as ZLB parameterization.

The MHN model abstracts from the issues of an open economy and imbalances arising from financial intermediaries. Apart from forward guidance, the authors also do not consider the full range of unconventional monetary policy measures, such as asset purchases. It must be noted that there may be other factors than those addressed in this article that affect the steady-state inflation rate that maximizes social welfare.

Reference

- Beyer, R. C. M. and V. Wieland (2019) "Instability, imprecision and inconsistent use of equilibrium real interest rate estimates," Journal of International Money and Finance, 94, 1--14.

- Carreras, M. D., O. Coibion, Y. Gorodnichenko, and J. Wieland (2016) "Infrequent but long-lived zero lower bound episodes and the optimal rate of inflation," Annual Review of Economics, 8, 497--520.

- Coibion, O., Y. Gorodnichenko, and J. Wieland (2012) "The optimal inflation rate in New Keynesian models: Should central banks raise their inflation targets in light of the zero lower bound?" Review of Economic Studies, 79(4), 1371--1406.

- Diercks, A. M. (2017) "The reader's guide to optimal monetary policy," mimeo.

- Friedman, M. (1969) The optimum quantity of money, and other essays, Chicago: Aldine Publishing Company.

- Laubach, T. and J. C. Williams (2003) "Measuring the natural rate of interest," Review of Economics and Statistics, 85(4), 1063--1070.

- Mineyama, T., W. Hirata, and K. Nishizaki (2019) "Inflation and social welfare in a New Keynesian model: The case of Japan and the U.S., [PDF 673KB]" Bank of Japan Working Paper Series, No. 19-E-10.

- Reifschneider, D. and J. C. Williams (2000) "Three lessons for monetary policy in a low-inflation era," Journal of Money, Credit and Banking, 32(4), 936--966.

- Summers, L. (1991) "Panel discussion: Price stability: How should long-term monetary policy be determined?" Journal of Money, Credit and Banking, 23(3), 625--631.

- Tobin, J. (1972) "Inflation and unemployment," American Economic Review, 62(1/2), 1--18.

Notice

The views expressed herein are those of the authors and do not necessarily reflect those of the Bank of Japan.