Explanation of "Statistics on Securities Financing Transactions in Japan"

October 2020

Financial Markets Department

Bank of Japan

Basic Information

- Compilation section :

- Financial Markets Statistics Group, Coordination and Market Analysis Division, Financial Markets Department, Bank of Japan

- Frequency of compilation :

- Monthly

- Time of release :

- 15th business day of the following month

- Method of release :

- Bank of Japan's website

- Commencement of data :

- December 2018

I. Overview of Statistics on Securities Financing Transactions in Japan

A. Overview of Statistics

Statistics on Securities Financing Transactions in Japan is a monthly publication of statistics compiled and released by the Bank of Japan (the Bank) to capture trends in securities financing transactions by financial institutions located in Japan.

In November 2015, the Financial Stability Board (FSB) released a report on standards and processes for global securities financing data collection and aggregation for reporting of aggregates by national/regional authorities to the FSB. In accordance with those standards, in Japan, the Financial Services Agency (FSA) and the Bank collect data on securities financing transactions in the domestic market.

The Bank releases part of that collected data as Statistics on Securities Financing Transactions in Japan.

B. Purpose of the Statistics

The purpose of those statistics is to widely share with statistics users data on securities financing transactions in Japan collected in accordance with the standards proposed by the FSB, and contribute to improving the stability of domestic financial markets, improving risk management in financial institutions, and monitoring their conformity with various regulations.

II. Compilation Method

A. Reporting Financial Institutions

In principal, the reporting financial institutions comprise about 50 financial institutions located in Japan (including branches and subsidiaries of foreign financial institutions) with the largest amount outstanding of securities financing transactions. Financial institutions that are not residents of Japan are excluded from reporting financial institutions. The scope of reporting financial institutions might be reviewed to ensure proper coverage of data on securities financing transactions.

B. Reported Transactions

Reported transactions are securities financing transactions conducted by reporting financial institutions as interested parties. Securities financing transactions include (1) repo transactions and (2) securities lending transactions.

1. Repo transactionsRepo transactions are transactions based on contractual arrangements involving the provision of securities or other financial assets in exchange for cash with a commitment to repurchase the same or similar collateral at a fixed price on a specified future date. Repo transactions include transactions conducted under master agreement of various countries and the following standard agreements: Japanese Master Agreement on the Transaction with Repurchase Agreement of the Bonds, Master Repurchase Agreement (MRA), and Global Master Repurchase Agreement (GMRA).

Of the flow data in the statistics, "1-1. Transactions in Japanese yen" covers transactions where the cash leg is denominated in Japanese yen. Of the stock data, "2. Repo transactions and securities lending transactions" (broken down into transactions where the cash leg is denominated in Japanese yen ["2-1. Transactions in Japanese yen, by counterparty"], and transactions where the cash leg is denominated in a foreign currency ["2-2. Transactions in foreign currencies, by counterparty," and "2-3. Transactions in foreign currencies, by cash currency"]) covers transactions with all securities because the types of collateral (securities traded) are not specified. On the other hand, "3-1. Transactions in Japanese yen, with Japanese government securities" covers transactions where the collateral (securities traded) is specified as Japanese government securities and the cash leg is denominated in Japanese yen. "3-2. Transactions in foreign currencies, with debt securities" covers transactions where the collateral (securities traded) is specified as debt securities and the cash leg is denominated in a foreign currency.

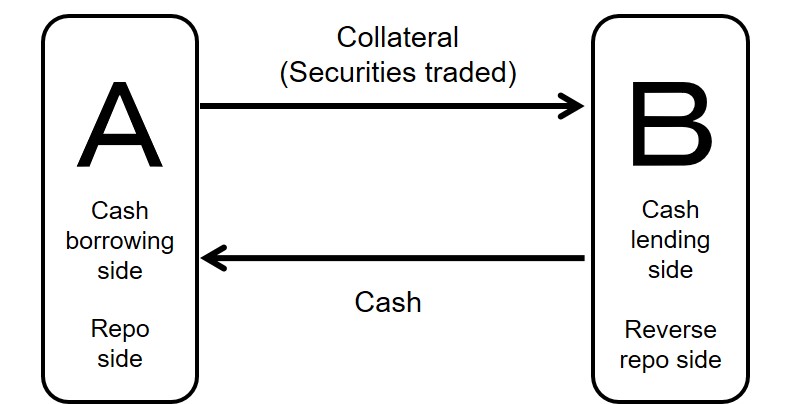

In the above transactions, securities providers (cash recipients) are referred to as the cash borrowing side or the repo side and securities recipients (cash providers) as the cash lending side or the reverse repo side.

Repo transactions

Securities lending transactions are transactions where one party (lender) lends securities to the counterparty (borrower), and after a period agreed between the parties, the borrower gives back the lender the same or a similar type of securities. Securities lending transactions include transactions conducted under master agreement of various countries and the following standard agreements: Japanese Master Agreement on Lending Transaction of Bonds, Japanese Master Agreement on the Borrowing and Lending Transactions of Share Certificates, Master Securities Loan Agreement (MSLA), and Global Master Securities Lending Agreement (GMSLA). However, unsecured transactions and transactions via securities finance companies associated with standardized margin trading are not considered securities lending transactions.

Of the stock data in the statistics, "2. Repo transactions and securities lending transactions" and "4-1. Transactions of Japanese government bonds, with Japanese yen" cover securities lending transactions with cash collateral. Furthermore, "2. Repo transactions and securities lending transactions" covers transactions with all securities because the types of borrowed securities are not specified. "4-1. Transactions of Japanese government bonds, with Japanese yen" covers transactions where the borrowed securities are specified as being Japanese government bonds and the cash leg is denominated in Japanese yen.

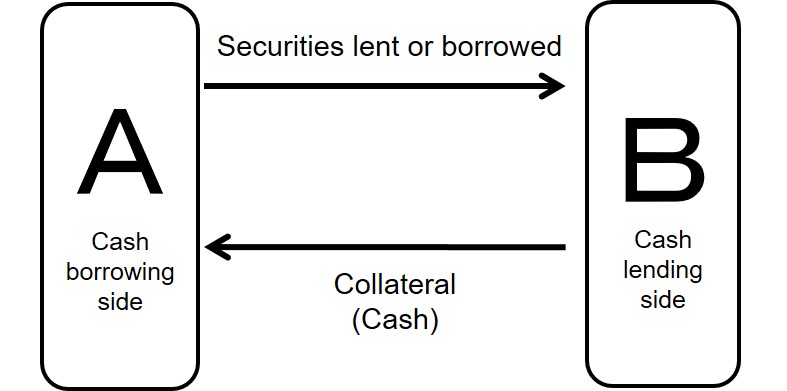

In cash-collateralized securities lending transactions, securities providers (cash recipients) are referred to as the cash borrowing side and securities recipients (cash providers) as the cash lending side.

Cash-collateralized securities lending transactions

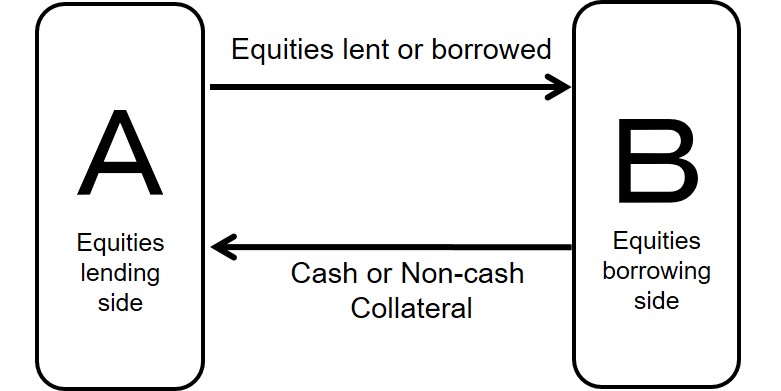

"4-2. Transactions of Japanese equities, with cash or securities" covers securities lending transactions where Japanese equities are borrowed. Here, transactions with cash and non-cash collateral are aggregated and released.

In equities lending transactions, equities providers (collateral recipients) are referred to as the equities lending side and equities recipients (collateral providers) as the equities borrowing side.

Securities lending transactions where Japanese equities borrowed

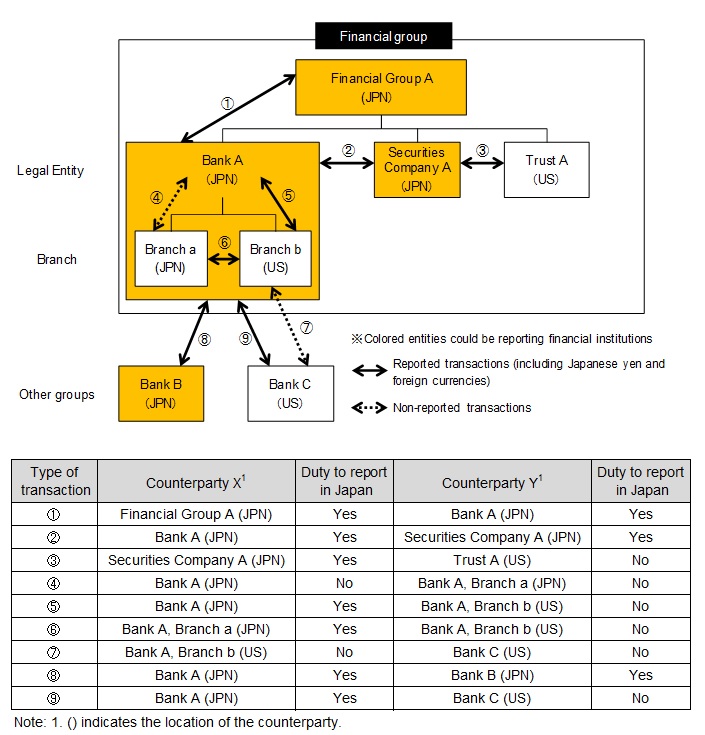

C. Scope of Data Reporting

All transactions conducted by reporting financial institutions are to be reported. That is, transactions with counterparties located overseas, intra-group transactions between different legal entities (banks or other subsidiaries) or between foreign branches and their parent companies, and transactions with international organizations are included in the scope of data reporting. However, internal transactions in which both counterparties are part of the same legal entity, transactions executed with individuals, transactions where reporting financial institutions only provide advice, and transactions executed with central banks or the Bank for International Settlements (BIS) are excluded from the scope of data reporting. See the chart below for details.

Duty to report based on type of transactions

D. Units of Figures

The Bank releases the principal amounts and the market value of securities in units of 100 million Japanese yen after converting the collected data in the traded currency into Japanese yen using the exchange rates for the reserve requirement system. Repo rates are rounded to two decimal places.

E. Notice on Usage

In principle, any corrections to collected data are made and announced on the subsequent release date, retroactively, for no longer than the previous twelve months. In addition, the Bank might not disclose some transaction items when the confidentiality of information regarding an individual company cannot be sufficiently guaranteed.

III. Contents

A. Datasets

The statistics consist of daily "flow data" and monthly "stock data." Furthermore, stock data consists of four items: "repo transactions and securities lending transactions," "repo transactions," "securities lending transactions," and "rates of transactions." See the statistics for details.

B. Brief Explanation of Each Dataset

Flow data/Stock data

1. Flow dataIn the flow data, the Bank releases the principal amounts of new transactions that originated on each business day in Japan by the starting date. Transactions involving a rollover are reported as new transactions whenever the rollover occurs, if both parties actively renew a contract. However, evergreen transactions where the maturity date is automatically renewed are excluded.

2. Stock dataIn the stock data, the Bank releases the principal amounts of transactions and the market value of the securities as of the end of the reporting period after incorporating substitutions* and cancellations before maturity.

- Specifically, the parties agree on an "early close-out" clause, which allows them to terminate the original sell/buy back and initiate a new one for the remaining term to maturity and with the adjusted amount of cash or collateral.

Reporting financial institution side

| Cash lending side (securities recipients) |

This refers to aggregate principal amount, etc., of which reported by securities recipients (cash providers) in repo transactions and securities lending transactions. |

|---|---|

| Cash borrowing side (securities providers) |

This refers to aggregate principal amount, etc., of which reported by securities providers (cash recipients) in repo transactions and securities lending transactions. |

| Equities borrowing side (collateral providers) |

This refers to aggregate principal amount, etc., of which reported by equities recipients (collateral providers) in securities lending transactions if the borrowed securities are equities. In this case, collateral includes both cash and non-cash collateral (bonds, equities, etc.). |

Types of securities

The definitions of the types of securities in the statistics are as follows.

| Government securities | Japanese government securities | Government securities (government bonds, local government bonds, government guaranteed bonds, etc.) that are denominated in Japanese yen. | |

|---|---|---|---|

| Japanese government securities | Japanese government bonds | Japanese government bonds that are denominated in Japanese yen. | |

| Foreign government securities | Government securities (government bonds, local government bonds, government guaranteed bonds, etc.) that are denominated in foreign currencies (excluding U.S. Agency MBSs guaranteed by Ginnie Mae, Fannie Mae, or Freddie Mac). | ||

| Japanese equities | Japanese equities that are denominated in Japanese yen (including convertible bonds). | ||

Maturity

Maturity in the statistics means the original maturity and that maturity is calculated as the difference between the ending date and the starting date of the transactions.*1

| Overnight | Overnight, including 1-day term trades or longer that mature the next business day |

|---|---|

| 2D or more 1W or less | From 2 days (included) to 1 week (included) |

| More than 1W 1M or less |

From 1 week (not included) to 1 month (included)*2 |

| More than 1M 3M or less |

From 1 month (not included) to 3 months (included)*2 |

| More than 3M | 3 months (not included) and more |

| Open-end | Open or continuing terms contracts for which no maturity date is specified |

- *1The number of days is calculated based on the calendar date in Japan.

- *2If a day equivalent to the starting date in the first or third month of the contract does not exist, that date is designated as the last day of the relevant month.

Counterparty jurisdiction

Counterparty jurisdiction is classified based on the countries or regions listed in Appended Table 2 of the Ministerial Ordinance concerning Reports on Foreign Exchange Transactions, etc. (Ordinance of the Ministry of Finance No. 29 of 1998; hereinafter referred to as Ministerial Ordinance).* See the table below for details.

| Residents in Japan | Of the countries and regions listed in Appended Table 2 of the Ministerial Ordinance, Japan. | |

|---|---|---|

| Residents outside Japan and others | United States | Of the countries and regions listed in Appended Table 2 of the Ministerial Ordinance, United States. |

| Europe | Of the countries and regions listed in Appended Table 2 of the Ministerial Ordinance, the countries and regions located in Eastern Europe and Western Europe. | |

| Others | Countries and regions listed in Appended Table 2 of the Ministerial Ordinance (excluding Japan, the United States, and countries or regions located in Eastern Europe and Western Europe) and international organizations. | |

- Counterparty jurisdictions that do not have an ISO 3166-1 alpha-2 code are excluded from the scope of data reporting.

Counterparty sector classification

The counterparty sector classification is based on the System of National Accounts (SNA) definitions and is as consistent as possible with other FSB proposals. In the statistics, the types of sector are classified as banks, broker-dealers, and others in consideration of ensuring confidentiality.

| Banks | Of the FSA's "List of licensed (registered) Financial Institutions," "banks." Trust account transactions by trust banks are included. | |

|---|---|---|

| Broker-dealers | Securities companies | Of "financial instruments business operators, etc." in the FSA's "List of licensed (registered) Financial Institutions," operators that are registered as Financial Instruments Business Operators Engaged in Type I Financial Instruments Business and that conduct reported transactions on proprietary accounts. |

| "Tanshi" companies (money market dealers) | Based on Article 1-9 (v) of the Order for Enforcement of the Financial Instruments and Exchange Act (Cabinet Order No. 321 of September 30, 1965), among the persons who mainly make call loans or act as intermediaries for the lending and borrowing of such call money in the course of trade, those designated by the Commissioner of the Financial Services Agency. | |

| Others | Business sectors other than banks, and broker-dealers. Specifically, life insurance companies, securities finance companies, investment trusts, etc. | |

GC repo transactions/SC repo transactions

The statistics distinguish "General Collateral (GC) repo transactions" (used mainly for funding purposes), where the securities are not specified, from "Special Collateral (SC) repo transactions" (used mainly for securities borrowing purchases), where the securities are specified. If it is difficult to grasp the actual status of a transaction, it is classified as a GC repo transaction.

| GC repo transactions | Transactions where securities are not specified. |

|---|---|

| SC repo transactions | Transactions where securities are specified. |

CCP cleared/Non-CCP cleared transactions

Central counterparty (CCP) cleared transactions are defined as those where a clearing organization takes on counterparty credit risk. CCP cleared transactions include Subsequent Collateral Allocation Repos where collateral allocation is delegated to a third party just before settlement. Subsequent Collateral Allocation Repos represents GC repo transactions where at the time of execution of the transaction, the parties only agree on the amount of funds and the basket of securities to be delivered, and delegate the allocation of collateral to a third party just before settlement.

Securities lending fee and rebate rate

A securities lending fee is the fee that the borrower of the securities pays to the lender when the securities loan is backed by non-cash collateral. A rebate rate is the rate agreed to by the borrower and the lender (or an agent on lender's behalf) when the securities loan is backed by cash collateral. The securities lending fee or rebate rate is not requested for trades where it is difficult to report those rates or trades conducted under exclusive agreements.*

- In this arrangement, the lender or its agent negotiates an exclusive arrangement with a borrowing counterparty. The borrower pays a set upfront fee for exclusive access to borrow from the lender's securities portfolio.

Repo rates

In the statistics, repo rates are volume-weighted averages of the rates on repo transactions and the interest rates on collateral* in securities lending transactions after subtracting the securities lending fee or rebate rate. Of the stock data, "5-1. Repo rates" are calculated based on underlying stock data in "3-1. Transactions of Japanese yen, with Japanese government securities" and "4-1. Transactions of Japanese government bonds, with Japanese yen."

- Interest rates on collateral paid by the cash borrowing side. If those rates are variable by mutual agreement, the interest rates on the reporting date (if the reporting date is on a holiday, the interest rates on the last business day of the reporting month) are reported.

IV. Others

A. Reference

- Financial Stability Board (2011), "Shadow Banking: Strengthening Oversight and Regulation: Recommendations of the Financial Stability Board," October 27, 2011.

- Financial Stability Board (2013), "Strengthening Oversight and Regulation of Shadow Banking: Policy Framework for Addressing Shadow Banking Risks in Securities Lending and Repos," August 29, 2013.

- Financial Stability Board (2014), "Strengthening Oversight and Regulation of Shadow Banking: Regulatory Framework for Haircuts on Non-Centrally Cleared Securities Financing Transactions," October 14, 2014.

- Financial Stability Board (2015), "Transforming Shadow Banking into Resilient Market-based Finance: Standards and Processes for Global Securities Financing Data Collection and Aggregation," November 18, 2015.

- Ono, N., Sawada, K., and Tsuchikawa, A. (2015), "Toward Further Development of the Repo Market" Bank of Japan Review, 2015-E-4.