Trends in the Discussions of the Costs and Benefits of Price Fluctuations

SUGIOKA Yu, ITO Yuichiro, KAIHATSU Sohei, TAKATOMI Kosuke (Bank of Japan)

Research LAB No.24-E-2, December 11, 2024

Keywords: Inflation, Optimal Monetary Policy, Price Setting Behavior, Wage Setting

JEL Classification: E24, E31, E52, L11

Contact: yuuichirou.itou@boj.or.jp (ITO Yuichiro)

Summary

The impact of price fluctuations on social welfare has been a significant area of research in economics. This article reviews trends in the discussions of the costs and benefits of price fluctuations and the related topic of desirable inflation rates. Examining the discussions of desirable inflation rates in the 1990s, numerous studies highlighted the costs of inflation, particularly in relation to holding money. In the 2000s, a central view was that it was desirable for prices to remain constant under conditions of price rigidity. Thereafter, following the global financial crisis and the subsequent period of low inflation in major economies, there has been lively debate about the costs of deflation and low inflation, stemming from the zero lower bound on nominal interest rates and nominal wage rigidity. Recent research suggests that even in a context of price rigidity, moderate inflation may be desirable for social welfare, considering heterogeneity across firms and products. Since there are numerous challenges in evaluating the impact of price fluctuations on social welfare, assessments from various perspectives are essential.

Introduction

The costs and benefits of price fluctuations are among the important research topics in macroeconomics. Since the 1990s, with the widespread adoption of inflation-targeting policies in major economies, the question of how steady-state inflation affects social welfare has gained increasing attention.

This article reviews past discussions of the costs and benefits of price fluctuations and presents recent theoretical trends regarding desirable inflation rates.

Major Issues of the Costs and Benefits of Price fluctuations

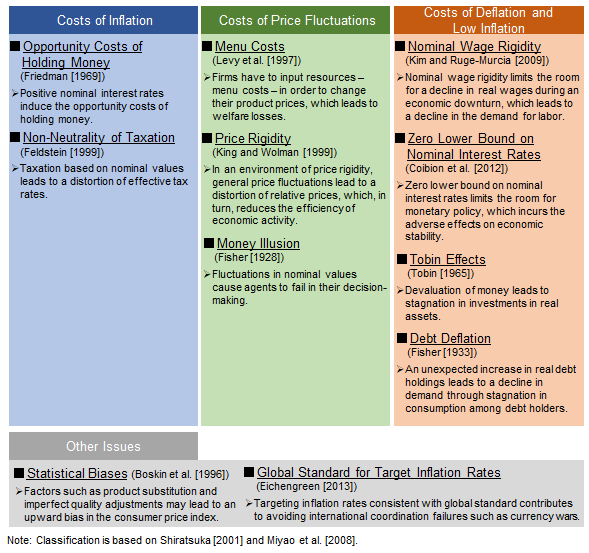

The impact of price fluctuations on social welfare is an important topic in macroeconomics that has been assessed from various perspectives. The issues can be classified into four categories: (1) the costs of inflation, (2) the costs of price fluctuations, (3) the costs of deflation and low inflation, and (4) other related issues. However, academic consensus on desirable inflation rates has not yet been reached (Figure 1).1 The following section briefly reviews the academic debate on these topics.

In the 1990s, discussions centered on (1) the costs of inflation. A key argument, represented by Friedman [1969], is the "opportunity costs of holding money." Inflation reduces the value of money that does not yield interest, effectively imposing costs on holding cash -- opportunity costs. In this context, inflation rates at or below zero are considered desirable to minimize these opportunity costs. From a tax perspective, studies also highlight that nominal income taxes in an inflationary environment could increase the real tax burden, disrupting the optimal allocation of resources (e.g., Feldstein [1999]). Thus, the emphasis during this period was on the costs of inflation.

In the 2000s, discussions focused on (2) the costs of price fluctuations, influenced by the widespread adoption of the New Keynesian framework, which assumes "price rigidity." Under this assumption, general price fluctuations distort relative prices and resource allocation. Moreover, under the "menu cost" assumption, which is a factor that induces price rigidity, it is socially optimal in terms of social welfare to achieve a situation where general prices do not fluctuate and thus firms do not have to change their product prices -- menu costs are not incurred. However, as discussed below, maintaining inflation rates near zero, as seen in Japan, may overly suppress price fluctuations, leading to social costs by distorting business strategies.

Since the global financial crisis of 2008, attention has shifted to (3) the costs of deflation and low inflation. As natural interest rates have fallen in major countries, the zero lower bound on nominal interest rates has limited the effectiveness of monetary policy, threatening economic stability. Additionally, there is concern over "downward nominal wage rigidity."2 It has been pointed out that downward nominal wage rigidity leads to insufficient wage declines in deflationary environments, which keeps wages excessively high and subsequently increases unemployment.

Other issues include statistical biases and the global standard for target inflation rates. Regarding statistical biases, it has been argued that the consumer price index tends to have an upward bias compared to the actual prices faced by consumers. Therefore, targeting positive inflation is suggested to counteract this bias.3 Additionally, the global standard for target inflation rates has also been a topic of debate. It has been argued that consistent inflation targets across countries are necessary to prevent international coordination failures, such as currency wars. As discussed above, the costs and benefits of price fluctuations have been examined from various perspectives.

Figure 1. Major Issues Presented in the Literature

- Adam and Weber [2024] reviews existing studies on the issue of desirable inflation rates. In the paper, the authors emphasize that this issue is still an open question, and that further analysis is needed.

- Mineyama et al. [2022] provides a quantitative analysis of optimal inflation rates, considering all types of costs from (1) to (3).

- Kobayashi et al. [2024] notes that the measurement error of the consumer price index in major countries, including Japan, has generally been shrinking. However, the authors state that the measurement errors may remain especially in service prices, and that the changes in transaction flows may affect those errors.

Trends in Academic Research

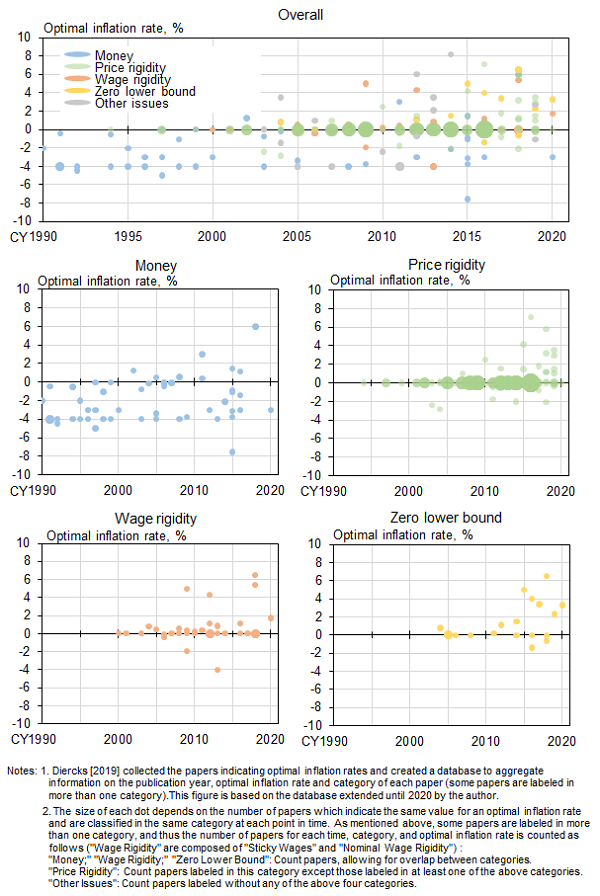

Based on the issues presented above, this section reviews academic research trends regarding desirable inflation rates. Specifically, it examines the trends in optimal inflation rates over time as argued by individual research papers, with a focus on Diercks [2019], which surveys quantitative analyses of optimal inflation rates for the United States. Figure 2 illustrates the optimal inflation rates suggested by the individual papers, categorized according to factors such as (1) the opportunity costs of holding money (labeled as the "money" category), (2) price rigidity, (3) nominal wage rigidity, and (4) the zero lower bound on nominal interest rates.

Figure 2. Trends of Research on Optimal Inflation Rates for the United States

Figure 2 indicates that in the 1990s, research primarily focused on (1) the opportunity costs of holding money (labeled as the "money" category) in relation to inflation costs, often arguing that desirable inflation rates should be at or below zero. In the 2000s, the focus shifted to (2) price rigidity, with studies emphasizing the costs of price fluctuations and suggesting that inflation rates around zero were optimal. Since the 2010s, following the global financial crisis and a period of low inflation, there has been an increase in studies addressing (3) nominal wage rigidity and (4) the zero lower bound on nominal interest rates, with these studies tending to argue for positive inflation rates. However, the optimal inflation rates proposed by these studies vary, and no clear academic consensus has been reached.

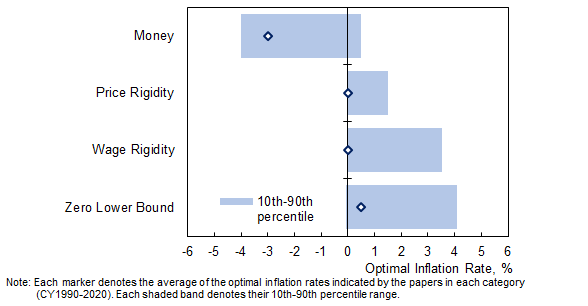

Figure 3 shows the distribution of optimal inflation rates across these studies and their respective topics. While most research on the opportunity costs of holding money suggests inflation rates at or below zero, studies focusing on nominal wage rigidity and the zero lower bound on nominal interest rates often indicate positive inflation rates as optimal. Although many studies on price rigidity argue for inflation rates near zero, a significant portion of these rates fall within the positive range, with some explicitly advocating for positive inflation rates.

Figure 3. Optimal Inflation Rates by Paper Classification

The following section explores recent discussions of price rigidity, nominal wage rigidity, and the zero lower bound on nominal interest rates, which are key areas of focus in academic research on desirable inflation rates.

Discussions of Price Rigidity

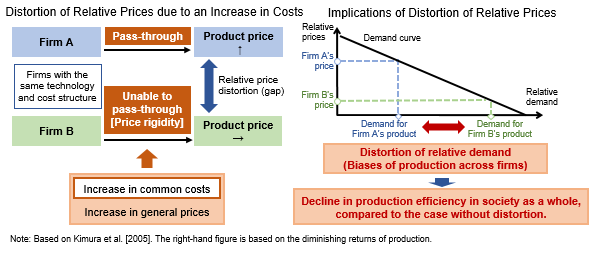

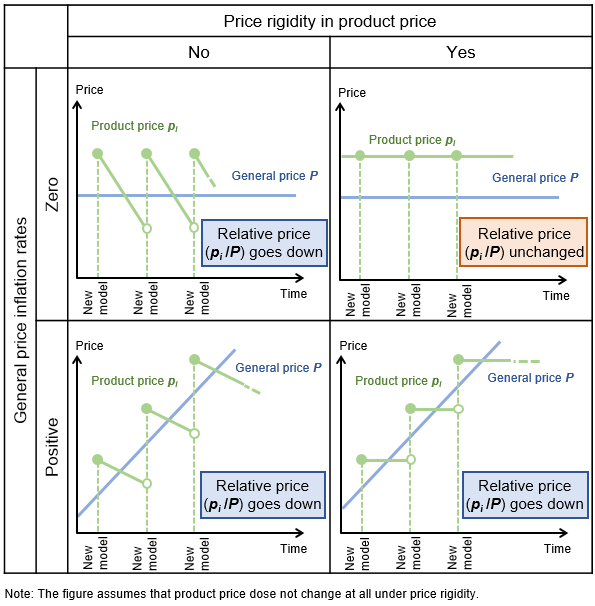

This section reviews conventional discussions of price rigidity -- the tendency for the prices of goods and services not to be immediately adjusted according to the balance of supply and demand -- and highlights recent research trends. In the conventional discussion, when firms face rising production costs due to inflation, some are unable to pass these costs on to consumers because of price rigidity. This results in distortions in relative prices and demand among firms, which, in turn, reduces overall production efficiency. From this perspective, conventional arguments suggest that zero inflation, which minimize relative price fluctuations, leads to efficient resource allocation by preserving the signaling function of prices (Figure 4).

Figure 4. Conventional Discussions of Price Rigidity

On the other hand, there has been research suggesting that zero inflation can impose social costs. Watanabe [2022] points out that, in environments where inflation remains near zero for extended periods, as in Japan, people begin to expect prices to remain stagnant, which discourages them from accepting price increases. He then points out that this situation can make firms reluctant to raise prices, which may, in turn, hinder investment in research and development -- ultimately imposing a cost on society.4

On the issue of price rigidity, recent studies have also focused on the heterogeneity of products and firms. Adam and Weber [2019, 2023] analyzes how the product life cycle, from introduction onto the market to obsolescence, affects price fluctuations and social welfare. These studies show that (1) as firms gain experience, their productivity increases, leading to lower marginal costs (experience accumulation effects), while (2) consumer demand declines as products age (fashion effects).5 These studies argue that a downward trend in the relative price of products is desirable for efficient resource allocation and that moderate increases in general price levels may be necessary to achieve this in an environment of price rigidity (Figure 5).6

Figure 5. General and Relative Prices under Price Rigidity

Additionally, some studies highlight that moderate positive inflation rates can encourage economic metabolism among firms and support efficient investments in research and development (e.g., Santaro and Viviano [2022], Miyakawa et al. [2022], Inokuma et al. [2024]). While recent studies suggest that moderate positive inflation may improve resource allocation and productivity, this area of research is still at an early stage, and further advances in the analysis, both empirical and theoretical, are expected.

- 4It is known that the practice of maintaining product prices emerges under the assumption of the kinked-demand curve, where a marginal decrease in product prices tends to incur a limited increase in demand, whereas a marginal increase in product prices tends to incur a large decrease in demand. Kurozumi and Van Zandweghe [2024] argue theoretically that moderate positive inflation improves social welfare under the environment of the kinked-demand curve.

- 5Ueda et al. [2019] argue that the fashion effects are large in Japan, based on analysis using POS data.

- 6Furukawa et al. [2024] discusses price rigidity from the perspective of the prolonged changes in menu costs.

Discussions of Nominal Wage Rigidity

The issue of "downward nominal wage rigidity," -- the tendency for nominal wages to be difficult to decline during economic downturns -- has led to arguments that maintaining real wage flexibility through positive inflation rates can improve social welfare (e.g., Tobin [1972]). This view has been also supported by recent studies (e.g., Mineyama [2022]).

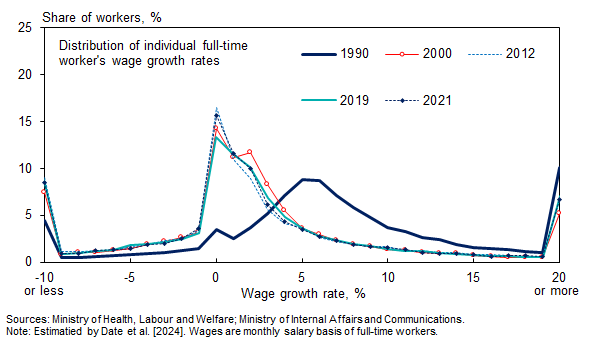

In addition, some research has shown that downward nominal wage rigidity can lead firms to fear that wages will remain high during economic downturns, contributing to upward nominal wage rigidity, and eventually to a situation where nominal wages become relatively inflexible (e.g., Daly and Hobijin [2014], Genda [2017], Hirata et al. [2020]). This trend is particularly pronounced in deflationary or low inflation environments. In fact, data on Japan's wage growth distribution since the 2000s, when inflation remained low, suggest that wage growth has clustered around zero (Figure 6).

Figure 6. Distribution of Nominal Wage Growth Rates

In an environment with wage rigidities, it may be difficult to adjust wages according to the productivity levels of individual workers or firms. Recent discussions have suggested that greater wage heterogeneity across workers and firms could promote job mobility and skill development (e.g., Watanabe [2023], Itoh [2024]), contributing to more efficient resource allocation in an environment with a positive inflation rate.

Discussions of the Zero Lower Bound on Nominal Interest Rates

Under the zero lower bound on nominal interest rates, a persistent decline in prices can raise real interest rates, thereby discouraging consumption and investment. From this perspective, some studies argue that maintaining positive inflation rates is desirable (Blanchard et al. [2010], Schmitt-Grohe and Uribe [2010], Billi [2011], Coibion et al. [2012]). Other research highlights the growing importance of the zero lower bound issue, particularly in light of the possibility that the natural rate of interest could fall, reducing the effectiveness of monetary policy (Williams [2019]).

Although unconventional monetary policies employed by central banks have had some success, their effectiveness is uncertain, and potential side effects remain a concern. Therefore, the welfare losses associated with the zero lower bound on nominal interest rates continue to be a significant issue for monetary policy. In fact, Ikeda et al. [2024] points out that unconventional monetary policy cannot fully replace conventional monetary policy, and thus the zero lower bound on nominal interest rates remains an important consideration when discussing desirable inflation rates. Another study suggests that the trade-offs between the effects and side effects of unconventional monetary policy should be carefully examined when setting inflation targets (ECB [2021]).

Conclusion

This article reviewed conventional discussions of the costs and benefits of price fluctuations and presented recent research on these topics. Recent studies suggest that positive inflation rates can enhance the signaling function of wages and prices, leading to a more efficient allocation of resources. Moreover, other studies suggest that the zero lower bound on nominal interest rates remains a key issue, even with the effectiveness of unconventional monetary policy.

However, research on these issues is still developing, and no academic consensus has been reached. Given the various issues related to the impact of price fluctuations on social welfare, it is essential to deepen our understanding and continue to evaluate these issues from multiple perspectives.

References

- Adam, K., and Weber, H., 2019. Optimal Trend Inflation. American Economic Review, 109(2), 702-737.

- Adam, K., and Weber, H., 2023. Estimating the Optimal Inflation Target from Trends in Relative Prices. American Economic Journal: Macroeconomics, 15(3), 1-42.

- Adam, K., and Weber, H., 2024. The Optimal Inflation Target: Bridging the Gap between Theory and Policy. CEPR Discussion Paper, 19170, Centre for Economic Policy Research.

- Billi, R. M., 2011. Optimal Inflation for the US Economy. American Economic Journal: Macroeconomics, 3(3), 29-52.

- Blanchard, O., Dell'Ariccia, G., and Mauro, P., 2010. Rethinking Macroeconomic Policy. Journal of Money, Credit and Banking, 42(s1), 199-215.

- Boskin, M. J., Dulberger, E. R., Gordon, R. J., Griliches, Z., and Jorgenson, D. W., 1996. Toward a More Accurate Measure of the Cost of Living. Final Report to the Senate Finance Committee, December 4, 1996.

- Coibion, O., Gorodnichenko, Y., and Wieland, J., 2012. The Optimal Inflation Rate in New Keynesian Models: Should Central Banks Raise their Inflation Targets in Light of the Zero Lower Bound? The Review of Economic Studies, 79(4), 1371-1406.

- Daly, M. C., and Hobijn, B., 2014. Downward Nominal Wage Rigidities Bend the Phillips Curve. Journal of Money, Credit and Banking, 46(52), 51-93.

- Date, D., Kurozumi, T., Nakazawa, T., and Sugioka, Y., 2024. Heterogeneity and Wage Growth of Full-Time Workers in Japan: An Empirical Analysis Using Micro Data. Journal of the Japanese and International Economies, (73) 101324.

- Diercks, A. M., 2019. The Reader's Guide to Optimal Monetary Policy. Available at SSRN:

https://ssrn.com/abstract=2989237(Link to an external website) or

http://dx.doi.org/10.2139/ssrn.2989237(Link to an external website) - Eichengreen, B., 2013. Currency War or International Policy Coordination? Journal of Policy Modeling, 35(3), 425-433.

- European Central Bank [ECB], 2021. The ECB's Price Stability Framework: Past Experience, and Current and Future Challenges [PDF](Link to an external website). Occasional Paper Series, 269, European Central Bank.

- Feldstein, M. S., 1999. Capital Income Taxes and the Benefit of Price Stability. The Costs and Benefits of Price Stability, edited by M. S. Feldstein, The University of Chicago Press.

- Fisher, I., 1928. The Money Illusion. New York Adelphi Company.

- Fisher, I., 1933. The Debt-Deflation Theory of Great Depressions. Econometrica, 1(4), 337-357.

- Friedman, M., 1969. The Optimum Quantity of Money and Other Essays. Chicago: Aldine Publishing Company.

- Furukawa, K., Hogen, Y., Otaka, K., and Sudo, N., 2024. On the Zero-Inflation Norm of Japanese Firms (Link to the IMES website). Paper Presented at the 2024 BOJ-IMES Conference, Tokyo, Japan.

- Genda, Y., 2017, Why Are Wages Not Rising despite the Labor Shortage? Keio University Press (in Japanese).

- Hirata, W., Maruyama, T., and Mineyama, T., 2020. Flattening of the Wage Phillips Curve and Downward Nominal Wage Rigidity: The Japanese Experience in the 2010s. Bank of Japan Working Paper Series, 20-E-4, Bank of Japan.

- Ikeda, D., Li, S., Mavroeidis, S., and Zanetti, F., 2024. Testing the Effectiveness of Unconventional Monetary Policy in Japan and the United States. American Economic Journal: Macroeconomics, 16(2), 250-286.

- Inokuma, H., Katagiri, M., and Sudo, N., 2024. Innovation Choice, Product Life Cycles, and Optimal Trend Inflation (Link to the IMES website). IMES Discussion Paper Series, 2024-E-17, Institute for Monetary and Economic Studies, Bank of Japan.

- Itoh, M., 2024, Downward Rigidity: a Barrier of Economic Metabolism. Iken-Takken, Nikkei Veritas (February 25, 2024), Nikkei Inc (in Japanese).

- Kim, J., and Ruge-Murcia, F. J., 2009. How Much Inflation is Necessary to Grease the Wheels? Journal of Monetary Economics, 56(3), 365-377.

- Kimura, T., Fujiwara, I., and Kurozumi, T., 2005. Economic Welfare of Society and Purpose of Monetary Policy. Bank of Japan Review Series, 2005-J-9, Bank of Japan (in Japanese).

- King, R. G., and Wolman, A. L., 1999. What Should the Monetary Authority Do When Prices are Sticky? Monetary Policy Rules, edited by J. B. Taylor, The University of Chicago Press, 349-404.

- Kobayashi, S., Shinohara, T., Shiratsuka, S., Sudo, N., and Takeuchi, I., 2024. Measurement Errors in the Consumer Price Index: Perspectives on Numerical Targets for Price Stability in Major Economies (Link to the IMES website). IMES Discussion Paper Series, 2024-E-16, Institute for Monetary and Economic Studies, Bank of Japan.

- Kurozumi, T., and Van Zandweghe, W., 2024. Output-Inflation Trade-offs and the Optimal Inflation Rate. Journal of Economic Dynamics and Control, 164, 104874.

- Levy, D., Bergen, M., Dutta, S., and Venable, R., 1997. The Magnitude of Menu Costs: Direct Evidence from Large U.S. Supermarket Chains. The Quarterly Journal of Economics, 112(3), 791-825.

- Mineyama T., 2022. Revisiting the Optimal Inflation Rate with Downward Nominal Wage Rigidity: The Role of Heterogeneity. Journal of Economic Dynamics and Control, 139, 104350.

- Mineyama T., Hirata, W., and Nishizaki, K., 2022. Optimal Inflation Rates in a Non-linear New Keynesian Model: The Case of Japan and the United States. International Journal of Central Banking, 18(3), 1-45.

- Miyakawa, D., Oikawa, K., and Ueda, K., 2022. Reallocation Effects of Monetary Policy. International Economic Review, 63(2), 947-975.

- Miyao, R., Nakamura, K., and Shirota, T., 2008. Costs of Price Fluctuations -- Concept and Measurement, Bank of Japan Working Paper Series, 08-J-2, Bank of Japan (in Japanese).

- Santoro, S., and Viviano, E., 2022. Optimal Trend Inflation, Misallocation and the Pass-Through of Labour Costs to Prices [PDF](Link to an external website). Working Paper Series, 2761, European Central Bank.

- Schmitt-Grohé, S., and Uribe, M., 2010. The Optimal Rate of Inflation. Handbook of Monetary Economics, 3, edited by B. M. Friedman, and M. Woodford, Elsevier, 653-722.

- Shiratsuka, S., 2001. Is There a Desirable Rate of Inflation? A Theoretical and Empirical Survey (Link to the IMES website). Monetary and Economic Studies, 19(2), 49-84.

- Tobin, J., 1965. Money and Economic Growth. Econometrica, 33(4), 671-684.

- Tobin, J., 1972. Inflation and Unemployment. American Economic Review, 62(1/2), 1-18.

- Ueda, K., Watanabe, K., and Watanabe, T., 2019. Product Turnover and the Cost-of-Living Index: Quality versus Fashion Effects. American Economic Journal: Macroeconomics, 11(2), 310-347.

- Watanabe, T., 2022. What are Prices? Kodansha Ltd (in Japanese).

- Watanabe, T., 2023. Current Situation and Future Outlook of the "Virtuous Cycle between Wages and Prices." Handout at the 17th Meeting of the Council on Economic and Fiscal Policy (December 21, 2023, in Japanese).

- Williams, J. C., 2019. Living Life near the ZLB(Link to an external website). Remarks at 2019 Annual Meeting of the Central Bank Research Association (CEBRA), July 18, 2019.

Notice

The views expressed herein are those of the authors and do not necessarily reflect those of the Bank of Japan.