Highlights of the Outlook for Economic Activity and Prices (January 2026)

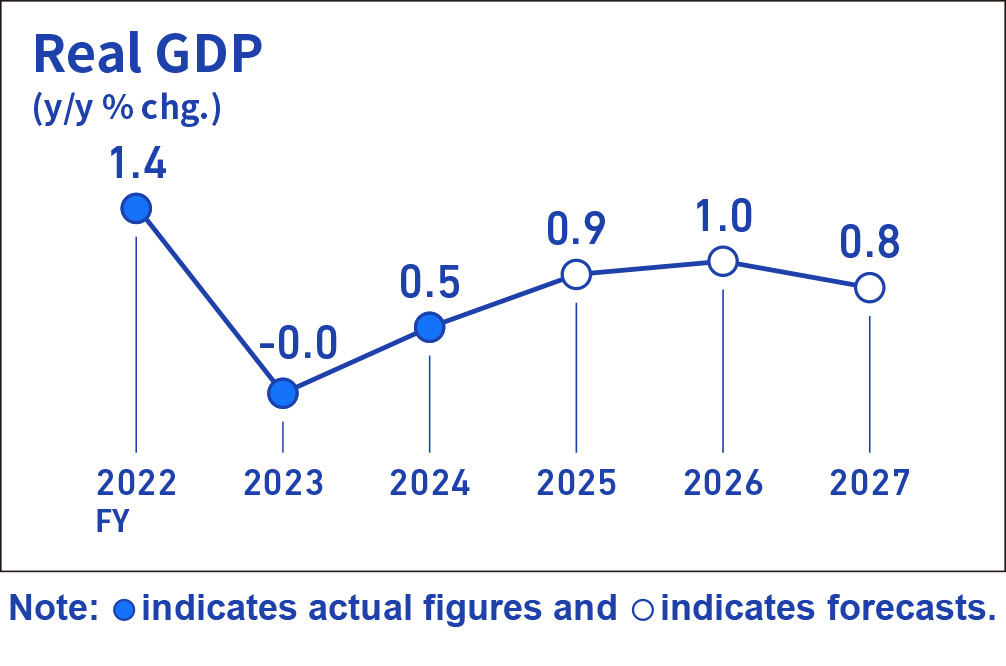

Japan's economy is likely to continue growing moderately.

Japan's economy is likely to continue growing moderately, with overseas economies returning to a growth path, and with support from factors such as the government's economic measures and accommodative financial conditions, while the economy is projected to be affected by trade and other policies in each jurisdiction.

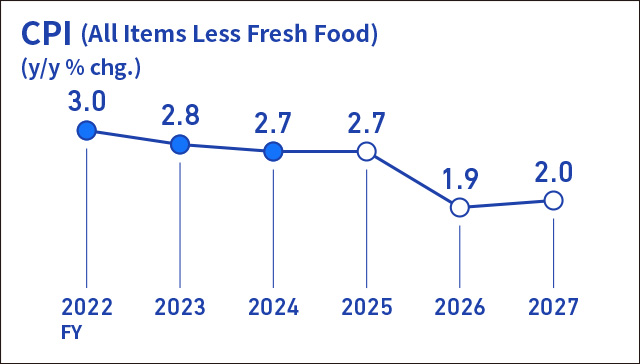

Inflation is likely to move toward around 2 percent.

The year-on-year rate of increase in the CPI is likely to decelerate to a level below 2 percent in the first half of this year. However, underlying CPI inflation, which excludes temporary fluctuations, is likely to continue rising moderately. Thereafter, as the economy continues to improve, it is expected that the rate of increase in the CPI and underlying CPI inflation will increase gradually and then be at a level that is generally consistent with the price stability target of 2 percent.

Developments in overseas economic activity and prices, wage- and price-setting behavior of firms, market developments, etc. warrant attention.

Risks to the outlook for Japan's economic activity and prices include developments in overseas economic activity and prices under the impact of trade and other policies in each jurisdiction, wage- and price-setting behavior of firms, and developments in financial and foreign exchange markets, and these risks require attention.

The Bank will conduct monetary policy with the 2 percent target.

As for the conduct of monetary policy, if its outlook for economic activity and prices will be realized, the Bank, in accordance with improvement in economic activity and prices, will continue to raise the policy interest rate and adjust the degree of monetary accommodation.

Policy Board Members' Forecasts

Outlook for Economic Activity and Prices

For further details, please see "The Bank's View" and the full text of the Outlook for Economic Activity and Prices (Outlook Report) on the following pages: